Consider this: Amazon is one of four online giants projected to account for 65% of the global health & beauty e-commerce market by 2025, which is projected to rise to 16.5% globally post COVID-19, increasing to 23.3%. Edge by Ascential projected that Alibaba represented $43.2B in health and beauty online sales in 2020, followed by Amazon ($28.8B), and Pinduoduo ($16.8B).

The pandemic may have removed any last vestige of concern for beauty brand holdouts when it comes to integrating Amazon into their distribution strategy. Late adopters who hadn't shopped on Amazon before were forced to use the platform during the pandemic, which will have a long-term impact on consumer behavior. In truth, one way or another, your products, especially if your brand is in demand, will end up on Amazon. The question is, will you own that relationship, be in control of your brand and capture the sales, or will you leave that up to others?

“With COVID-19 driving increased demand for health and beauty products, many retailers are planning further inroads into the category via enhanced online services and product lines. However, as department stores experience a -10.9% fall in growth in 2020, more beauty brands will be forced to diversify and focus on investing in online to expand reach and boost growth," said Florence Wright, Senior Retail Analyst at Edge by Ascential. “The rapidly developing digital outlook, coupled with the growing dominance of online players like Amazon and Alibaba, highlights how crucial it is to enhance omnichannel offerings and online capabilities. This includes strong search optimization, as well as powerful online visual merchandising as a means to recreate the in-store experience and to better engage with shoppers.”

In the new normal, the consumer is the distribution channel. As a brand, you need to be available to them where they are when they are ready to purchase. Amazon is a marketplace, but 52% of consumers also report starting their product search on Amazon, which increased to 63% during COVID-19, according to Wunderman Thompson. As a result, regardless of the size of the brand or the nature of the product, Amazon provides a platform with millions of eyeballs every day.

Another driver on Amazon is the realization by brands that given the rise in the cost of acquiring new consumers online, Amazon can be a cost-efficient acquisition channel. In Q1 the average daily spend for sponsored products and sponsored brands was up 41% and 89% YoY, while conversion rates for sponsored product ads rose to 17.42%, representing an 11% increase compared to Q1 2020.

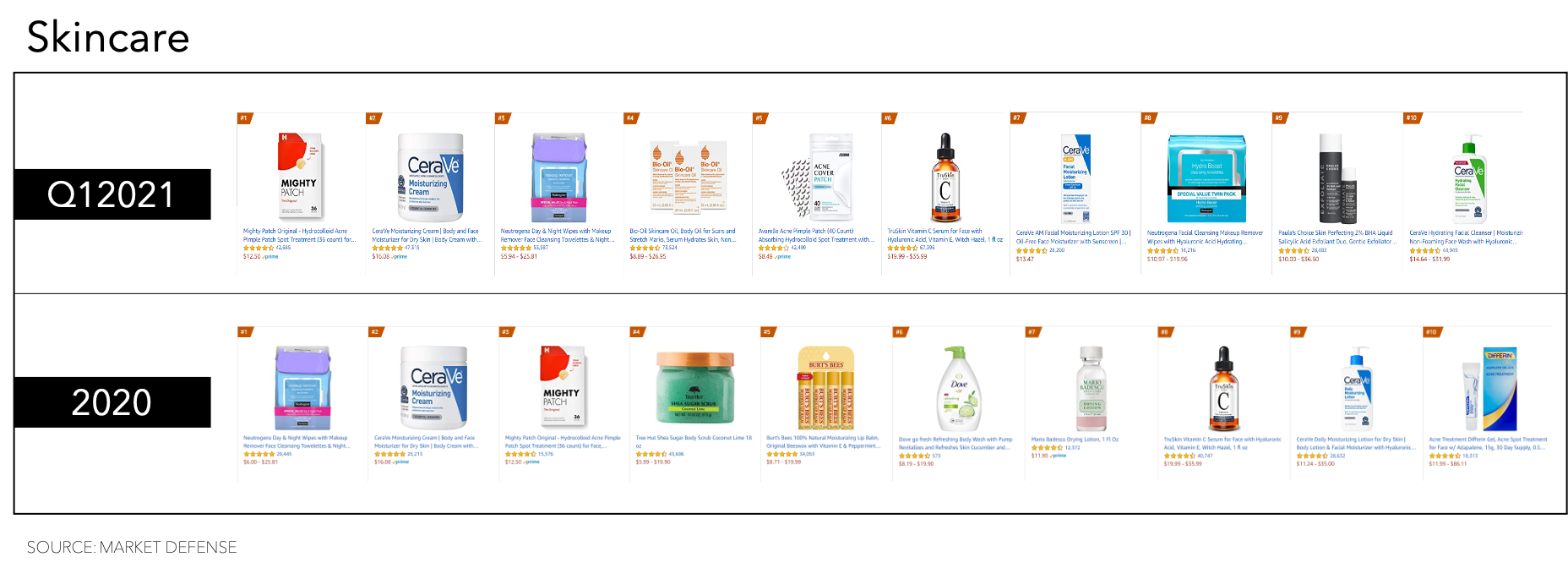

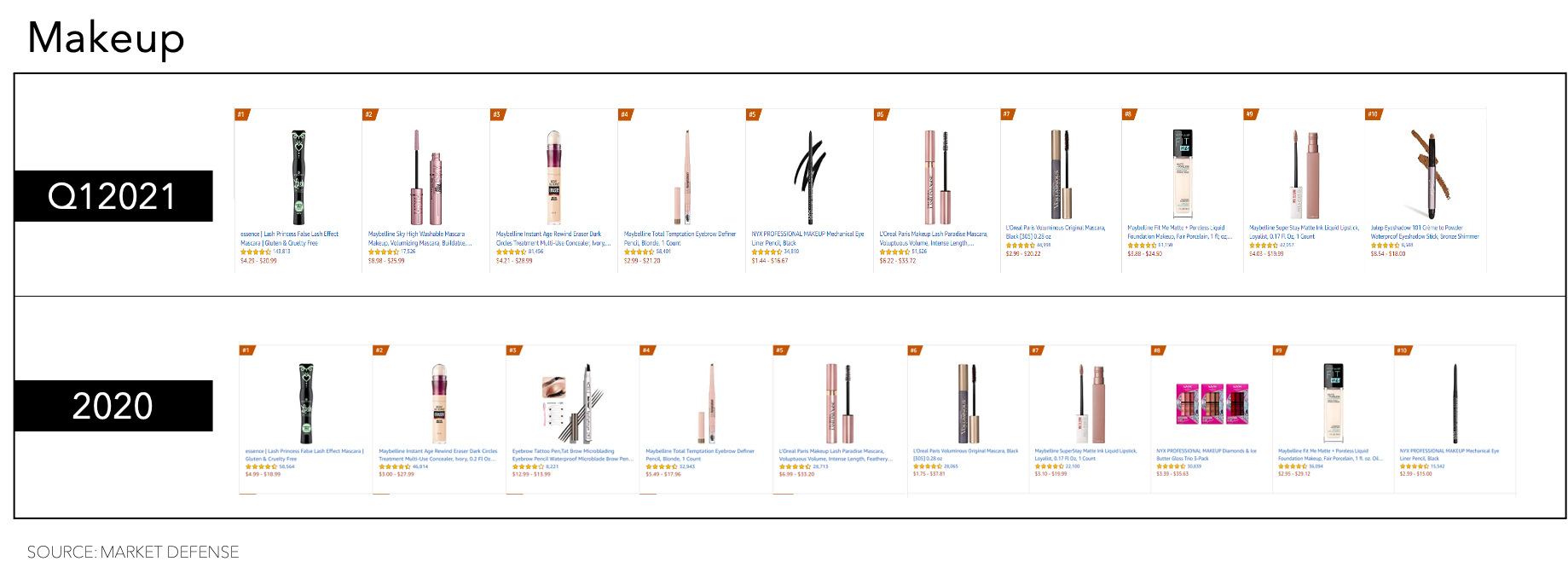

Vanessa Kuykendall, VP of Business Development at Market Defense, provided insight into the drivers for the top 25 beauty products on Amazon in the first quarter, "As most of America continued to wear protective masks the first quarter of 2021, it was all about the eyes on Amazon as Eye Pencils and Dark Circle solutions doubled their placements in the Top 25. Skin Care shoppers are still looking for solutions for 2020’s Maskne, and are just starting to think about SPF as Elta MD UC Clear Sunscreen creeps into the top 25."

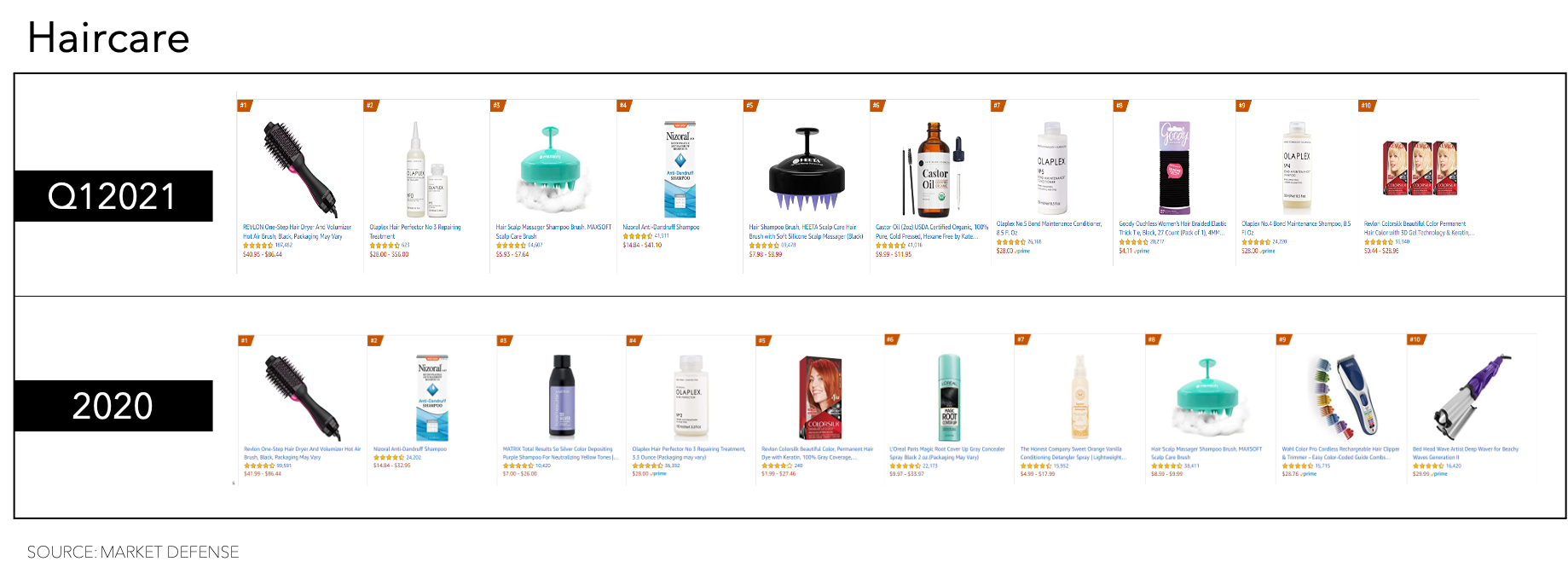

She continued, "With billions of views on TikTok, #AmazonFinds are influencing customer choices as viral TikTok brands & products like NYX, CeraVe, Paula’s Choice 2% Liquid, and trending #scalpmassager also jump into the top 25, displacing hand sanitizer and hand wash."

TOP 6 PRODUCTS ON AMAZON Q1 2021 VS 2020

The top six products in the beauty and personal category remain the same, but the ranking has shifted. The most significant jump is Hero Cosmetics Mighty Patch Original's Hydrocolloid Acne Pimple Patch Spot Treatment, moving from number 6 in 2020 to the number 3 spot in Q1. This indie beauty brand founded in 2017 is punching above its weight class and is representative of how brands are building omnichannel distribution strategies that bridge traditional retail while incorporating the power of Amazon. Its revenue grew over 300% in 2020 with a Hero product sold every 15 seconds in the US, and the brand projects sales in 2021 to exceed $80 million in retail revenue.

TOP 25 PRODUCTS ON AMAZON Q1 2021 VS 2020

The top 25 products in the beauty and personal care category are ruled by big beauty and their portfolio brands with predominantly mass or masstige distribution. The exception has been in the skincare and haircare categories, with prestige players like Paula's Choice, Elta MD (acquired by Colgate-Palmolive in 2017), and Olaplex entering the top 25 in the first quarter.

The average price point in Q1 was $14.24 compared to $13.24 in 2020, with average reviews more than doubling to 56.1K from 27.4K and the average rating remaining constant at 4.6. The first quarter also saw 12 new products enter the top 25.

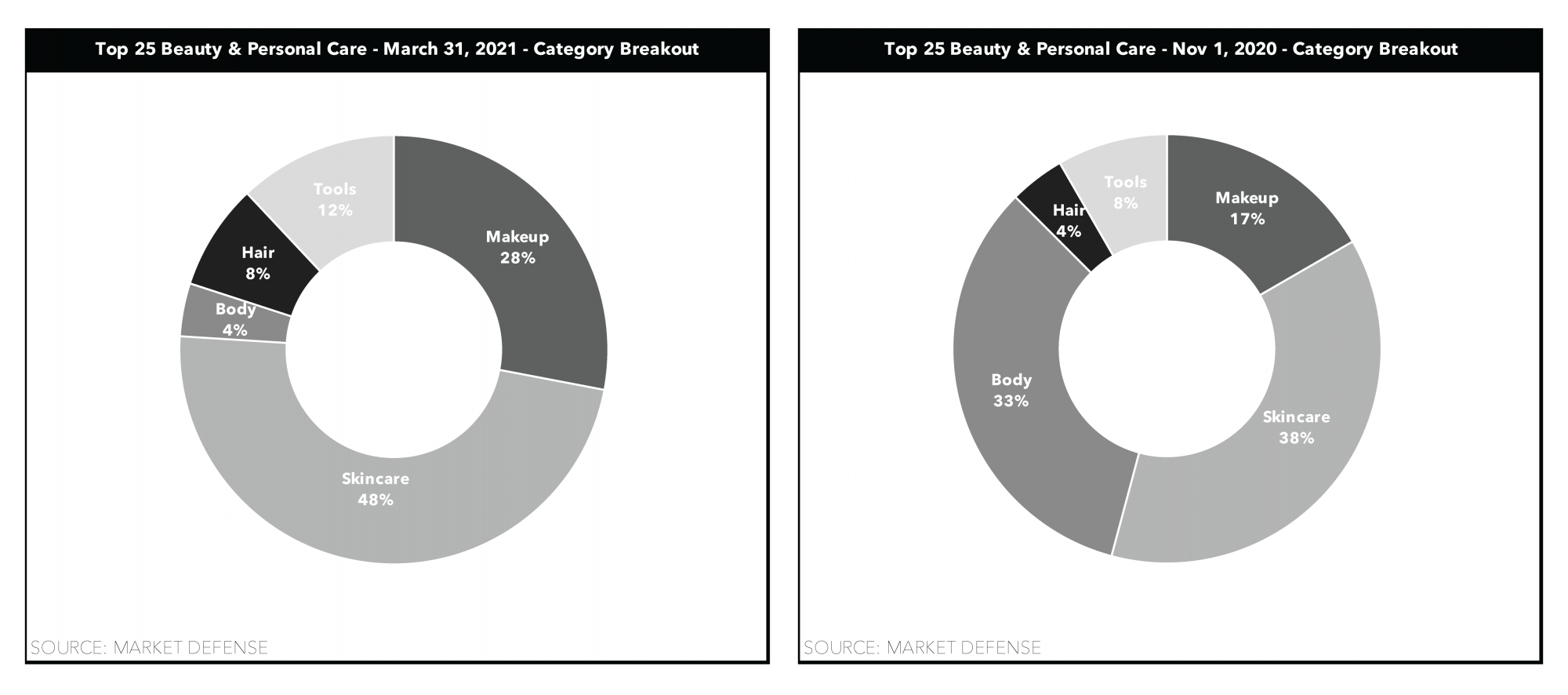

In segmenting the top 25 product list for beauty and personal care, some interesting shifts emerged: hair doubled to 8%, makeup increased 11%, while skincare decreased 10% and body decreased by a whopping 29%. While it's only representative of 3 months, could this be an early indicator of post-pandemic behavior?

Kuykendall said, "Overall, brands that are capturing customer interest digitally through Instagram, TikTok and other channels are driving significant growth, including Olaplex who grew from one item in the Top 10 Hair Care list to three. Amazon continues to be a place where demand is not necessarily created, but the ideal channel to fulfill consumer demand, especially the TikTok-driven Gen Z population.”

It was reported that beauty, health, and personal care at Amazon captured 32% of all beauty bought online, with $23 billion in sales in 2020 representing a 45% increase from 2019. Everyone has an opinion about Amazon, but the numbers speak for themselves. Amazon has already dominated the mass category and remains laser focused on unlocking the potential of the premium and luxury categories within the beauty sector.

What can other beauty brands learn from the Top 25’s success on Amazon? Kuykendall bulleted some techniques they have applied to the Market Defense portfolio of brands the company refers to as “passion brands” to fuel increases on Amazon: