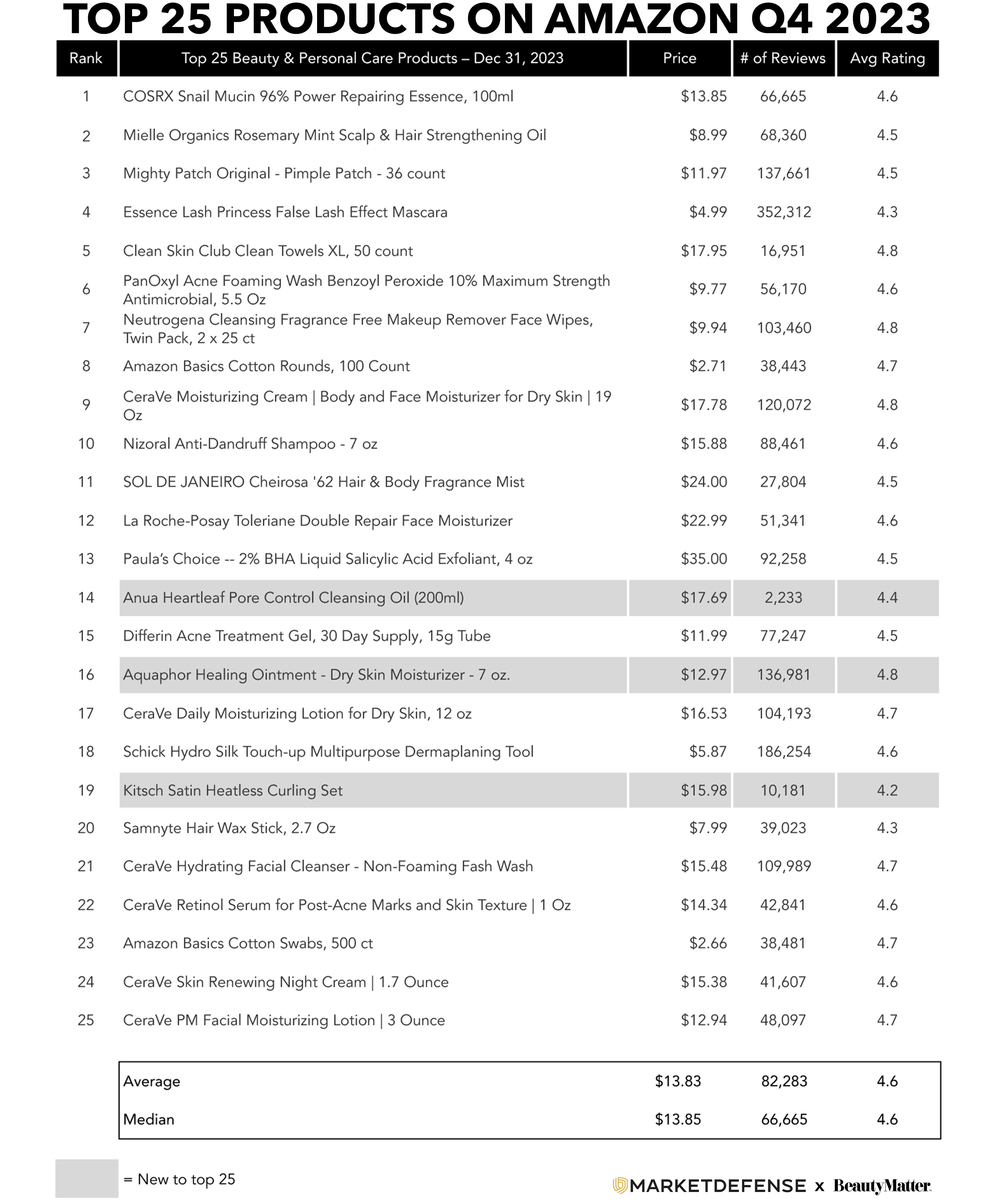

Amazon’s Top 25 Beauty & Personal Care Products in Q4 2023 was a showstopper for legendary skincare favorite, CeraVe, which saw six products on the list this quarter. The Top 25 also included a mix of 2023 TikTok viral hits and beauty pantry staples.

At the top of the chart for the second consecutive quarter was COSRX Snail Mucin 96% Power Repairing Essence, which beat out Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil, Mighty Patch Original Pimple Patch, and Essence Lash Princess False Lash Effect Mascara. Clean Skin Club Clean Towels XL moved its way up the list this quarter to round out the Top 5. Clean Skin Club broke into the Top 25 in Q1 2023 at number 24. It was absent from the list in Q2 but returned at number 14 last quarter. Since its debut, reviews have grown 58%, with Amazon’s new AI-driven review summary stating that “customers like the absorbency, softness, quality, and effect of the skin cleaning wipe.”

While CeraVe had six products in the Top 25 in Q4, the only other brand to have more than one product on the list was Amazon’s private label brand, Amazon Basics, with two—both cotton swabs with different product counts.

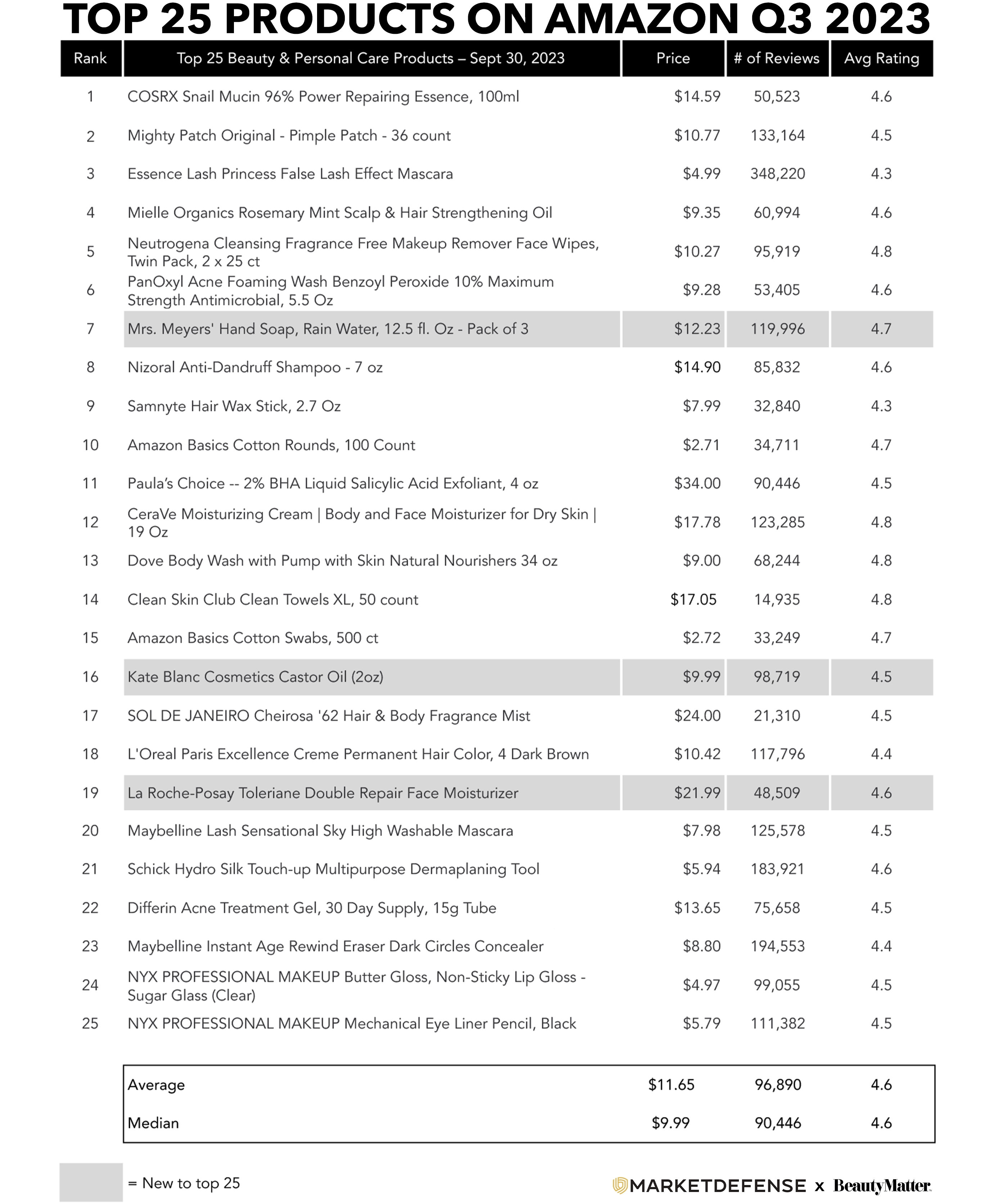

Three new products broke into the Top 25 in Q4: Anua Heartleaf Pore Control Cleansing Oil; classic, cold-weather favorite Aquaphor Healing Ointment; and Kitsch Satin Heatless Curling Set. The new items were all over $12, contributing to an average MSRP of $13.83 in Q4—a full $2.17 more than the average MSRP of $11.65 in Q3, and the highest average MSRP since Q1 2022.

Korean brand Anua’s Heartleaf Pore Control Cleansing Oil is benefitting from growing interest in K-Beauty products on Amazon, with searches for “Korean skincare” up 180%. The Kitsch Satin Heatless Curling Set made it into the Top 25 after a successful Prime Event in November, where it was the seventh best-selling haircare product of the two-day event. TikTok posts for #heatlesscurls have almost 7 billion views.

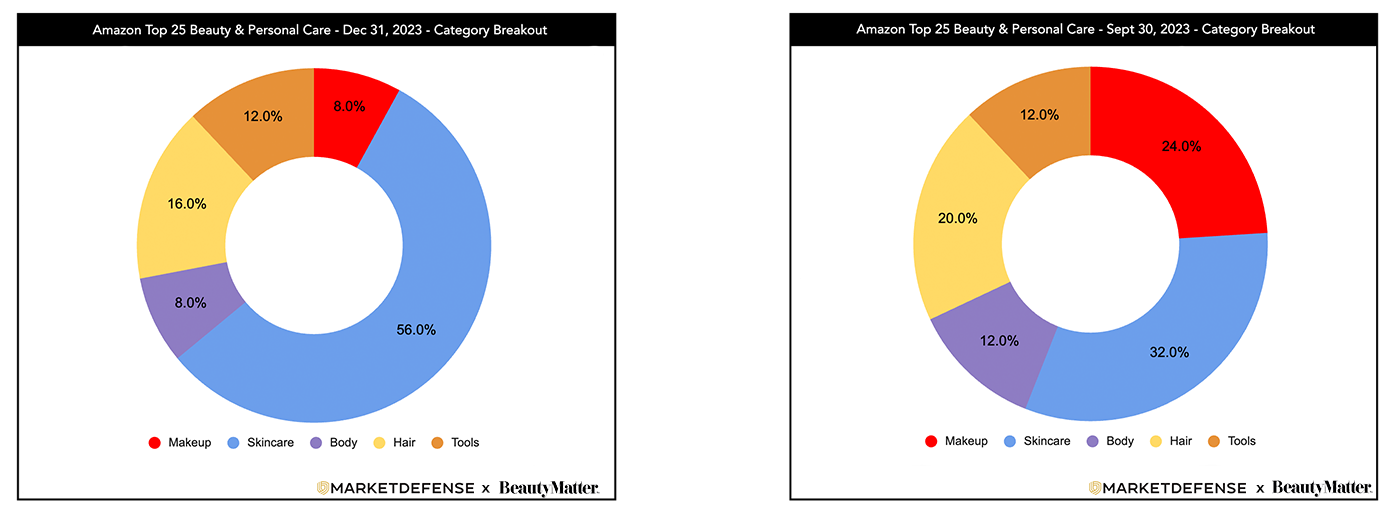

In Q4, the Top 25 list was dominated by skincare products. A record 56% of products on the list were skincare products. This came primarily at the expense of makeup, which had only 8% of products on the Top 25 in Q4, versus 24% in Q3, and body, which fell to 8% from 12%.

Mass and masstige brands like COSRX, Mighty Patch, PanOxyl, Neutrogena, and CeraVe made up the majority of the Skincare Top 10 in Q4. Anua’s Heartleaf Pore Control Cleansing Oil joined the top 10 this quarter for the first time ever. The average price point of the skincare top 10 was $17.01.

The Haircare Top 10 continued to be led by Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil and Nizoral Anti-Dandruff Shampoo. Kitsch Satin Heatless Curling Set joined the top 10 in the number three spot. The average price point of the haircare top 10 was $22.13.

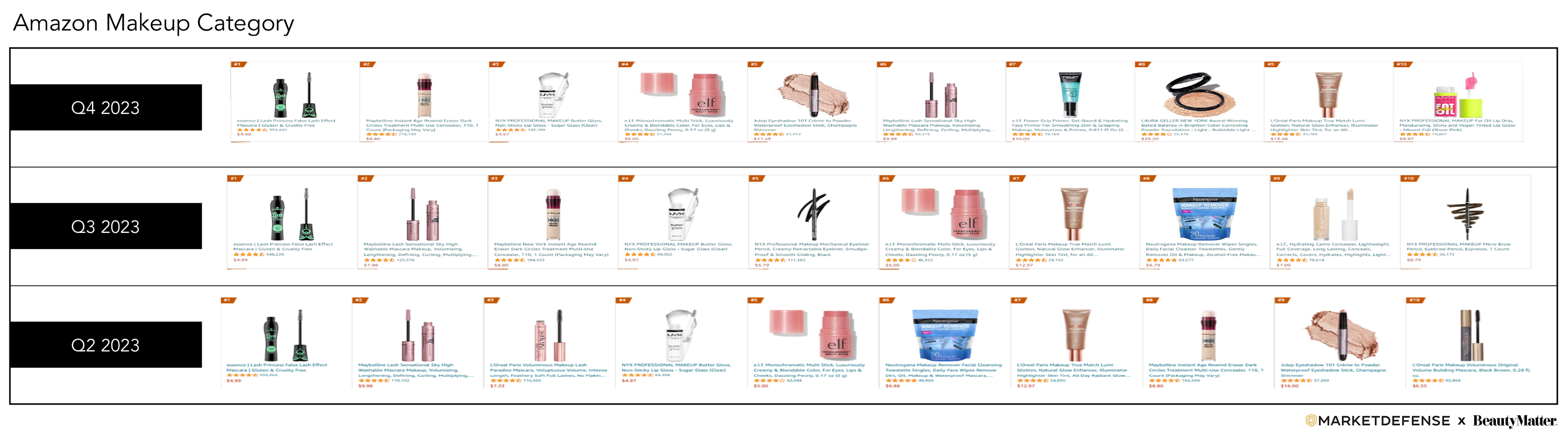

The Makeup Top 10 was consistent with previous quarters, highlighting favorites from Essence, Maybelline, NYX, and e.l.f. Top 10 newcomer, Laura Geller New York Award-Winning Baked Balance-n-Brighten Color Correcting Powder Foundation, helped drive the average price point of the Makeup Top 10 to $10.29, from $7.31 last quarter.

What is on the horizon for Amazon in 2024? Dave Karlsven—Amazon industry veteran and SVP of Client Marketing and Data Science at Market Defense, a marketplace services agency for premium beauty brands—predicts the following advances coming to the platform in 2024 will help drive growth and ROI for beauty brands:

Without a doubt, Amazon’s rich consumer data will continue to drive innovation. “Because we have a portfolio of many of the top-selling Beauty brands on Amazon, it has allowed us to gather large amounts of advertising and sales data across all the beauty categories on Amazon. We then use AI tools to help our team of data experts run analysis on the data to get better understanding and actionable insights on every brand, product, ad campaign, and keywords that drive the majority of traffic and sales in every beauty category across Amazon and many other online marketplaces where beauty products are sold,” says Karlsven. “This data allows us to make better decisions on budget allocation and execute on more advanced advertising strategies that produce bigger and faster sales growth for our clients.”

Previous Reports:

Q3 2023 Amazon Top 25 Beauty & Personal Care

Q2 2023 Amazon Top 25 Beauty & Personal Care

Q1 2023 Amazon Top 25 Beauty & Personal Care