The British High Street’s post-COVID recovery—though tentative—is being led by independent beauty and grooming salons, according to research from the Local Data Company (LDC) that is cited in a new report from business insurance group Superscript titled “Can Independent Retailers Save the High Street?”

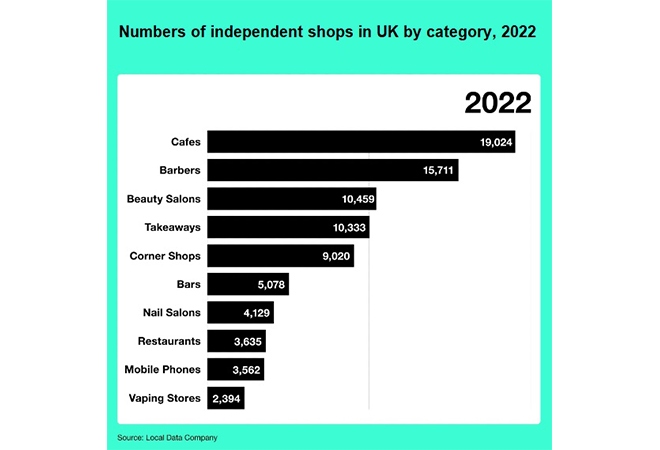

The LDC data put barbers, beauty salons, and nail salons in the top five independent retail categories when it came to growth. UK towns and cities have been hit by shop closures due to retail’s shift to e-commerce over the past decade, as well as the impact of COVID-19. Consequently, more than 10,000 chain store branches disappearing in 2021, according to PricewaterhouseCoopers. But it has been a different story for beauty.

Over the past five years (2017-2021), there has been a net gain of 2,194 beauty salons, 3,247 barber shops, and 952 nail salons, each growing at between 25% and 29%. These data came from a British Beauty Council investigation into micro-beauty businesses alongside the LDC that was released in January 2022.

The British Beauty Council said, “The research highlighted the resilience of small businesses noting that the beauty sector grew by 1.1% between January 2020 and December 2021 compared to the overall retail and leisure sector, which declined by 3.2% over the same period.”

Surviving and thriving

The organization’s CEO, Millie Kendall, commented, “The data reveal that we have been nothing but resilient. Our industry has a ‘long tail’ that is made up of thousands of small independents. Most have survived and thrived because they speak to so many things that the modern consumer is looking for.”

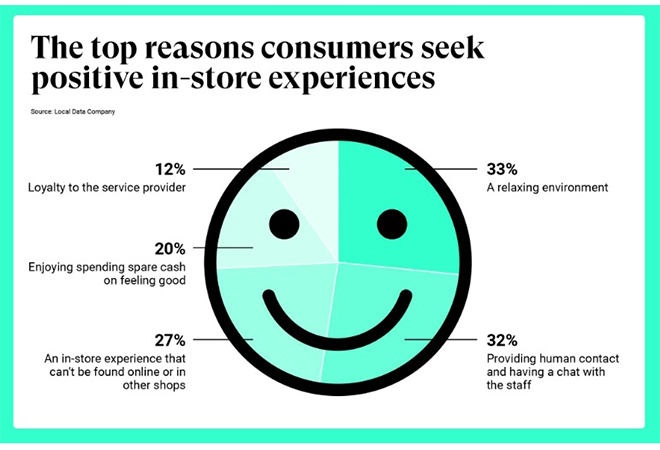

Superscript’s report points to positive in-store interactions and experiences; human contact; and more loyalty to local businesses as important elements that have helped to keep beauty on a growth trajectory during the pandemic.

The company’s survey of 2,000 local shoppers also found that 20% of respondents said they prefer to spend spare cash on looking and feeling good, while over 30% said they head to salons for personal contact and communication with their beauty providers.

Talking to Superscript, Oli Gittins, who opened his barbershop OliBarber in Dorset a year ago, said, “Being able to transform your image to the best external version of yourself every few weeks or so is an attractive idea. You nail that first trim, and your customers will return.”

Megan Cummings, who runs Quirk Nail Studio in Swindon, added: “Summer is always the busiest period, but particularly this year I can’t keep up with the demand. I think Instagram has a big part to play as people are becoming more image conscious and looking to get an Instaworthy shot. I get a majority of my customers through Instagram as they can easily see my work and prices.”

Lurching from one crisis to another

While the recovery from COVID is ongoing, hairdressers and beauticians are now preparing for a cost-of-living crisis this winter. However, London-based analyst Global Data predicts the beauty industry will experience a 2.8% compound annual growth rate to 2023, and it has highlighted the “lipstick effect” feel-good factor as a key driver.

The theory—which is backed up by Depression-era data—suggests that when people are going through economic difficulties they are still likely to purchase little luxuries, though less costly ones. During the economic crisis of the 1930s—between 1929 and 1933—industrial production in the US halved but sales of cosmetics rose.

Want to continue reading this article and others just like it?

Subscribe to BeautyMatter and access the most current beauty intelligence and news updates.

SubscribeAlready a member, login here.