Hainan’s duty-free share of China’s total personal luxury market has doubled from 6% in 2018 to an estimated 13% last year – with beauty holding a dominant position. In a new report, global consultancy Bain & Company has identified the island province as one of the drivers of future luxury growth in China, although the picture is less rosy from a profitability and image viewpoint.

Hainan has been a designated duty-free retail destination for about a decade, but the tripling of the allowance in summer 2020 dramatically increased its importance—to beauty in particular—as mainland Chinese flocked to Hainan when they were barred from international travel shopping due to the pandemic.

Bain’s China Luxury 2021 report, an annual study released in January, says that luxury beauty comprises more than 50% of Hainan’s duty-free sales. We have already reported how the island has boosted some houses such as Estée Lauder Companies in unexpected ways.

Plenty of other brands in travel retail have jumped in. They include big multi-brand players, from France’s L’Oréal Group, Japan’s Shiseido Group, and Coty, to Elizabeth Arden and Foreo. But the big push to drive duty-free sales in Hainan—when the rest of the channel, namely airports, is struggling—could be at the expense of profits.

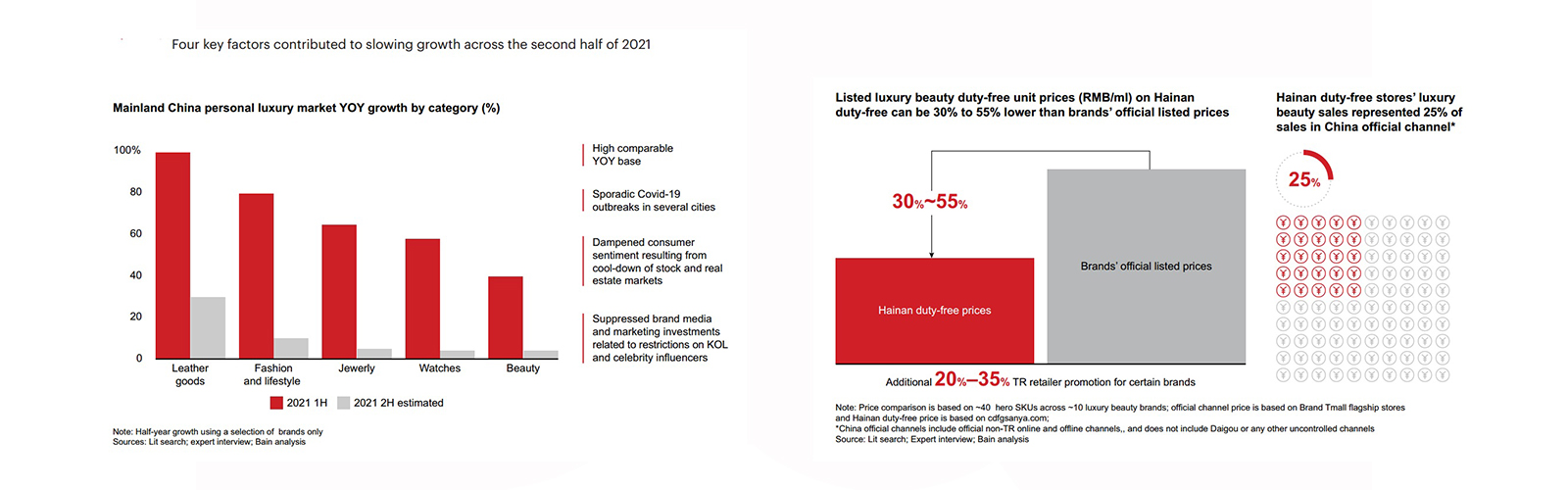

In its report, Bain states: “The biggest promoter of Hainan success has been its aggressive pricing. For many brands, the advantages go well beyond mere tax benefits. For example, we conducted store checks across many beauty brands during the Christmas season. Our research shows that Hainan unit prices (RMB/ml) can be 30% to 55% lower than brands’ official listed prices.”

Will luxury beauty get caught out?

Naturally, consumers are rushing to take advantage of such big reductions in luxury beauty. As a result, the island’s sales now represent almost 25% of those in China’s official channels (both online and offline) in this category. The big price gap has also disrupted the luxury beauty market’s pricing system and is “contributing to slow growth in other channels,” according to Bain.

The promotional demands from retailers in Hainan can be costly and not only do they risk profitability, they could also change consumer perceptions. Luxury brands without the marketing budgets to reinforce their high-end brand images risk being downgraded to prestige, while prestige becomes “masstige" and so on.

This might be the price paid for popularity in order to drive up sales volumes. At one time, China Duty Free Group controlled virtually all duty-free sales on Hainan, but within the past 12-18 months, other international duty-free operators such as DFS Group, Dufry, and Lagardère Travel Retail have piled in with Chinese partners.

“As more operators arrive, we expect retail shopping opportunities on the island to continue expanding. With more options for buyers, price competition is likely to become more intense,” Bain said.

A US market scenario in the making?

Such continued pricing disruptions, including the resilient daigou channel (where professional shoppers buy duty-free on behalf of several individuals) are taking beauty to a possible cliff edge. “We anticipate major risks for category repricing and negative impacts on brand image and equity. It is a US market scenario in the making,” Bain warned.

For now, brands appear to be more interested in winning duty-free sales and market share, and Hainan’s offshore market can deliver handsomely on at least one of those two ambitions. The island has become a luxury hub that can’t be ignored. In 2020, thanks to the tripling of the allowance, sales more than doubled (by 120%).

Last year, sales increased again by about 85% to reach RMB60 billion or just under $10 billion, helped by an influx of 81 million tourists, up 25% from a year earlier. Hainan’s provincial government is targeting duty-free sales of more than $46 billion by 2025, more than four times current sales.

Bain calculates that Hainan contributed about 5% to China’s overall luxury goods market growth in 2021. Personal luxury makes up almost all (95%) of the island’s sales. That high percentage will not last forever, though beauty’s dominance should continue.

The Hainan Provincial Bureau of International Economic Development is pushing hard to make the island a luxury destination, helped by the China International Consumer Products Expo. The second annual event will run in April and promises to be bigger, with a larger share of foreign brand exhibitors.

More widely, China’s luxury market continued its double-digit growth trend of 2020, though it slowed down in 2021 to 36% (from 48% in 2020), and was particularly shaken in the second half (see chart) due to multiple shocks. However, the three core trends of digitalization, continued repatriation of spending, as well as Hainan’s explosive duty-free growth, mean that the country is on track to become the world’s largest luxury market by 2025, overtaking the US.