As a source of daily consumer products, the haircare market in China has massive headroom for brands to grow. The overall Chinese haircare market gained at a steady growth rate of 4.8% in 2020, tapping a market size of 48.7 billion RMB ($7.7 billion), according to Mintel. The latest research by Mintel found 94% of Chinese consumers believe scalp care is as essential as skincare.

China’s shampoo and haircare market is experiencing steady and sustained growth and is expected to reach 60.5 billion RMB ($9.5 billion) by 2025. The rapid increase in the consumption of haircare products is driven by rising awareness of specific haircare issues and the vertical category, and the consumption upgrade trend in China, in which consumers trade up to more premium products.

The study from Mintel showed that shampoo is still the largest segment in the haircare consumer market, and these products are used by Chinese consumers daily. It is an in-demand and highly competitive product category. Sales of conditioner and scalp care products are much lower than shampoo sales, but the growth rate of these product segments is double that of shampoo. In the future, conditioner and scalp care will be the main driver of the industry's retail sales growth.

Claims blurred from skincare categories are widely accepted

The concepts and trends that continue to migrate from the popular skincare market have accelerated the upgrade of self-care functions and consumers' increasing awareness of scalp health. Top-rated claims in skincare are migrating to haircare products, reflecting consumers’ evolving purchasing needs. Cleansing as a basic function is still the most in demand, but more people are starting to care about hair damage repair (37%) and expanded functions such as repairing color-treated hair and scalp care.

Interestingly, consumers prefer product claims related to scalp care, such as antioxidant, probiotics, vitamins, and minerals, which made up 4%, 2%, and 11% in 2020 respectively, Mintel states. Today, as the concept of "skincare" grows more entrenched in the haircare industry, product claims connected to haircare products also reflect customer purchasing needs. As such, customers demand clarity on the ingredients used in shampoos, targeted treatments, and evolving function demands.

Conditioner and oil products are gaining attention for claims addressing anti-dandruff, dandruff prevention, and scalp problems. Consumers’ evolving concerns about scalp problems reflect significant demand for scalp care solutions. Unlike a decade ago, Chinese consumers now treat dandruff by deep cleansing. They are now increasingly aware that the root cause of dandruff is unhealthy scalp conditions. More and more consumers believe that scalp care is as crucial as skincare.

With hair perms and dye becoming the norm for the younger generation of consumers, there is also a considerable increase in interest in hair damage repair and color treatment. Consumers are no longer satisfied with traditional product claims and now look for targeted treatment delivered by ingredients such as keratin, amino acid, and essential oils.

Market segmentation of China's haircare market: high-demand products

Tmall B2C retail sales of haircare products have shown two years of consecutive growth above 30% per annum, according to the Tmall 2021 Haircare Market Consumer Trend Report. Tmall’s figures also show customers tend to choose high-quality, targeted functions, or high value-added products. This also means new players and more competition have entered this growing market.

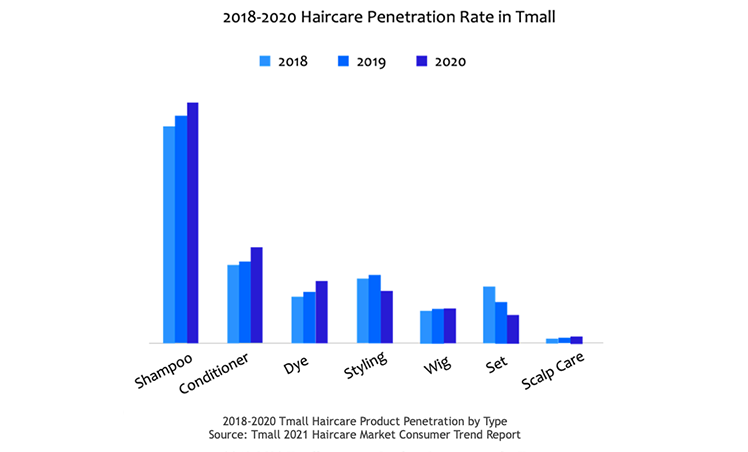

Shampoo has one of the highest penetration rates of personal care products in China. Shampoo is undoubtedly the most in-demand category, attracting most haircare brands and intense competition.

Penetration rates of haircare, scalp care, dye, and perm are also growing stably. Conditioner growth in 2020 is even higher than shampoo, the Tmall Haircare Market Consumer Trend Report highlights. As diverse needs increase, customers will spend more on scalp care. This is a tremendous category opportunity.

Other products, such as styling and set, also have enormous scale, but the overall penetration is decreasing. The drop can be seen in set products especially. Customers have more precise demands regarding what they want, and they are proactively choosing products instead of accepting a hard sale from the merchant.

What are the opportunities in China's haircare market?

The trending search terms on popular social media platforms reveal that Chinese consumers have a strong demand for anti-dandruff, oil control, hair growth, and itching in the shampoo category. Coconut flavor, orange blossom, fluffy, hair follicle, hair loss prevention, and nourishing have become new hot spots for shampoo. Caffeine, hair stabilization, hair growth, color lock, color protection, silicone oil-free, etc., are also niche demands.

Repairing dryness and softening frizz are still the two top haircare needs. Static-free, correction, and recovery have become fast-growing new search terms. Perm, moisturizing, curling, fluffy, and essential oils are the second highest-growth keywords.

Chinese consumers are willing to try new things, whether it comes to changing products or trusting new brands. According to Mintel's haircare survey in China, 66% of respondents said they don't like to keep using the same haircare products. Notably, young consumers aged 25 to 39 are the major explorers who try new haircare products. 67% of Chinese consumers consider their specific hair problem the most important reason to try new products and brands.

Chinese consumers' appetite for new products is driven by benefits, especially in resolving their pain points, including hair problems and conditions. Such a mindset is similar to the effectiveness-led skincare market to some extent. Consumers are still discovering the best solutions that work, and they're open to trying niche imported brands, revealing an ongoing trend for consumers to look for high-end products that deliver better treatment or elegant scent.

A few innovative merchants benefited from an increase in e-commerce and China's quick recovery from the pandemic, allowing them to outperform the sector. America’s HASK Beauty, a brand that stands for hair and skin kindness, quickly expanded digital operations via Tmall Global in 2021 to capture the growing demand for essence treatments and scalp care, and has seen a sales boom. Kerastase, a premium haircare brand owned by L’Oréal, is the beneficiary of China's haircare market. The brand has been in the market for many years, becoming popular among Chinese consumers through cross-border e-commerce business. Witnessing colossal success, Kerastase then entered the China market through general trade and launched its Tmall flagship store. The brand stocks a large inventory in mainland China warehouses to meet local consumer demand and shorten shipping times with general trade. Now, the Kerastase Tmall store boasts nearly 4 million fans.

According to Tmall scalp care sales data (Oct 2020 – Sep 2021), Kerastase is the haircare brand with the highest market share, accounting for 16.37% of sales. Also, it is the only brand that accounts for more than 10%, which shows that there is still a lot of room for development in the scalp care market.

Haircare reflects the premiumization trend

Premium haircare lines are doing great in China and have lots of growth potential. A-list haircare from one of Paris’s most prestigious salons, Christophe Robin, has built its official China presence with a Tmall Global flagship store since 2018.

Haircare is becoming a category where consumers desire more and more quality, and we see that premiumization remains an opportunity. Oribe, owned by Kao, a luxury haircare brand that costs nearly 500 RMB (nearly $80) for a 250ml bottle of shampoo, has also opened its official Tmall Global flagship store and has nearly 11K shop followers so far.

Cross-border e-commerce provides a shortcut to give DTC brands access to the Chinese market quickly and affordably, especially for those that do not have a presence in China.

E-commerce platforms such as Tmall Global and JD Worldwide empower them with insights and data analytics to help them navigate the complex market and respond quickly to changes in customer behavior. These timely insights matter because brands rely on the customers of these platforms to boost brand awareness and sales.

While digital marketing in sales channels can effectively drive sales, marketing in China does not stop at the marketplaces. For DTC brands, leveraging social media platforms to grow brand awareness is also essential to make the best possible move in China.