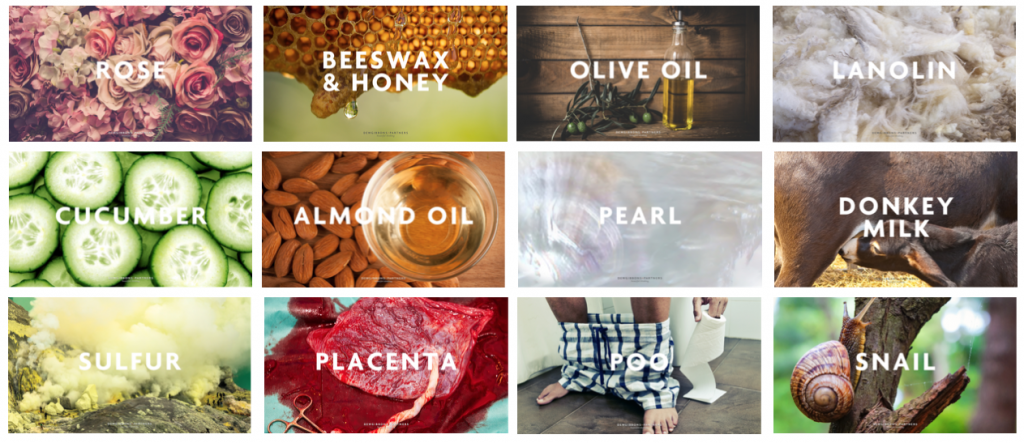

Think about face masks containing snail slime, sulphur, donkey milk, placenta, and bird poo. The latest innovative launch from a K-Beauty brand? Nope. They’re ancient recipes written by Ovid in The Art of Beauty over 2,000 years ago for brightening and dark spot–reducing treatments.

Even in beauty, there’s virtually nothing new under the sun. Today’s hottest beauty ingredients have been known for their beautifying qualities since ancient times: charcoal, copper, clay, eggs, and cork (the latter the star of Birkenstock’s unusual new beauty range).

In 2017, however, hero ingredient brands are big business, whether that’s plant, animal, or mineral/metal extracts. But what’s the reason behind this momentum of change?

In large part, it’s due to the phenomenal rise of the natural and organic beauty segment. Mintel’s latest United States report shows 24% annual growth in the segment against 2.7% for the total beauty category in 2016. Add this to the wider cultural distrust of big business and “experts” seen in recent years, and you get a marked shift away from abstract science towards ingredients and provenance.

As a result, beauty brands are venturing ever deeper (literally in the case of seahorse plankton microalgae) to find unique ingredients to leverage. But with demanding and fickle consumers asking for the latest thing, how can ingredient-led brands differentiate themselves from their competitors? Can a focus on an ingredient actually be a limiting factor for long-term growth and success?

The answer depends, as with all things, about how the ingredient story is brought to life. We define three key ways that brands can engage with ingredients, all of them with pros and cons.

INGREDIENT-NAMED Ingredient Named does what it says on the tin: the ingredient is the star of the brand show. The Jojoba Company, Marula Pure Beauty Oil, Maya Chia, Manuka Doctor, Oud Essentials, and more spring up almost weekly. This provides absolute focus and clarity to the consumer and—in the case of new ingredients—it can capture the space with first-mover advantage. It can position the brand as an expert of the ingredient, rather than being simply an addition to a wider portfolio—an opportunity to build trust with skeptical consumers who distrust “scientific” beauty ingredients.

But the flipside is that such a distinct ingredient focus can become a prison: some ingredients simply cannot stretch its category as far as others. Where honey, beeswax, coconut, and rose can go, snail slime is unable to follow.

It’s also challenging to create a believable and compelling narrative that supports “ownership: of an ingredient—a name alone is not enough—and first-mover advantage can be quickly eroded by more sophisticated competitors. Add to this the fact that last year’s kale is replaced by this year’s baobab, ingredient novelty is not enough. Efficacy has to be proven to keep the brand relevant, and NPD/innovation is far trickier to undertake within an ingredient straitjacket.

For best in class, Maya Chia stands out. It’s all about its gastro crossover hero ingredient, but it’s a beauty brand first, with the design simplicity that that demands, using an abstract representation of the chia flower, ample white space, and a refined colour palette. Something established ingredients like argan and charcoal struggle to do against established and limiting design semiotics (turquoise, gold, and brown and black black black respectively). Maya Chia’s name also brings together both the ingredient and its geographic provenance, giving it a richer brand story. New range additions like The Super Couple Serum leverage the hero ingredient and introduce new actives through clever secondary naming.

Shea Moisture, however, seems to have lost control of this. Its runaway success has manifestly diluted its ownership of shea. Literally, scores of ranges make it almost impossible to navigate. And despite the company’s stated commitment to natural and organic, the blandly commercial appearance of the brand may well see its original shea butter consumers go elsewhere to more purist quarters.

INGREDIENT NARRATIVE Another approach is to create a distinct Ingredient Narrative, where the ingredient is evoked and centered, yet not eponymous. Aveeno, Caudalie, African Botanics, and Charlotte Mensah all excel at weaving a wider, compelling story. Some reference place, others person, some both. This approach gives the brand more flexibility in terms of its design identity. From a growth perspective, there are far more opportunities to introduce companion hero ingredients in a meaningful way, extending the range into different beauty categories.

Of course, however, this means that the brand’s identity and communications have to work harder to establish what hero ingredient it’s focused on, and it is challenging to achieve the delicate balance needed between the different elements of person/place. An ultra-expert position on the core ingredient is harder to establish, putting it vulnerable to competition from both ingredient-named brands and ingredient ranges. There is also an added risk of not only ingredients, but also people and places falling out of favor due to geopolitical or personal upheaval.

One brand that has managed to navigate this is Caudalie, master of the grape. Long before the hero ingredient trend started, the French natural brand wove a compelling narrative based on ingredient and place— a family vineyard in Bordeaux—that has visual charm, is highly believable and focused, and that has even extended from skincare into sun care and fragrance. The brand’s founders coined the phrase “Cosm’ethics” to highlight their refusal to “choose between effectiveness and naturalness, between glamour and ecology.” So while the brand’s visual and verbal identity is steeped in everything grape, its Cosm’ethics approach gives it the “permission” to incorporate other green active ingredients to continually improve efficacy, without diminishing its focus.

A newer entrant into the Ingredient Narrative arena is luxury beauty brand African Botanics, with the ingredient marula oil at the heart of its current hero SKUs. The narrative of the brand, however, speaks to its setting in the Cape of South Africa, giving a huge palette of natural ingredients to introduce without it seeming opportunistic or false to the brand. Its fresh, elegant design doesn’t fall foul of the usual clichés relating to Africa (heavy use of reds, green, gold, and black and “tribal” motifs) even as it has traditional muds, scrubs, and oils in its product portfolio.

INGREDIENT RANGE The final approach is Ingredient Range, with brands happily playing with any ingredients, from the intensely natural and organic to the manifestly not. Think Origins, Weleda, Dr Organics, Garnier Ultimate Blends, and current superstar Yes To.

The main benefit of this approach is that the brand can benefit from established and emerging trends without having to “break” them themselves. And, by not being first movers, range brands can credibly make the argument that they are about using efficacious, reliable ingredients that have evidence behind them. In addition, the brand is not tied to one ingredient, making it more resilient to fads and less bound by what is current in terms of fashionable ingredients. Depending on the brand’s execution and narrative, theoretically, expansion is limitless.

But of course, there’s always the other side of the coin. Ultra-natural brands can find it hard to introduce hero ingredients from outside their natural heartland (or geography) without looking opportunistic. Mass brands, on the other hand, simply don’t have the natural credentials to be credible with certain ingredients. Too many different ingredient ranges, even for those with credibility and distinctness, can cause confusion in the consumers’ mind. Conversely, too many combinations of hero ingredients dilute their power.

At the high, natural range end, Neal’s Yard’s iconic blue bottles set the tone for everything about this well-established beauty and wellness brand. The brand’s consistent visual language, strong brand purpose, and herbalist background gives them the opportunity to truly talk to the properties of the ingredients they use. Pioneers in the modern usage of rose oil and frankincense, new ranges include white tea and palmarosa. Weleda, Jāsön, Kneipp, Dr. Hauschka and others similarly use their well-earned credibility to claim mastery of their ingredients. However, innovation too far aware from their literal and geographic heartlands is always risky. While Neal’s Yard has frequently ventured to India for its ingredients, congruent with its British heritage, would the Amazon basin work as well? Possibly not.

At the mass end, Yes To is a phenomenon, perhaps the pinnacle of the hero ingredient trend and evidence of people’s thirst for simplicity and natural ingredients. With its recent addition, Yes to Cotton, launching in the States, it’s hard to see them slowing down anytime soon. The brand is abundantly clear and bold about its hero ingredients and what they can do on- and off-pack. However, as with any ingredient range, as the varieties mushroom, the possibilities of cannibalization always loom. Not to mention a look of a “chemical” brand, despite their “95-99%“ claims. For true ingredient purists that will never be enough.

Bringing us back to the beginning, where ingredient beauty emerged against the range of mass science brands. Truly there is nothing new under the sun. The hero ingredient is just the latest style, just as science was back in the ’80s (pentapeptides anyone?).

Ultimately, any beauty brand’s enduring success is about being elegantly simple, focused and delivering a true benefit to the consumer, woven into a compelling brand story. In 2017, for ingredients, that means incorporating them—and their provenance—with a light touch in brand design and comms and ensuring that the products match up in performance.

Far from being a hero, any ingredient style may well turn out to be a villain if brands fail to follow this meaningful approach. This is true as even credible brands look to expand: ever-bigger portfolios that aren’t driven by consumer value merely create confusion and erode the core brand. Bandwagon-jumping and greed never pay off well in the long run. The now-defunct pomegranate beauty ranges are a testament to that.