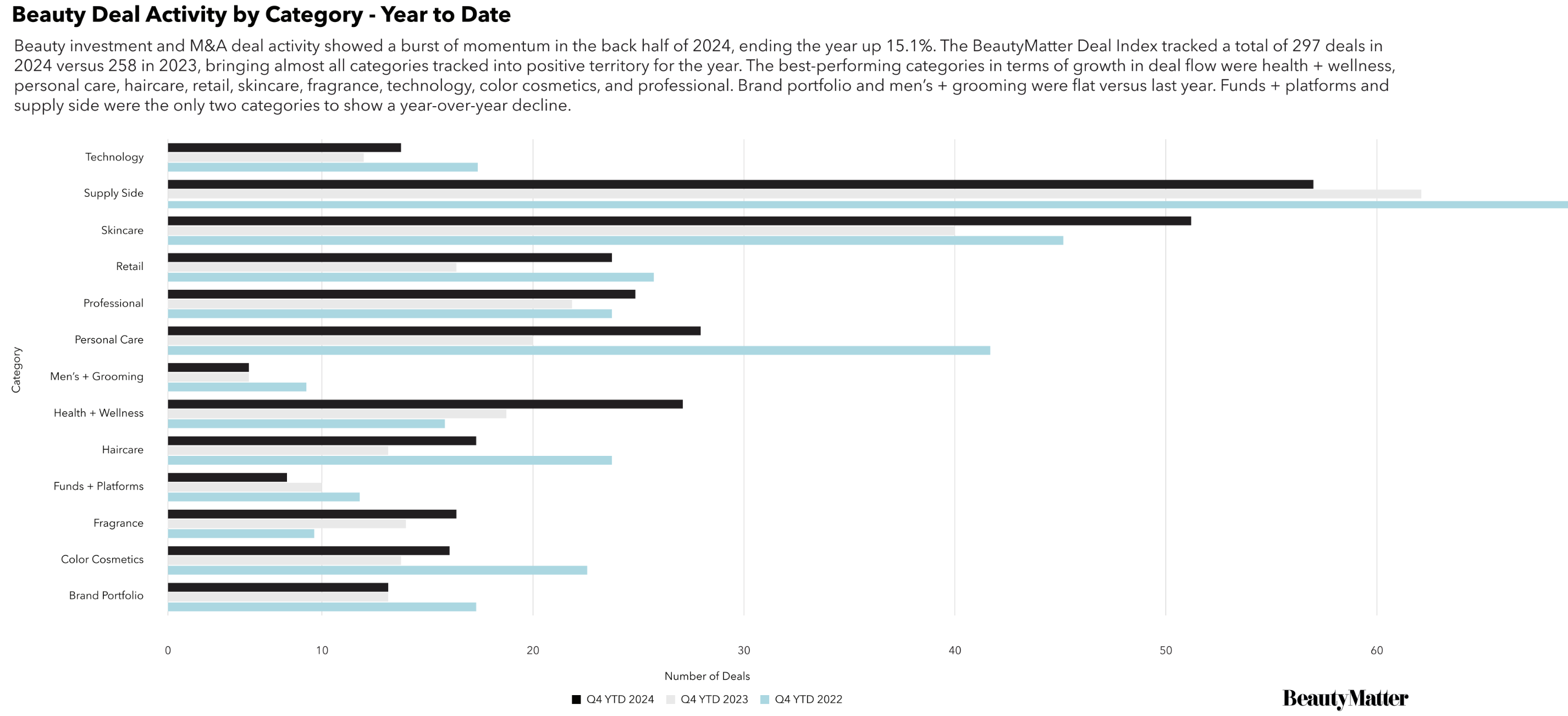

For the full year 2024, the BeautyMatter Deal Index tracked 297 deals, up 15.1% from 2023, when it tracked 258. The year started off strong in Q1, when deal activity was up 16.1%, but started to feel like a bit of a roller coaster by Q2, when activity fell 20.3%, and growth deals in particular bottomed out with the lowest number of deals in the history of the Index. Q2 saw just 16 growth deals, a far cry from the average of 43 per quarter over the last four years. But the back half of the year saw a recovery led by strong M&A activity. Q3 and Q4, combined, were up 34.3% and led to a strong finish for 2024. For the year, M&A comprised about 55% of deals, while growth represented 43%. The remaining 2% of deals were the six IPOs the Index tracked in 2024, the most since 2021.

Purchase the 445-page report that covers deals across the beauty and wellness value chain.

Beauty Deals: Investment + M&A Transactions Year End 2024

“BeautyMatter is the only one that provides full insight, not just the hard data or the numbers, but also the intelligence of understanding what the numbers mean for companies and the market. I think that is a super valuable source for the investors, for the founders, for the strategists who are trying to buy brands, to understand what it's really like, what's going to be the next thing.”

-Jorge Cosano

Founder & Managing Partner, Synchronicity Ventures

Investors: If you’re an active or interested investor in the beauty and wellness space, this report is a must-read. The detailed analysis and insight provided will help guide you toward fruitful investment decisions.

Brands and Retailers: If you are in fundraising mode or contemplating an exit and looking for a list of investors active in the space, we’ve also got you covered.

You will have access to:

For a competitive edge, follow the money.

BeautyMatter Premium Members Save 15%

Complimentary for Professional Members. Learn more

Purchase the report now.