While Alibaba executives are optimistic about the future in the face of declining market share, self-inflicted wounds within China’s largest online platform create opportunities for brands.

There’s little debate over the importance of the value of the Chinese online consumer. China’s National Bureau of Statistics announced a 6.2% YOY increase in online retail sales of physical goods during 2022, reaching over ¥10 trillion ($1.5 trillion). Since 2005, China has grown from representing less than 1% of worldwide e-commerce transactions to over 40%. And this is particularly important for the beauty sector, where estimates of online share of total beauty sales range from 60% to 80%.

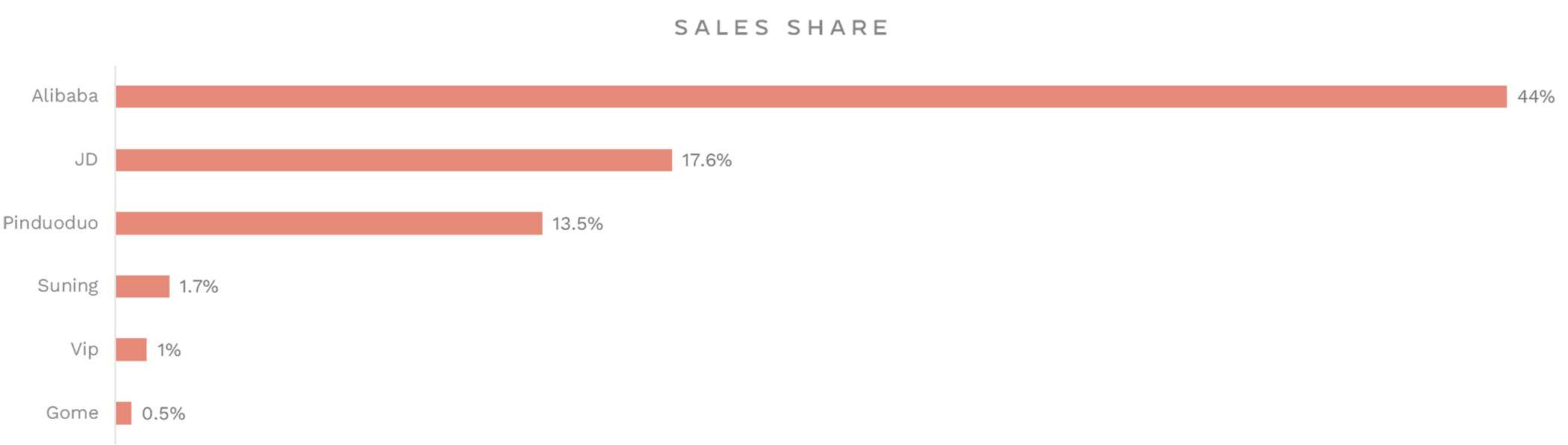

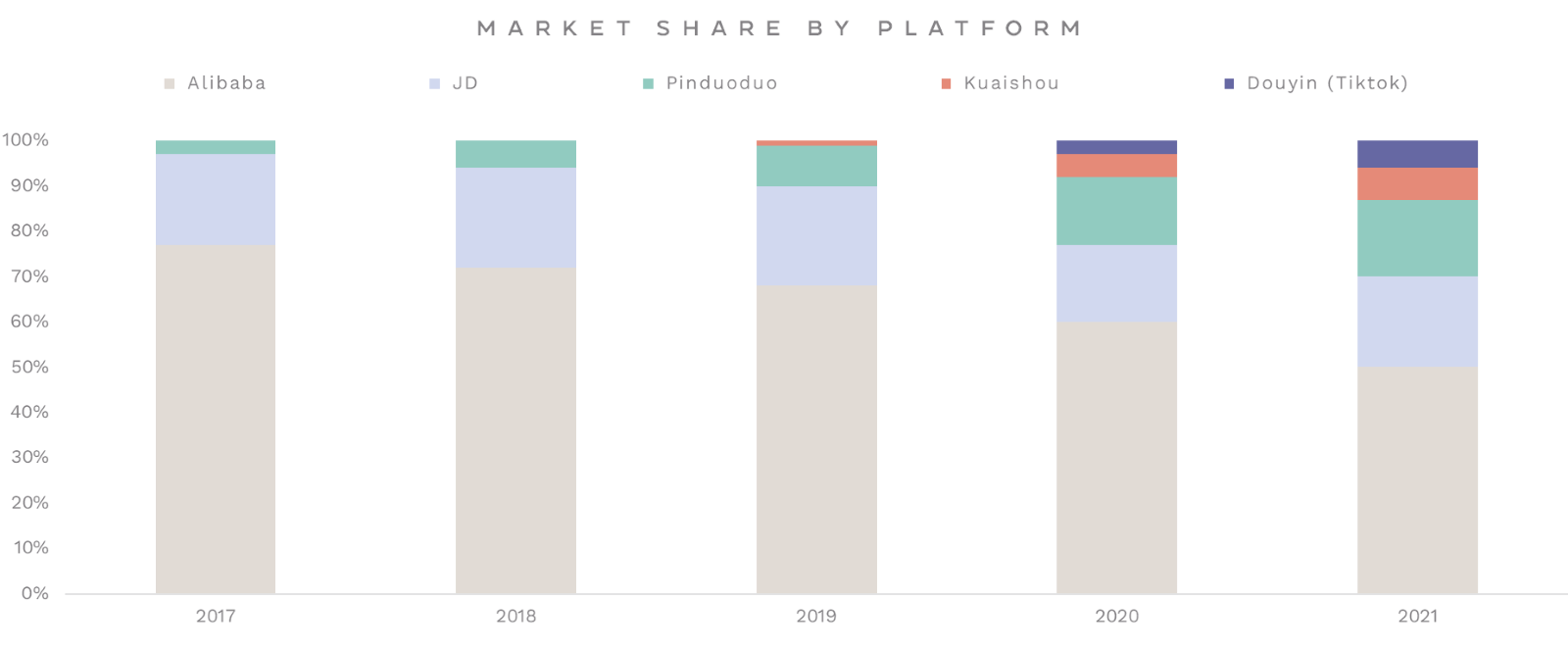

For decades, Alibaba has been China’s leading e-commerce platform, with 2022 annual revenue increasing 23% YOY to ¥924 billion ($135 billion). However, as competition arises, Alibaba has seen the sales share of its ecosystem of platforms—including Taobao, Tmall, Tmall Supermarket, Tmall Global, and Tmall Global Supermarket—drop by nearly 50% to a 44% e-commerce market share in 2022 from 78% in 2015.

“When we used to talk about marketplace-based core, it was Taobao and Tmall,” said Alibaba Group CEO Daniel Zhang, who identified increased competition as one of Alibaba’s main obstacles in 2021, “But now we’re working hard on building all these different businesses, each with its own unique and compelling value proposition.” And this diversification has not allowed Alibaba to hold on to share as the market has grown.

To understand Alibaba’s growth, it’s helpful to look at overall drivers of online sales in China. The Wall Street Journal has identified five:

1. A dramatic 86% increase (73% penetration rate) in internet users in the past decade.

2. Record-setting online shopping trends among China’s internet users.

3. An unprecedented rise in mobile payments, with 40% of transactions processed via mobile apps in 2022.

4. A vast and highly efficient logistics ecosystem.

5. A lack of retail infrastructure in lower-tier cities, in conjunction with a rapidly growing middle class.

Alibaba grew along with a unique market driven by these very attractive consumer dynamics. And then competition appeared to pick up a larger share of this growing pool of consumer spending.

Aside from the absence of market growth that was obscuring Alibaba’s decline, the biggest threats to Alibaba in 2023 are new competitors. Pinduoduo, Kuaishou, and Douyin have all increased their market share by becoming very intentional about consumer experience and incorporating digital customer interaction into their e-commerce apps. This is something Alibaba has not successfully done.

Pinduoduo draws in consumers by offering game-like elements and lower-priced goods, but a major driver of market share is the company’s highly innovative mindset. By implementing a C2M business model, team purchases, and social commerce programs, Pinduoduo offers efficiency to both consumers and vendors. The C2M business model in particular has turned the platform into the biggest online marketplace for agricultural products in China, as it allows farmers to sell directly to their customers.

Kuaishou and Douyin have both benefited from and contributed to a shift in consumer behavior from search to browsing. Douyin has been especially successful in the Chinese e-commerce market, as the platform drove ¥1.4 trillion ($208 billion) in sales in 2022 (76% YoY increase). As adopters of the emerging social e-commerce trend, apps like Douyin and Kuaishou promote products through content creation and influencer partnerships rather than direct advertising. China has the most developed social e-commerce market in the world, with a market size of over ¥2.5 trillion ($374 billion) and 800 million participants.

This brings us back to Alibaba. Management has identified China consumption, globalization, and technology as three “strategic engines” driving Alibaba’s future growth. Where does consumer engagement that has driven competitors’ success fit into the growth equation for Aliababa? Well, plans appear thin and more focused on replication than innovation. The company’s strategy to increase consumption within the Chinese market involves adopting content creation, livestreaming, and discounting to both attract new customers and improve retention. Alibaba has launched Taobao Deals and Taocaicai (formerly Tao Grocery) to target Pinduoduo’s bargain hunters, and marketing strategies like Zhongcao, which rolled out 40 days of content-heavy campaigning on Taobao Live to increase engagement with both consumers and sellers.

And what do beauty brands do with this?