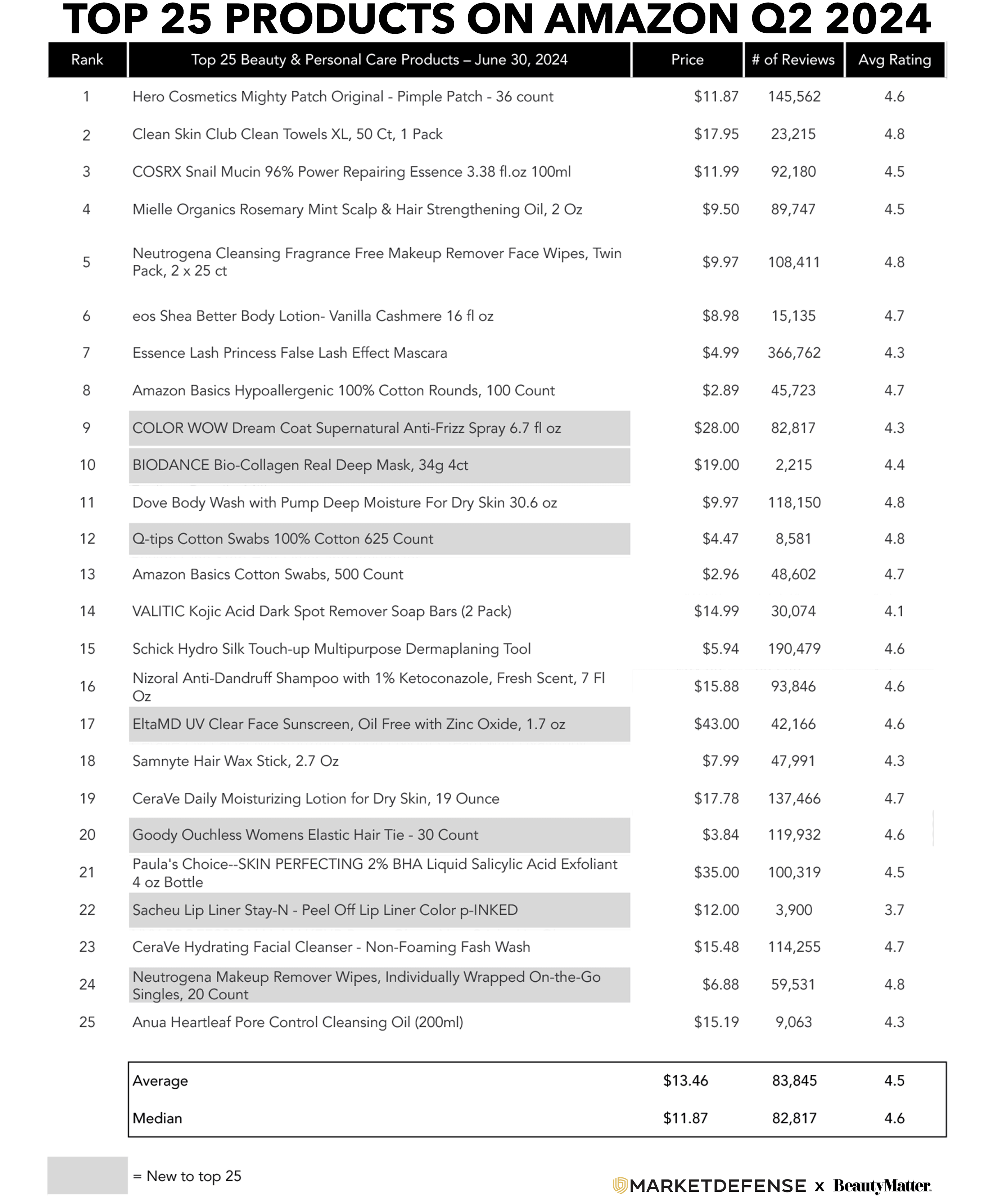

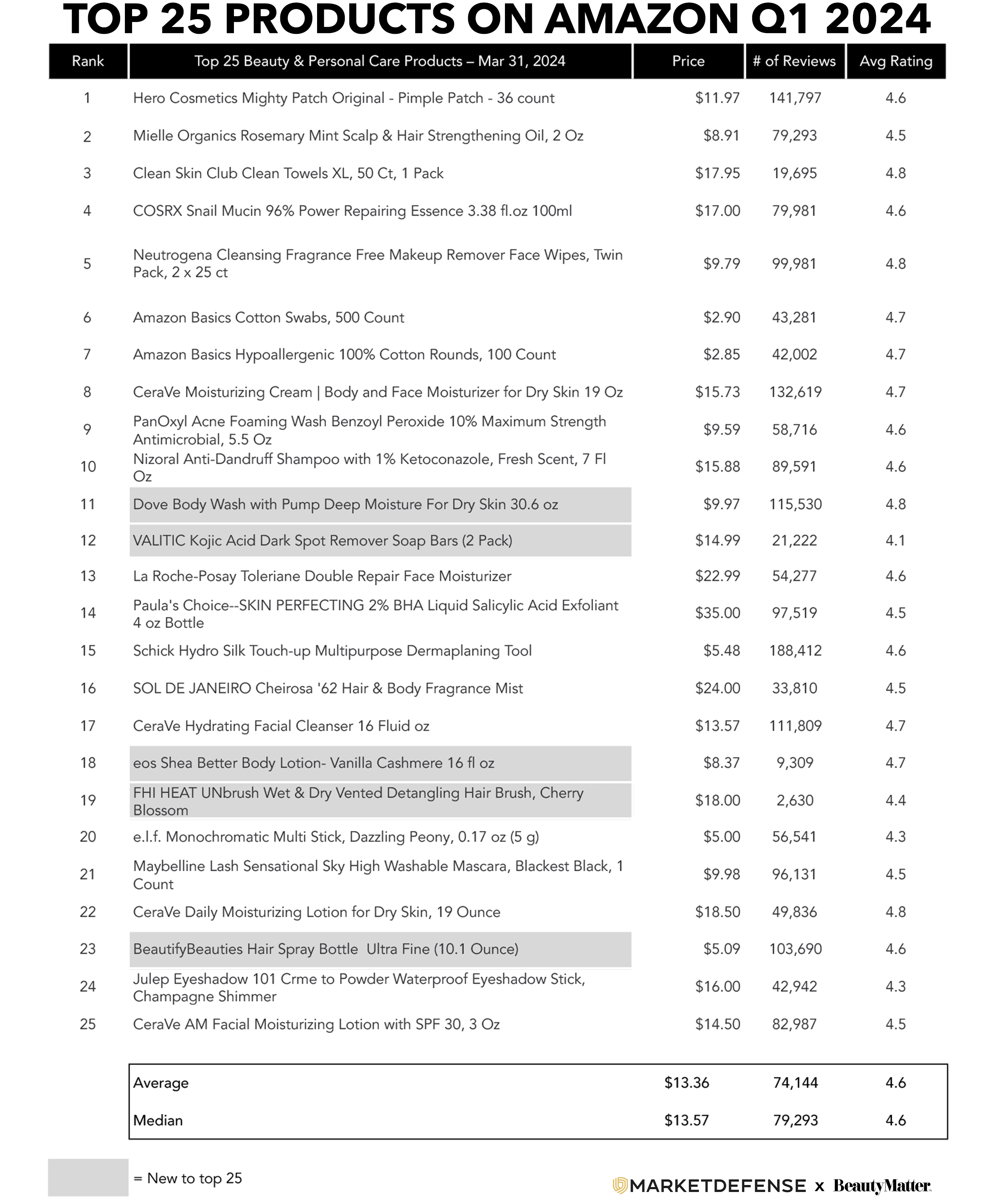

Leading the list of Amazon’s Top 25 Beauty and Personal Care products during Q2 2024 was Hero Cosmetics’ Mighty Patch pimple patches, continuing their reign as #1 from last quarter. Clean Skin Club Clean Towels XL was the #2 selling product, and COSRX Snail Mucin 96% Power Repairing Essence rose one spot to #3. Coming in as #4 is the Mielle Organics Rosemary Mint Scalp & Hair Strengthening Oil, and Neutrogena’s Makeup Remover Face Wipes rounded out the top five.

There were some exciting new brands on Amazon’s list this quarter. Seven products made their debut in the top 25 during Q2, including, Color Wow Dream Coat Supernatural Anti-Frizz Spray and Biodance Bio-Collagen Real Deep Mask which reached #9 and #10, respectively, and Sacheu Stay-N-Peel-Off Lip Liner, which came in at #22. EltaMD UV Clear Face Sunscreen at #17 was the highest-priced newcomer at $43. The remaining newcomers were Q-Tips Cotton Swabs, 625 count; Goody Ouchless Elastic Hair Ties; and Neutrogena Makeup Wipes, individually wrapped, which are all priced at under $7. The higher-priced newcomers helped to drive the average price up by $0.10 quarter-over-quarter to $13.46 in Q2.

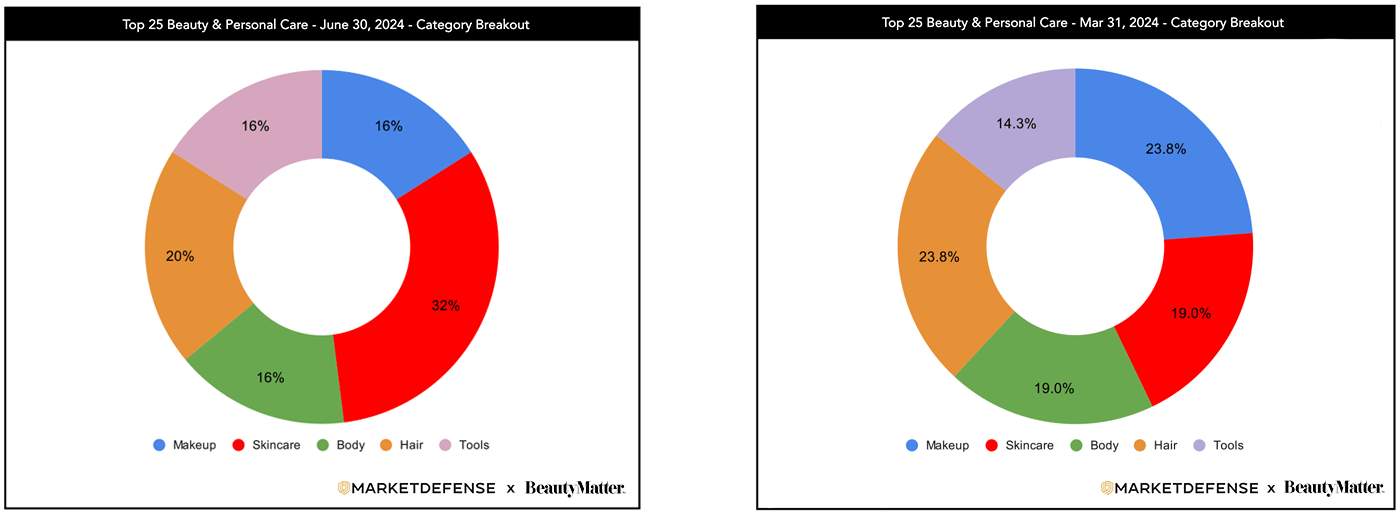

In terms of category mix, Q2 looked largely the same as Q1, with skincare continuing to attract the lion’s share of sales volume on Amazon. The haircare category gained some steam in Q2 as well, with volume ceded from tools and skincare.

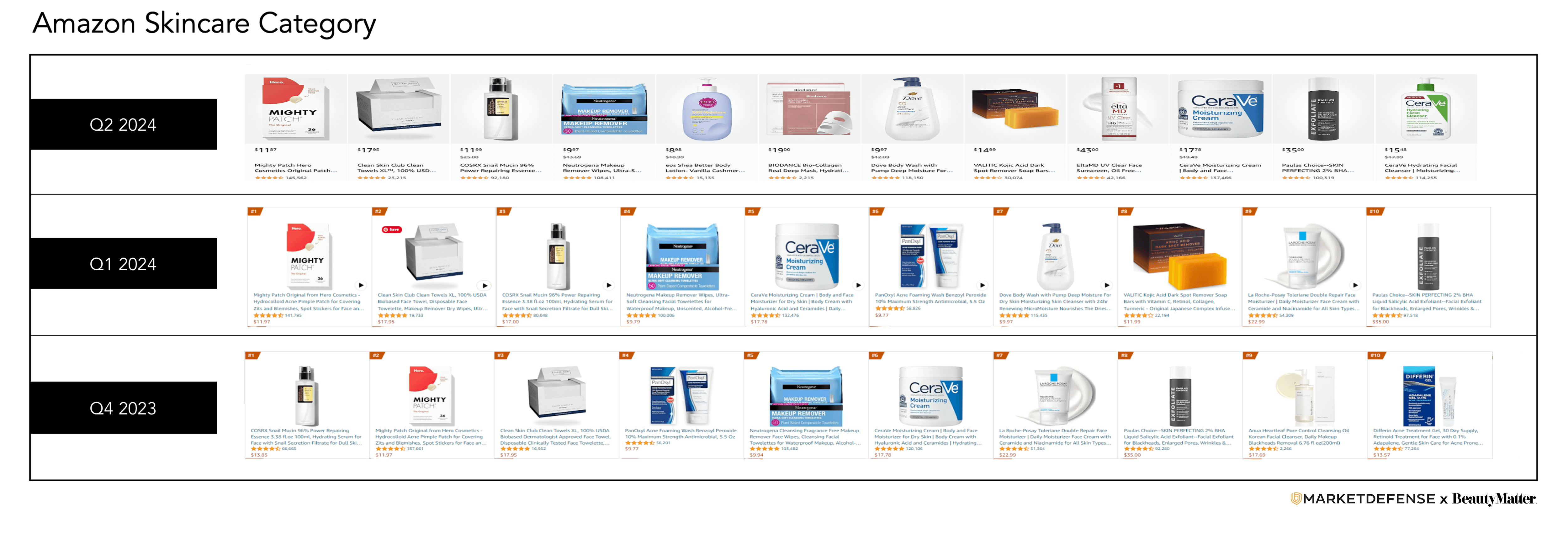

Mass brands like Mighty Patch, COSRX, eos, Neutrogena, and CeraVe made up the majority of the top sellers in the skincare category in Q2. Newcomer, Biodance joined the top brands at #6 and prestige brands, EltaMD and Paula’s Choice, held the course to round out the list. The average price point of the top skincare brands was $18.00, up about 10% from Q1.

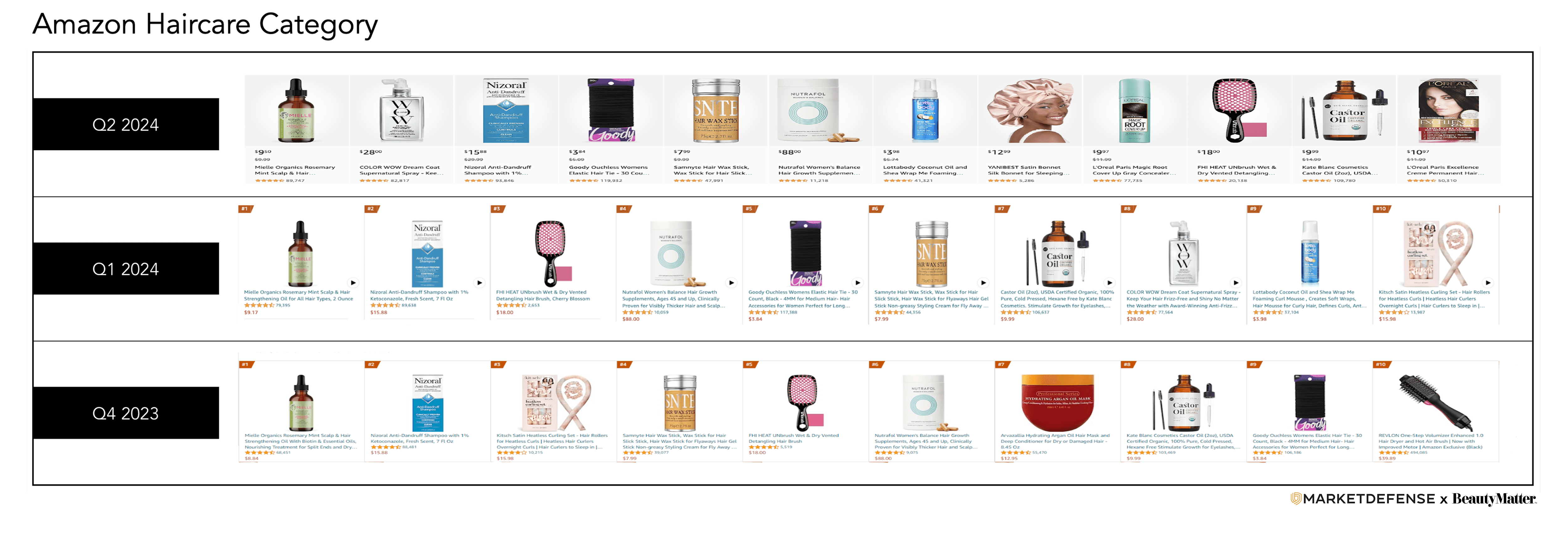

The top haircare brands continued to be led by Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil and Nizoral Anti-Dandruff Shampoo. Color Wow Dream Coat Supernatural Spray moved up the list to land at #2 in Q2. Nutrafol’s Women’s Balance Hair Growth Supplements was, by far, the most premium price point on any of the top product lists, at $88.00, was well above the top haircare average of $18.26.

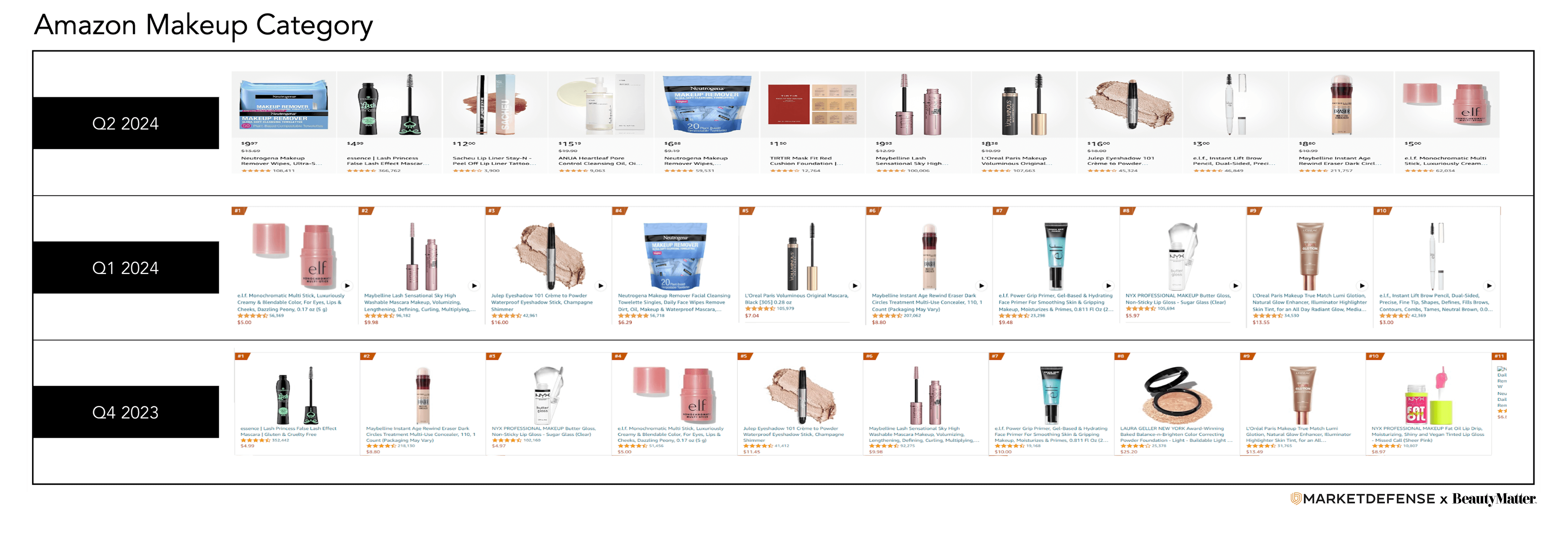

Mass mainstays from Maybelline, L’Oréal, Neutrogena, e.l.f., and essence characterized the top makeup brands during Q2. The average price point of the top makeup products was $8.47, largely in line with what it was in Q1.

The highest-ranked newcomer to the Top 25 list in Q2 was the viral hit, Color Wow Dream Coat Supernatural Anti-Frizz Spray, which has been steadily growing its reviews on Amazon this year to over 80,000. Biodance Bio-Collagen Real Deep Mask was the other highest-placing newcomer, converting a 1,900% jump in searches on Amazon for the product into millions a month in sales.

“The top keywords that drove Biodance’s jump into the top 10 selling products were a mix of nonbranded searches for “collagen face mask” and “Korean face mask,” and branded search terms for “Biodance” and K-beauty competitors “Medicube” and “Coco Beauty,” said Vanessa Kuykendall, Chief Engagement Officer at Market Defense. “By identifying these highly searched terms and advertising appropriately, Biodance was able to leapfrog over other legacy brands selling similar products who aren’t as dialed into the data. Brands may know how their consumer searches on DTC, but they need to know what search behavior is driving purchases on Amazon in order to gain share. It’s just not the same.”

Meanwhile, Interest in K-beauty on Amazon is not slowing down. Searches for “Korean skincare” are up 180% year-over-year on the platform. Another K-beauty brand joining Biodance in the Top 25 is Anua’s Heartleaf Pore Cleansing Oil, which first entered the Top 25 in 2023. At the top of the list was COSRX, the #1 selling Korean brand on Amazon, whose sales have grown over 1,000% year-over-year on the strength of its hero product, Snail Mucin Power Essence, which ranks as Amazon’s #1 selling facial serum.

The top driver of awareness and traffic for K-beauty brands on Amazon was social media. Platforms like Instagram, YouTube, and TikTok are flooded with beauty influencers and skincare enthusiasts showcasing Korean beauty products, driving awareness and interest. Related K-beauty searches on TikTok continue to grow; searches with the hashtag #kbeautymakeup were up 85% year-over-year.

The global rise of Korean pop culture, including K-pop and K-dramas, has also contributed to the popularity of Korean beauty brands. Fans of these cultural phenomena often aspire to achieve the flawless skin seen on their favorite celebrities, driving demand for the same beauty products.

How have Korean beauty brands turned their significant popularity into high demand and ultimately fast-growing revenue on Amazon? “Korean beauty products are known for their innovative formulas and unique ingredients, such as snail mucin, bee venom, and various plant extracts. Consumers seeking advanced skincare solutions know to shop Amazon by ingredient, and as long as these brands are optimizing their keyword strategy, K-beauty consumers will find them,” Kuykendall said.

K-beauty is also known for its cute and aesthetically pleasing packaging and relatively affordable prices compared to Western luxury brands. This not only makes the products more appealing on the Amazon virtual shelf but makes them attractive to a broad range of consumers. This wide Amazon audience pays off in positive reviews, which boosts consumer trust and encourages more people to try them. Word-of- mouth and peer recommendations play a significant role in their popularity. COSRX Snail Mucin reviews have tripled in one year to over 90,000.

Beauty brands selling on Amazon can learn several valuable lessons from the success of Korean beauty brands. Here are some key takeaways from Kuykendall:

1. Innovation in Product Development

Korean beauty brands are known for their innovative ingredients and formulations. They introduce unique products such as snail mucin, bee venom, and fermented ingredients, which capture consumer interest with their novel benefits.

Lesson: Invest in research and development to create innovative products that stand out in the crowded marketplace. Regularly introduce new and unique ingredients that offer tangible benefits to consumers. Ensure you are surfacing in search results for these keywords; savvy skincare customers know to search by ingredients.

2. Emphasize Multistep Skincare Routines

Korean beauty brands popularized multistep skincare routines, which appeal to consumers looking for comprehensive skincare solutions. This approach not only encourages the sale of multiple products but also positions the brand as an expert in skincare.

Lesson: Educate consumers on the benefits of a complete skincare regimen and offer product lines that cater to different steps of the routine. Providing detailed guides or sets can help consumers easily adopt these routines. Utilize Amazon templates in your storefront that make it easy for consumers to buy a regime or layer products.

3. Affordable Luxury

Korean beauty products often offer high quality at a reasonable price point. This balance makes them accessible to a wide range of consumers while maintaining a perception of luxury.

Lesson: Strive to offer high-quality products at competitive prices. Ensure that the perceived value matches the price point. If your product is premium priced, use infographics in your image carousel that clearly explain the value your products deliver.

4. Aesthetic and Functional Packaging

Korean beauty brands pay great attention to packaging, making it both visually appealing and functional. Attractive packaging can enhance the overall user experience and encourage social sharing.

Lesson: Invest in aesthetically pleasing, innovative, and practical packaging. Eye-catching designs can attract consumers and encourage them to share their purchases on social media, increasing brand visibility. Make sure your images on Amazon also educate; your product packaging should quickly tell the story of your ingredients, features, and benefits. If it doesn’t, consider a rendering.

5. Strong Online Presence and Influencer Marketing

Korean beauty brands effectively leverage social media and influencer partnerships to build their brand and reach new customers. Influencers can create authentic content that resonates with their followers and drives interest.

Lesson: Develop a robust social media strategy and collaborate with influencers who align with your brand values. Authentic endorsements can significantly boost credibility and reach among target audiences. Engage with influencers who have Amazon storefronts that can share your product to their following; Amazon pays them a commission if their posts result in a sale.

6. Positive Customer Reviews and Engagement

Korean beauty brands often receive positive reviews due to their effective products, which in turn attract more buyers. Engaging with customers through reviews and feedback helps build trust and loyalty.

Lesson: Encourage satisfied customers to leave positive reviews on Amazon. Actively engage with customer feedback to show that you value their opinions and are committed to improving their experience. Feature your favorite Amazon review on your social media; superfans appreciate being acknowledged for their loyalty, which in turn can drive more reviews.

7. Cultural Relevance and Storytelling

Korean beauty brands often incorporate elements of their culture and heritage into their brand story, creating a unique and relatable identity.

Lesson: Leverage storytelling to connect with consumers on a deeper level. Share the brand’s journey, values, and what sets it apart. Highlight any cultural or unique aspects that can differentiate your brand from competitors. We encourage our clients to share their philanthropic efforts in their Amazon storefront; an authentic brand story helps build trust and loyalty.

8. Consumer Education

Korean beauty brands excel at educating consumers about their products and skincare routines through detailed descriptions, tutorials, and content marketing.

Lesson: Provide comprehensive product information, tutorials, and educational content that help consumers understand how to use your products effectively. Well-informed consumers are more likely to make a purchase and become repeat customers. Conversely, if a product is very niche, call that out. If a product is too active for sensitive skin, it is better to make that clear in your product copy than risk a consumer reacting poorly and leaving a negative review. Being transparent builds trust.

By integrating these strategies, beauty brands selling on Amazon can enhance their appeal, build stronger connections with consumers, and drive sales growth, just as Korean beauty brands have successfully done.

Previous Reports:

Q1 2024 Amazon Top 25 Beauty & Personal Care

Q4 2023 Amazon Top 25 Beauty & Personal Care

Q3 2023 Amazon Top 25 Beauty & Personal Care

Q2 2023 Amazon Top 25 Beauty & Personal Care