BeautyMatter and the British Beauty Council (BBC)—together with communications agency Spring―held their second UK event on February 23, 2023, called Decoding the Chinese Beauty Market. The sell-out conference was packed with information and tips about entering, and developing in, one of the world’s biggest consumer markets.

The lineup included heavyweight speakers from the UK’s Department for Business and Trade and international law firm Baker McKenzie; Jing Zhang, Global Editor-in-Chief of Jing Daily; as well as several experts on different aspects of the China beauty market including the President of Market Defense, Brandon Pemberton; Franklin Chu, Managing Director of Azoya International; and Alibaba’s Head of Beauty and Personal Care―UK, Kristina Hui.

The afternoon kicked off with a welcome address from the BBC’s Chief Policy Officer Victoria Brownlie in which she explained that the US and China—the two biggest beauty markets in the world—were important targets for British brands. But she added that many firms were “nervous about taking that leap” into China, hence this event.

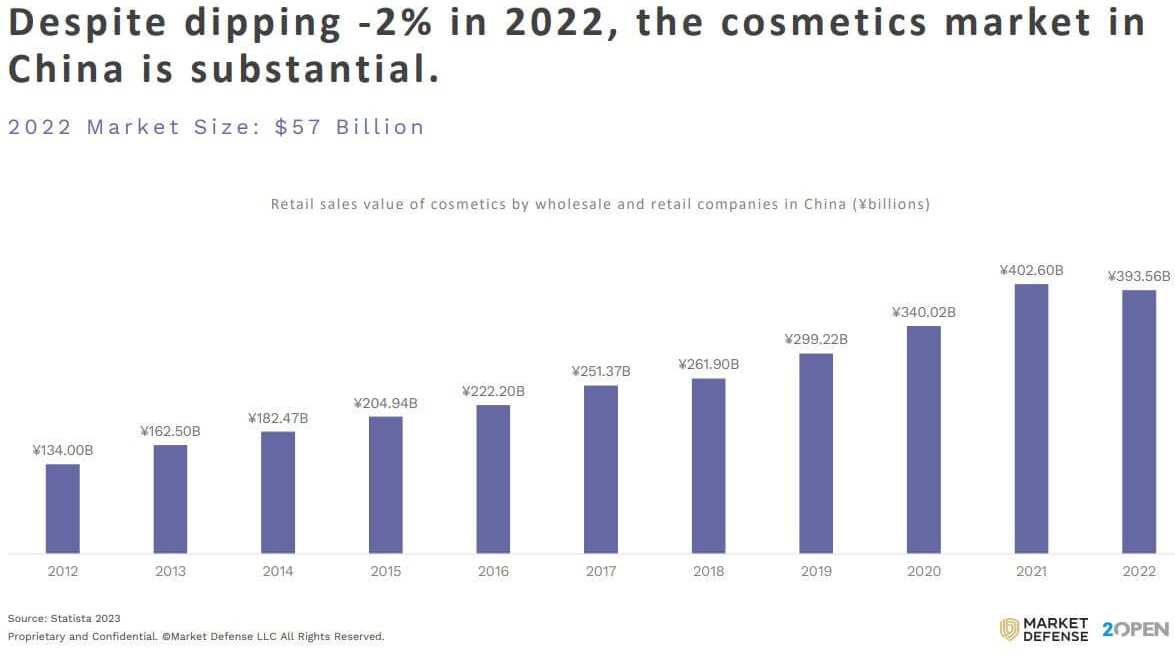

In the next session, numbers were used to quantify the current state of beauty in China. It was moderated by BeautyMatter CEO Kelly Kovack with a two-person panel: Pemberton and Luis Galan, CEO of 2 Open China Ecommerce.

The two speakers offered a wealth of detailed statistics on China beauty. Among the headline numbers was a 2% dip in the cosmetics business last year. However, with a market size of $57 billion, which is expected to grow again, this blip was not regarded as significant.

More important for beauty entrants is the importance of e-commerce, which had steadily risen to more than 84% of beauty sales by 2020. There is fierce competition in the market due to fragmented supply—with demand concentrated in certain geographical hotspots.

Some takeaways from the data were:

Both Pemberton and Galan agreed that 2023 would see more stable and financially sustainable beauty businesses than in the past. This has been helped by fewer market entrants of late and greater focus on profitable growth by brands.

Up next was Chu, an e-commerce specialist and brand-entry facilitator, who talked about how to enter the Chinese market profitably. He began by listing some labels that had either entered and exited quickly or scaled back their ambitions. Examples include e.l.f. Cosmetics, Huda Beauty, Estée Lauder’s Too Faced, and Revlon.

Chu said that ideally brand localization was vital along with a unique selling point, and he also painted a realist picture: Don’t expect to be profitable from day one and do allocate budgets to short video seeding on platforms like Little Red Book (XiaoHongShu), and Weibo, as well as to livestreaming. He added that the choice of KOLs [key opinion leaders] can make a big difference to a brand’s reception.

Even with all these building blocks in place, Chu had an ultimate warning about China: “The truth is only a few beauty brands can achieve long-term profitability."

Legal Dos and Don’ts

As if that wasn’t scary enough, the next session on legal considerations had some in the room sitting anxiously. The message from law firm Baker McKenzie was that beauty brands entering the China market need to take IP “intellectual property” and brand protection seriously.

Julia Dickenson and Tina Hartwright of Baker McKenzie noted that it can take nine months to gain a trademark registration. And if local companies have registered it before you (on a first-come basis, which they are allowed to do), it could take much longer due to legal holdups.

Another key point for newcomer beauty brands is to talk to local governments when deciding on primary or secondary locations like Shanghai or Wuhan, respectively. Different municipalities offer varied tax incentives and write-offs that newcomer beauty brands can take advantage of, especially when planning to establish a manufacturing base.

What Is GMPC Status?

In the next two presentations, the audience heard about the way through mandatory animal testing on imported cosmetic products into China and the process of getting products approved.

Richard Hall, the UK Head of Consumer at Britain’s Department for International Trade, explained that getting a Good Manufacturing Practice Certificate (GMPC) is a big enabler for any government that wants its beauty sector to export to China without doing animal testing.

The UK government achieved GMPC status in 2021, allowing regular cosmetics to be exported into China, thus removing a huge barrier for British brands. Hall noted some exceptions such as hair dyes, hair perming products, freckle-removing, whitening products, and sunscreens. Products must also not claim to be used by infants and children. “We’ve had hundreds of applications for this certification since launch,” he said.

Delving deeper into the regulatory landscape, Seongmin Sohn, General Manager and Principal Consultant at market access group Reach 24H, gave a very precise overview of China’s “positive listing” system for beauty in order to get a product registration.

What that means is that the country has an approved ingredients list for beauty― at the last count (in 2021) there were 8,972 items on it. Ideally, formulations need to include what’s already on that list because if other ingredients are present, a registration could be denied. There is also a list of prohibited ingredients for cosmetics that includes almost 1,300 items. The entire system is now managed digitally on one online platform, which is a step forward.

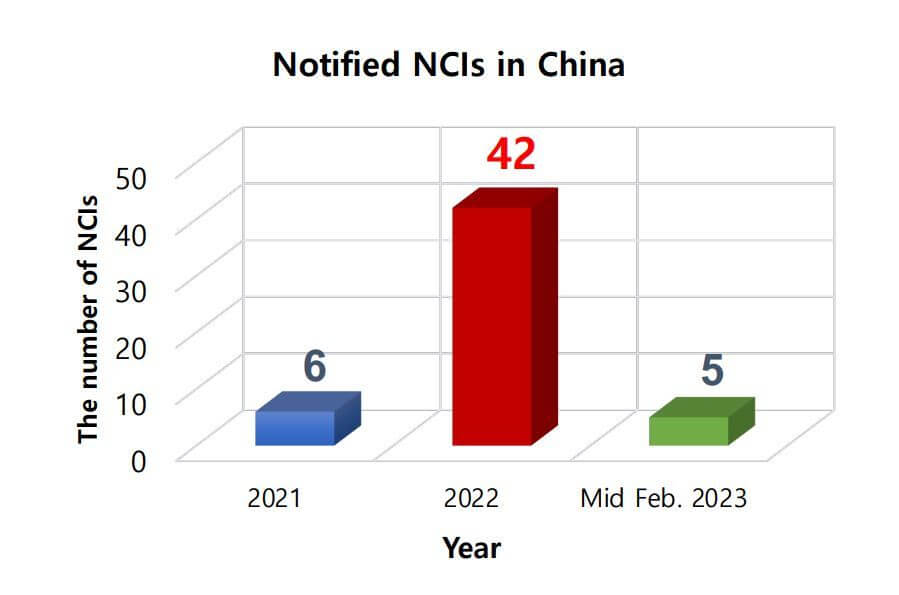

Another breakthrough is that natural or artificial ingredients used in cosmetics for the first time in China are designated new cosmetic ingredients (NCIs). These now go through a separate approvals system based on a three-level risk assessment, but it can take up to one and a half years for registration. The new system resulted in 42 NCI notifications in 2022―up from just six in 2021.

Getting the Selling and Marketing Right

In the next session, moderated by BeautyMatter COO John Cafarelli, the audience heard first-hand accounts from three beauty players: Zelens (a doctor brand); ARgENTUM Apothecary (a luxury beauty); and Shakeup Cosmetics (men’s cosmetics). In a panel discussion, the three founders talked about their practical experience of doing business in China.

ArgENTUM’s founder Joy Isaacs commented that China’s Gen Z shoppers were competitive and “very into efficacy” and brands that would fit their lifestyles. Founder of Zelens Dr. Marko Lens said that being a doctor brand gave Zelens extra credibility in the Chinese market, while Shakeup’s co-founder Shane Carnell-Xu noted that male beauty was a very fast-growing segment and that British-made was “a badge of quality” in China.

In terms of why they entered the market, there was no specific strategic aim. Answers ranged from the sheer size of the opportunity, to an approach by a Chinese distributor and running with it, to unexpected social media exposure that snowballed.

All agreed that getting the right trading partner (TP) is important but can be difficult, and the phrase “kissing a lot of frogs” came up more than once. A good TP can navigate the stressful product registrations process and other aspects of entry.

On the marketing and promotions side, one warning was that brands need to be agile with their strategies because the China market moves so fast. A Tmall (Taobao Mall) flagship today won’t necessarily work a year or two down the line and neither would “planting flags everywhere” because of loss of control―not to mention the high cost of taking that step. However, it was clear that in most cases budgets for livestreaming on social were necessary, given the huge amount of beauty purchasing that takes place online.

What’s Now and Next?

In the final panel session of the day, there was a lively discussion among China experts on trends driving the market. Here are some key quotes from the three-strong panel demonstrating the flavor of the debate:

On the seeming exodus of several beauty brands: “I don’t think it’s an exodus, more a pause as some companies have, for example, not figured out how e-commerce works in China,” said Elisa Harca, co-founder of Red Ant Asia.

In terms of entry strategy Zhang at Jing Daily commented: “A well-known brand name doesn’t do it any longer. There is a lack of localization and too much bland brick-and-mortar. It needs to have a much bigger impact."

Hui at Alibaba Group has huge available data pools to draw from. Commenting on trends to watch, she said that many existing ones remained relevant like make-up foundation, fragrance, and antiaging, but that in the latter case, shoppers were getting younger; in their late teens.

She added: “They do a lot of research before making a purchase, and there is a lot of interest in ingredients like retinol and peptides. Another trend is skincare for post-cosmetic surgery: it’s popular in China now.”

On the point of shopper’s doing their homework, Zhang said that brands with strong R&D credentials had an advantage: “They can push this to these ‘skintellectuals’ because beauty consumers are getting geekier.”

The closing presentation of the day came from Sally-Anne Limb, Head of Insights at Spring, and Coco Yu, co-founder of CP Concept, another communications agency specializing in China. Together they offered seven key principles for western beauty brands to take onboard to ensure success in China.

The seven covered various elements from tailoring brand positioning to resonate with Chinese consumers and embrace China’s extremely dynamic digital beauty ecosystem, to selectively setting up local collaborations to help create “cut through” and also capitalize on connections made with Chinese beauty fans who travel abroad.

As China transitions from a zero-Covid policy, there is light at the end of the tunnel to finally move past the pandemic-induced uncertainty. Navigating the market will require foreign brands to have the agility to navigate political, business, and cultural shifts as the second-largest consumer beauty market in the world reopens. We took a deep dive into understanding the nuances of the current China beauty landscape to surface the immense opportunities in a maturing market with perhaps the most sophisticated consumers in the world.

Download the decks from our recent London Summit: Decoding The China Beauty Market for data, current regulations, trends and market insights.