The COVID-19 pandemic has led to an unprecedented buzz of well-being concerns. In China, the health supplement dividend is poised to pay off, as consumer awareness and knowledge of personal fitness has exploded, indicating rapid market expansion.

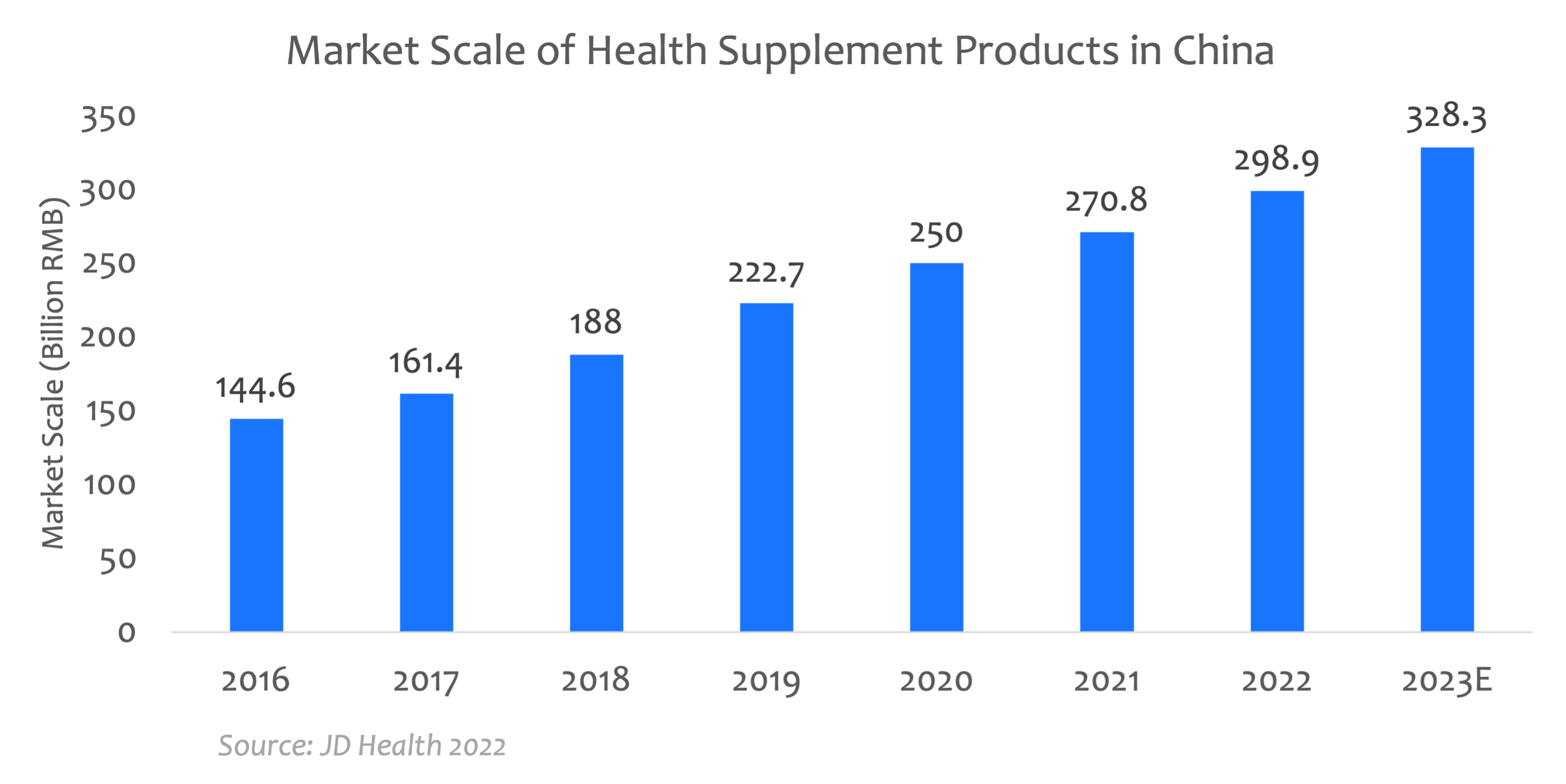

According to JD Health’s latest Nutrition whitepaper, in 2016, the scale of China’s health supplement market was only RMB 144.6 billion (USD $21 billion), and it topped nearly RMB 271 billion (USD $39 billion) in 2021. China’s market is on track to reach RMB 328 billion (USD $48 billion) in 2023. This health craze has evolved post-pandemic.

Well-Being Driving China’s Market

In the post-pandemic era, Chinese consumers’ awareness of personal and family health care continues to rise, even though their attention to the pandemic has dropped significantly.

During Alibaba’s 2022 Q4 earning report, Daniel Zhang, CEO of Alibaba Group, highlighted that the company’s health care and wellness-related business increased strongly.

A recent survey by consulting firm Ipsos proved the same result, as 81% of the respondents claim they are more concerned about physical wellness than before. Notably, 89% of consumers believe that adding "functional health ingredients" to food and drink claims will increase their purchase intentions.

Consumers' willingness to purchase health products has changed significantly. The consumption of health products will gradually shift from optional to mandatory consumer goods.

Approaching Potential Customers

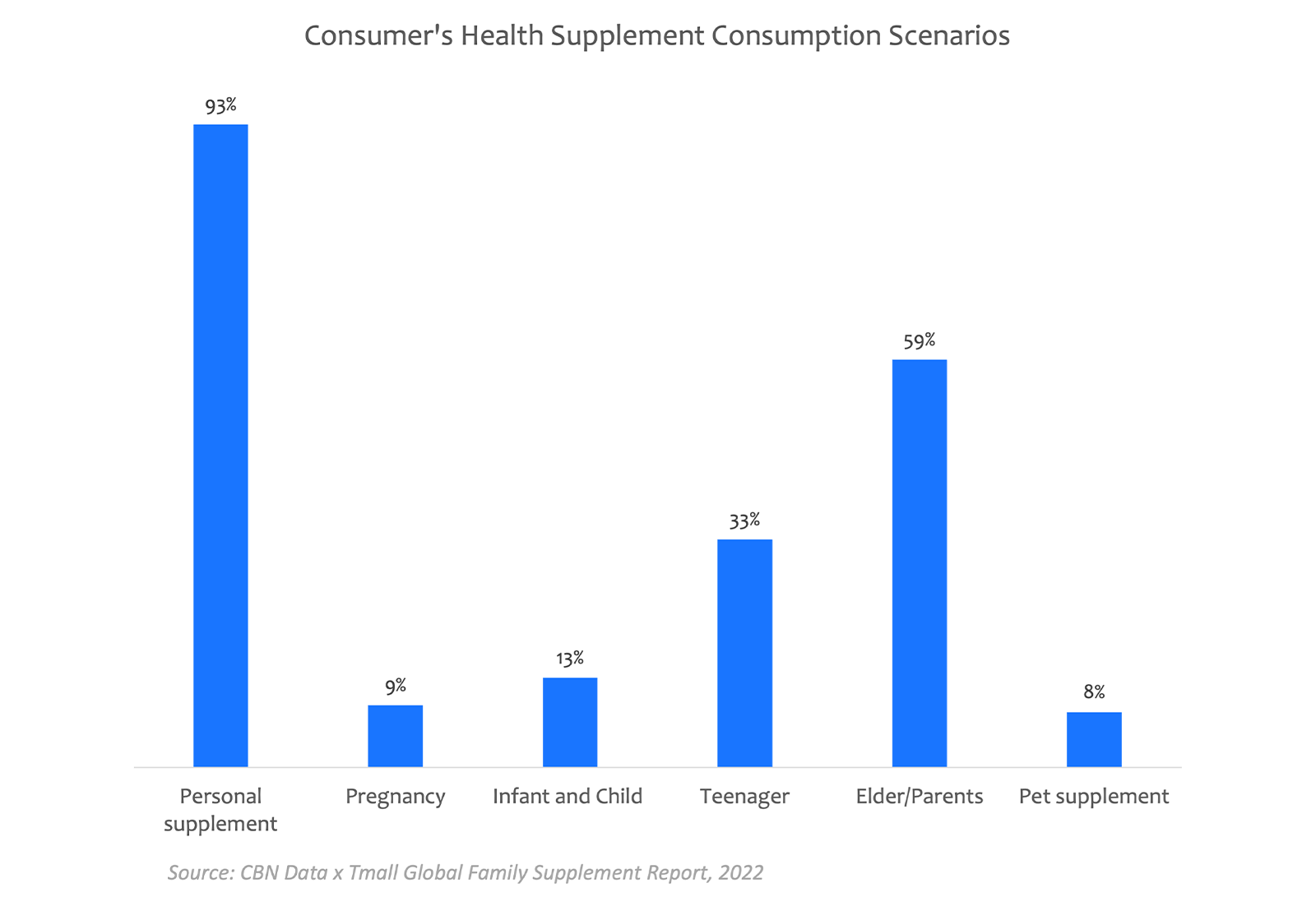

For consumers to overcome a suboptimal health state, buying health supplement products ranked as the primary option for 64% of Chinese people to enhance their health condition, followed by regular workouts and taking tonics accounting for 61% and 57% of respondents, respectively. As such, from personal use to the whole family, health supplement consumption gradually becomes a necessity.

Concerned parents and caregivers. Young Chinese parents who grew up with an affluent background are well-educated. The new generation of parents sees the importance of improving their baby's immunity to prevent disease as a reason to buy health care nutrition products. During each special period, from pregnancy preparation to baby care to building their own "protective wall," Chinese parents buy targeted nutritional supplements to care for their babies’ health and growth.

Conscious young parents are inclined to do in-depth research before making a purchase. Product research related to product safety, efficacy, formula/ingredient, brand reputation, and product reviews are the top five factors they are concerned about. They are more likely to trust professional advice and authentic feedback.

Infant probiotics brand Aunulife, launched in 2021 by Tmall’s number-one bestseller of children’s probiotics, Kabrita, has worked with Daddy Lab to get the product tested and certified. Daddy Lab is a Chinese company dedicated to ensuring children’s safety and has run experiments for various consumer products since its establishment in 2015. In Daddy Lab’s explanatory video for Aunulife, founder Wei Wenfeng demonstrated the implications for infants’ replenishing probiotics, product ingredients, and formulas, and making such information intelligible to parents.

Sports fans are mainly those aged 30 and below in first-tier and second-tier cities. They consider exercise to be an important part of their daily lives, and they want to maintain a good figure and emotional state of mind by selecting the appropriate form of exercise, such as yoga, bodybuilding, jogging, or ball games. Along with regular exercise, consumers are frequently concerned about their intake of dietary supplements to enhance their fitness results and achieve more significant exercise effects. Their main demands are for protein supplements, followed by the demand for certain electrolytes, vitamins, calcium, salt, and other specific supplements.

Beauty enthusiasts are paying more attention to the "beauty from within concept,” which is increasing in demand. Nearly 70% of beauty enthusiasts are female, and they focus on issues such as weight control, skincare, and preventing hair loss. The Chinese Women Consumption Report 2022 released by JD.com in March 2023 shows that purchases by female users of astaxanthin and collagen, which emphasize skincare and antioxidants, grew by 63% and 49% YoY in 2022, respectively.

Workplace overtime white-collars. Longer work hours in top-tier cities, combined with rising disposable incomes, encourage people to become more aware of the physical toll on their bodies. Integrated nutrition, melatonin, and anti-fatigue products that reduce stress, boost energy, and improve sleep quality are the products that these customers are most interested in.

Supplements for the elderly. Because of the physical and psychological effects of COVID-19, older Chinese consumers are more concerned about their health than ever before. In addition, China is an aging society, so there are an increasing number of older customers interested in health and dietary supplements. Vitamins, calcium, iron, and zinc are still popular subcategories. Meanwhile, nutrients such as coenzyme Q10, which plays an antioxidant role in the cardiovascular system and protects the health of the cardiovascular tube, are widely favored and in-demand for "precise nutrition" among the middle-aged and elderly.

Pet owners. Along with the pet ownership boom in China‘s urban cities, and the upgrade of consumer spending power, pet owners are willing to invest in their dearest furry family member. Cat owners prefer vitamin supplements and intestinal health for their pets, while dog owners prefer bone and joint health and oral health. For this intimate member of the family, adding a supplement has become the new refined feeding trend, and it is driving growth in the online pet health and nutrition market.

Gen Z Pursues Snacking Supplements

One of the major pain points among Chinese health supplement consumers is that they cannot continue to regularly consume health products if they are tablet-shaped and taste like medicine. Among consumers’ multiple scenarios, sales of functional gummies for the beauty-from-within and vitamin categories are soaring.

Young people increasingly favor health care products in the form of snacks like gummies, jellies, oral liquids, and ready-to-drink products, according to the growth rate of various types of health care products. The rich taste and mouthfeel of snack-like supplements do not have the psychological burden of consuming health care items.

Portable Nutrition Grows in Demand

Due to the increasingly fast pace of life, young people in pursuit of nutrition are inclined to buy convenient products. Packaging convenience has been improved to support the daily habit of taking nutritional supplements, and convenient and small bags have become hot search keywords.

On JD.com, sales of portable sports protein powder and spoon honey surged by 68% and 1,095% YoY respectively. Sales of mini tablets are growing fastest, and sales of oral liquids are doubling. Easy-to-carry products resolve customers’ pain points in diverse scenarios, including going to the office, on vacation, on business trips, and at the gym. Consumers are also less likely to forget to take the product, be confused about how much to take each time, or suffer the burden of carrying the entire bottle or box of supplements.

Competition is also growing, as both domestic and international brands are capitalizing on this market. International brands are launching via cross-border e-commerce, and working closely with marketplaces, including Tmall Global, to expand their reach to Chinese consumers. To date, a number of brands have debuted portable products, including Fancl, POLA, Swiss, Life Space, GNC, By Health, One-a-Day by Bayer, and homegrown brand WonderLab.

E-Commerce Driven: Going Where Customers Go

One of the most important trends accelerating China’s supplement market growth is e-commerce.

Benefiting from the growth dividends of the e-commerce market, the share of online sales of health care products has grown significantly and reached 28% by 2021, JD.com highlights. The rising e-commerce platform Douyin (TikTok’s Chinese counterpart), witnessed sales in the health product sector skyrocket by 1,118% during this year’s Women’s Day shopping festival (from March 1 to 8).

Looking forward to this year’s mid-year 618 shopping bonanza in June, more health supplement brands and trends will actively seek to gain the attention of discerning and affluent Chinese consumers.