Key Takeaways:

Forget waiting until Black Friday. Amazon gave its more than 200 million Prime members a jump-start on holiday shopping with its annual Prime Big Deal Days on October 7-8. According to Market Defense’s Amazon Prime Big Deal Days October 2025 Report, the two-day event made Amazon a lean, mean conversion machine, attempting to lure cautious consumers into holiday shopping.

The October event may have been shorter—as opposed to July’s Prime Day 4-day bargain bonanza—but Amazon’s strategy was sharper, according to Vanessa Kuykendall, Chief Engagement Officer at Market Defense. “The brands that rose to the top this Prime Big Deal Days understood the assignment: Drive discovery, convert quickly, and stay top of mind,” Kuykendall said. “From K-beauty cleansers to stem cell serums, these beauty power players knew how to turn clicks into carts.”

Amazon leveraged familiarity and loyalty with its shoppers and leaned heavily on lower-funnel tactics, such as promoting deals on past purchases and cart-based messaging, rather than bombarding shoppers with a wave of new brands. In this “no-frills, just funnels” approach, shoppers saw personalized placements like “Deal on your past purchase” and “Keep Shopping.”

“Amazon doubled down on personalization again this Prime Big Deal Days,” said Dave Karlsven, SVP of Marketing and Data Science at Market Defense. “We saw the platform surfacing deals uniquely tailored to each shopper’s browsing and purchase history. It is very likely that the same algorithmic personalization will play an even bigger role in the T12 holiday season.” Winning brands aren’t just discounting, explained Karlsven, but they are also using personalization in their own marketing strategy.

Prime Fatigue?

The number of sales days wasn’t the only thing reduced from July’s Prime Day event. Baskets were smaller, with the average order size being $45.42, down 15% from July’s Prime Day, while average household spend was $104.69, down 33% from July’s Prime Day.

Exchanging dopamine-releasing impulse buys for well-researched shopping decisions, more than half of Prime Day Big Deal Days shoppers (56%) compared prices at other retailers before checking out. But Amazon didn’t always win the price-comparison battles: 27% of shoppers said they planned to or had already participated in Target Circle Week (October 5-11), while 36% did the same for Walmart Holiday Deals (October 7-12).

Enthusiasm for Amazon’s sales events appeared to have cooled since July’s Prime Day. Only 58% of shoppers reported being highly satisfied with the Big Deal Days deals, a noticeable dip from 66% in July.

Despite 90% of shoppers knowing about Amazon Prime Big Deal Days, only 61% of those who shopped in July returned to shop the October event, with 19% unable to recall if they participated in July. This is a sharp contrast to July’s Prime Day, when 88% of shoppers had a history of engaging in past Prime Day events.

Proceed (Holiday Shopping) with Caution

Just one week before the Prime Big Deal Days event, the US government shut down on October 1 due to a lapse in appropriations, suspending paychecks for approximately 2 million workers and furloughing 750,000 employees.

The shutdown, along with steep international tariffs, may have led fewer shoppers to use Prime Big Deal Days to get a head start on holiday purchases than last year. Signaling consumer caution, only 23% of shoppers made holiday purchases, compared to almost 45% who shopped early last November.

But these political headwinds will not deter Americans from shopping for gifts this holiday season. Eighty-four percent of shoppers said they would return to Amazon for holiday purchases. But with economic uncertainty, consumers face tougher purchasing decisions. “While 92% of shoppers intend to celebrate the holidays, 80% expect prices to be higher, and nearly a third say they will buy fewer items this year,” said Kuykendall, who highlighted that with rising grocery costs squeezing discretionary budgets, customers will be more selective and strategic in their gift-giving and self-care splurges. “For beauty brands, that means value perception is everything: Shoppers will be weighing price, efficacy, and social proof more carefully than ever.”

Kuykendall also advised brands to highlight multifunctional products since 64% of US consumers say they prefer multifunctional formulations, “So be sure to call out those benefits clearly in content, advertising, and on PDP.”

Winners’ Circle

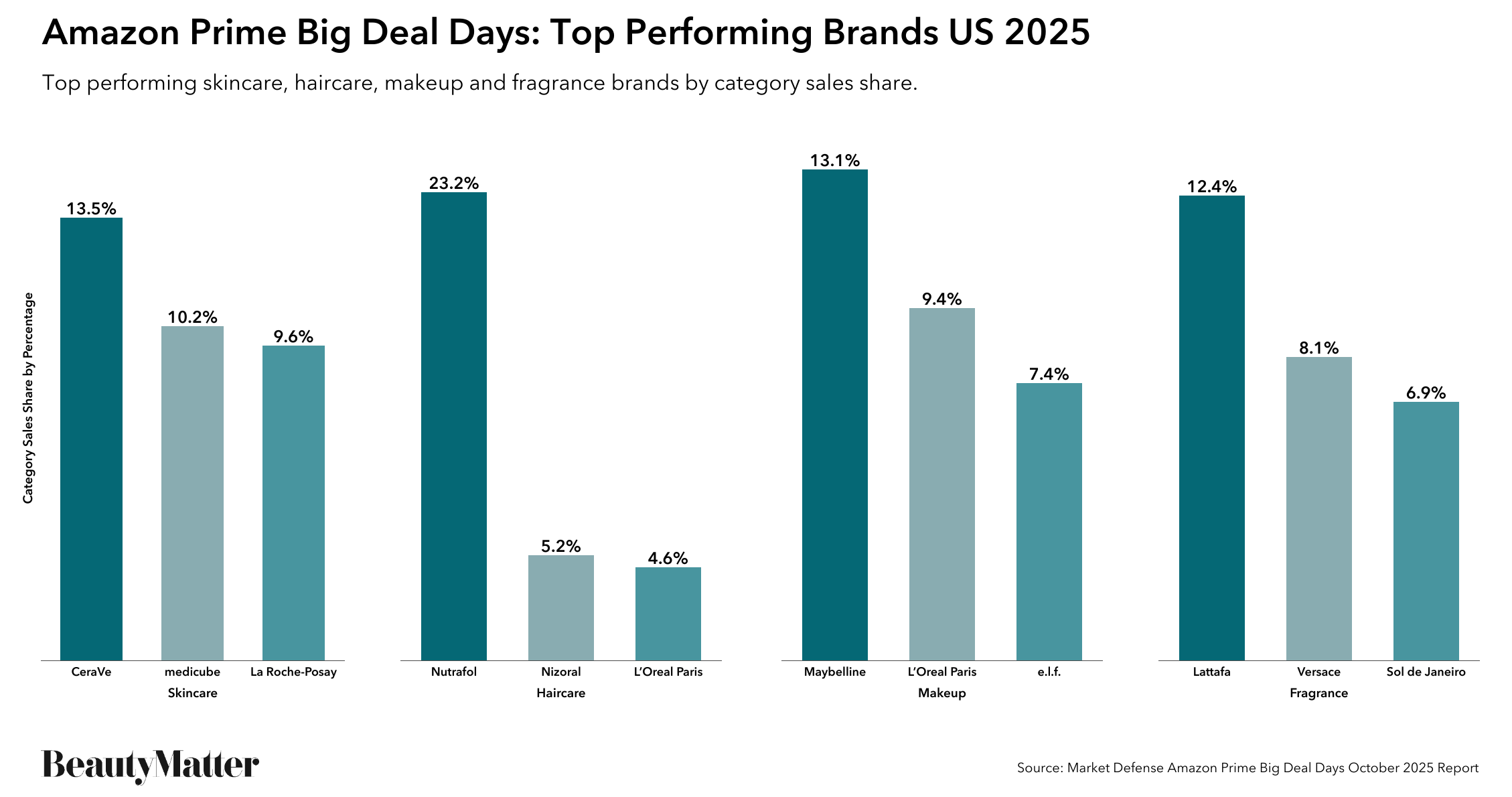

Basket sizes may have been down, and consumers shopped with caution, but a select few beauty brands were the clear winners of Amazon’s Prime Big Deal Days event. According to the Market Defense report, the top three performing skincare brands were CeraVe (13.5% of the category sales share), Medicube (10.2%), and La Roche-Posay (9.6%). The top three performing haircare brands were Nutrafol (23.2%), Nizoral (5.2%), and L'Oréal Paris (4.6%). In makeup, the top three brands were Maybelline (13.1%), L'Oréal Paris (9.4%), and e.l.f. (7.4%). The top-three performing fragrance brands were Lattafa (12.4%), Versace (8.1%), and Sol de Janeiro (6.9%).

Skincare reigned supreme, with eight of the top ten Beauty & Personal Care products being skincare products. Powered by 450,000 weekly TikTok views of #eosvanillacashmere, and amplifying the sweet smell trend (65% of shoppers say they prefer gourmand scents), eos Shea Better Body Lotion Vanilla Cashmere ranked as the #1 Beauty & Personal Care product overall, despite not making the ranking last year.

In the Skincare category, Medicube’s Zero Pore Pads 2.0 held strong at #3, riding the viral wave of #skincareroutine, which captured 1.6 billion TikTok views, with Medicube as the fan favorite, according to the Market Defense report. K-beauty continues its tsunami with #KoreanSkincare, dominating TikTok with 1.9 billion views year to date (YTD).

Discerning skincare shoppers are looking for at-home alternatives to in-office treatments. Searches for “stem cell serum” are up 345%, and searches for “microneedling serum” have surged 508%—leaving white space for brands to ride the results-driven wave and invest in terms shoppers are actually searching. Shoppers are also buzzing for bee venom products, with Amazon searches for “bee venom cream wrinkles” up 256%, and “Botox bee venom” up 288%.

The top-selling haircare products showed shoppers are looking for problem solvers. Amazon searches for “gray hair products” are up 253% YoY, while “gray hair coverage” has jumped 123%, and “hair growth” still pulls in 1.4M searches a month. Nizoral’s dandruff solution snagged the #1 spot, with the rest of the top 10 addressing hair growth, gray coverage, and DIY color. Nutrafol continues its blaze of glory: their Women’s Balance Hair Growth Supplements was the #2 seller, and is also the #1 selling Hair Care product YTD by share of sales.

The top five haircare keywords in search visibility were “shampoo,” “hair ties,” “dry shampoo,” “shampoo and conditioner set,” and “hair clips.” Kitsch’s Satin Scrunchies also debuted in the top 10, gaining traction as Amazon searches for “hair ties” continue to exceed one million per month.

Thanks to Gen Z mirroring the TikTok trend, texture is reigning men, and it has become a haircare priority, with L3’s Texturizing Powder making its debut in the Top 10. The category has exploded on TikTok, with a +897% YoY jump and an average of 11 million weekly views. Hashtags like #formen and #glowuptips are each clocking 1.1 million weekly TikTok views.

Eyes and lips dominated the top-10-selling makeup products, with three mascaras making the top 10, despite the “No MascaraLook” trend rising 92%. YoY on TikTok, lashes still lead with more than 1.2 million Amazon searches a month for “Mascara”. Makeup wipes are also having a moment, grabbing two slots in the top 10, with “makeup wipes” searches up 812% on Amazon. The two remaining top selling Makeup spots went to Lip Stains The lip stain category off-Amazon has seen an 85% YoY surge, fueled by a 16 million surge in TikTok views, with peel-off versions up 130%. #SacheuBeauty alone has 52 million views. And, the most-searched branded term proved makeup has no age limit: “Laura Geller makeup for older women” rode the viral #MakeupForOlderWomen (203,000 weekly TikTok views) trend to the top.

When it came to fragrance winners, Gen Z and Gen Alpha-favorite fragrance brand Sol de Janeiros Cheirosa 62 Hair & Body Fragrance Mist retook the top spot (they were also #1 in July’s Prime Day). Arabian fragrances continued to enchant, claiming four of the top 10, and Bodycology’s Whipped Vanilla Body Mist made its mark in the booming Body Spray category, which is up 50% YoY.

BellaVita, whose Luxury Honey Oud Eau de Parfum was the #6 selling fragrance, has also gained steam on TikTok as the #4 top-selling fragrance YTD on the app, with Lattafa and Rasasi Hawas also ranking in TikTok’s top 10. Two of the top 10 fragrances this Prime Event were for men, c aligning with the off-Amazon trend. #menscologne is trending with 60,000+ TikTok posts, and 37% of the audience is 18-24.

“Growth comes from focus,” said Karlsven. “Top fragrance brands are winning by rallying product lines around a single hero SKU: investing in ads, content, and search to keep it discoverable year-round, while expanding with flankers, body products, and seasonal editions.”

“As Seen on TikTok”

K-Beauty’s dominance further amplified the “TikTok trends to Amazon carts” pipeline. TikTok Shop now ranks in the Top 10 US beauty retailers with more than 8 million hours of shopping sessions hosted on TikTok Live in 2024.

From January to August 2025, TikTok Shop saw $309 million in US skincare sales, outpacing makeup ($308 million) and leaving fragrance ($208 million) trailing like a base note. Fragrance may be smaller, but it’s the fastest-growing category on the app. K-beauty continues to lead the charge, and hashtags like #koreanskincare and #skincareroutine are fueling mass discovery.

These viral moments don’t stay siloed. When shoppers see it on TikTok, they’re searching for it everywhere, including Amazon.

Sage Advice

Amy Rudgard, SVP of Client Delivery at Market Defense, suggests that brands get creative with a solid post-event plan to keep up the momentum, retarget audiences, and capitalize when others pull back. “Black Friday and Cyber Monday pull in loyal shoppers, which is the perfect time for upsells and cross-sells. One way to boost this is through Amazon’s new Shoppable Collections an upgraded Brand Story module that enables curated, interactive content with shoppable links, comparison charts, integrated 'add to cart' buttons, and the ability to feature special promotions and deals. Early data suggests it is driving more add to carts and strengthening cart conversion rates.”

“Tentpole moments are when brands have the most to gain and the most to lose,” said Market Defense Chief Operating Officer Karan Raturi. Maintaining profitability during these peaks isn’t just about managing spend; it’s about investing in acquiring the right type of new customers, protecting margin, and driving lifetime value well beyond the event. That discipline ultimately builds the kind of sustainable growth that both brands and investors look for.”

Kuykendall stressed that with 53% of all US beauty sales online, brands can’t rely on in-store storytelling to do the heavy lifting. “Fragrance that lasts through a workout, a serum that doubles as primer … those are the details that convert. Influencers can spark interest, but it’s your PDP that has to close the deal.” Use data from Prime Big Deal Days to reevaluate your Q4 merchandising, Kuykendall advised. “Are your images inclusive of your full audience? Are your claims clear, current, and compelling? Are you adapting for mobile-first discovery? Q4 is more than a sales spike; it can reveal how your brand is seen, searched, and shopped in real time.”

Meeting cautious shoppers where they shop will be vital for beauty brands this holiday season.