Beauty giant Coty—home to brands such as Burberry, Calvin Klein, Gucci Beauty, and Hugo Boss—delivered a strong set of results with double-digit growth in its most important geographical markets—the Americas and EMEA—and a stellar performance in its prestige division.

The company share price closed out Wednesday (August 25) at $8.17, a four-month high.

Sales for fiscal 2022 (ending June) reached $5.3 billion, increasing 16% on a like-for-like basis. The rise was chiefly driven by surging sales in the company’s prestige division, up 22%, while the smaller consumer beauty business—encompassing brands such as CoverGirl, Max Factor, and Rimmel—grew by a more modest 8%. For the full year, prestige sales hit $3.27 billion and consumer beauty rang up $2.04 billion.

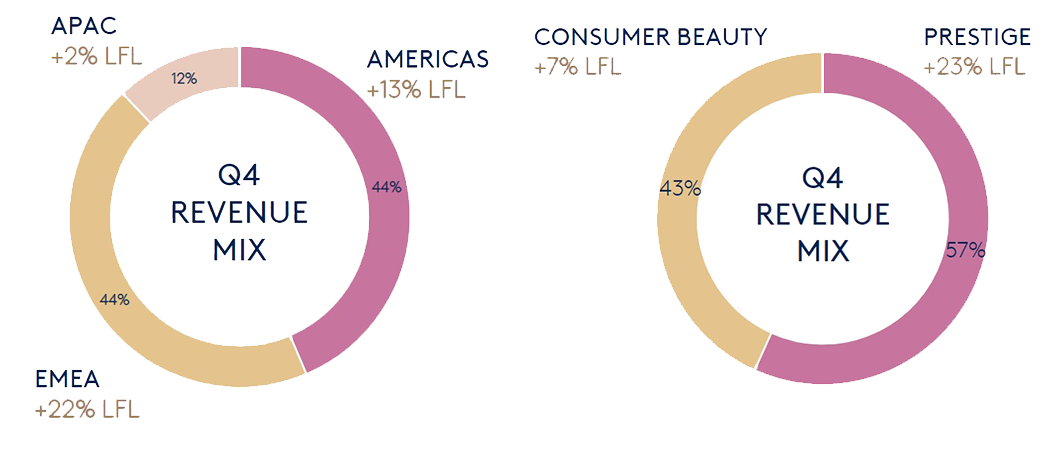

The momentum was maintained in Q4 with nearly all prestige brands delivering solid double-digit growth. Particular strength came from Hugo Boss, Burberry, Chloé, Calvin Klein, and Gucci Beauty, helped by launches such as Gucci Flora Gorgeous Gardenia, Burberry Hero, and Boss Bottled Marine.

By region, the best growth came from EMEA, up 18%, despite Coty exiting its Russia business; and the Americas, up 15%, led by the US. The two regions account for over 80% of total revenue, with Asia-Pacific taking the rest and growing by 14% in FY22. However in Q4, growth in Asia plummeted to 2% reflecting the resurgence of COVID in China and related lockdowns, particularly in April and May, leading to some uncertainty in the market. Meanwhile, the travel retail channel also saw sales double, helped by Coty’s category expansion and premiumization strategy.

Beauty remains resilient

Coty’s CEO, Sue Y. Nabi, said: “We have demonstrated the sustainability of Coty’s turnaround strategy by delivering eight consecutive quarters of results in line with, or ahead of, expectations. We have generated sales growth in both Q4 and FY22 that is well above the underlying beauty market.

“While macro concerns continue to dominate headlines, it’s important to remember that beauty is among the most resilient discretionary categories. It is upon us and our peers to inspire consumers and create new demand through innovative products, new looks, and disruptive campaigns. We remain committed to protecting our media investments going forward.”

One of the most prominent investments in the skincare arena—which is a specific growth pillar for Coty across both prestige and consumer beauty divisions—was the June 21 launch of SKKN by Kim. It comes after Coty signed a deal in 2020 for a stake in the Kim Kardashian West brand, KKW, which was then mired in a lawsuit.

So far SKKN has amassed 5.5 million followers on Instagram and revenue is coming in ahead of plan by about 20% according to Coty. The nine-product skincare collection is said to sit “at the intersection of elevated simplicity and innovative science,” and only available through a US direct-to-consumer website for the time being.

Nabi added: “We continued building out our skincare business in Q4, and remain well-positioned as we enter FY23. In the quarter, Lancaster was the number two exclusive brand at Sephora China, and was number three among niche skincare brands in key Hainan retailers. We expect FY23 to be a year of continued expansion, in line with our medium-term growth targets.”