Long known for setting the standard in innovation and performance, professional beauty brands were previously sold only in hair salons and dermatologist offices—accessible only through licensed professionals. However, today’s consumers expect access everywhere, and Amazon has become a critical touchpoint in the beauty buying journey. As the industry faces headwinds, many pro brands are not just adapting to the marketplace—they're outperforming.

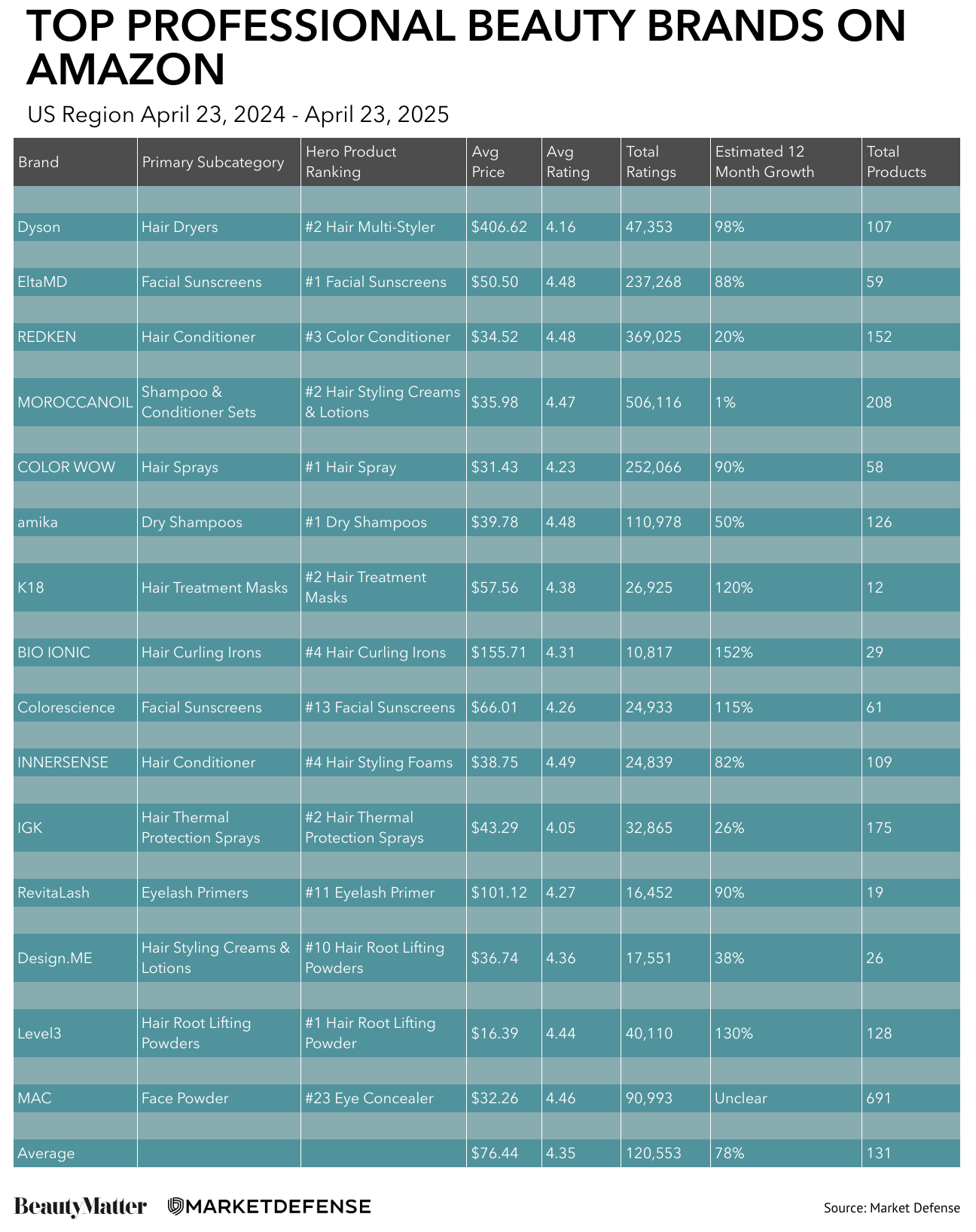

In this report, marketplace agency Market Defense spotlights the professional beauty brands thriving on Amazon in the United States and shares insights on how these brands are achieving year-over-year (YoY) growth from 4/24 - 4/25, even as broader beauty sales begin to slow. “We analyzed the pro-beauty brands outperforming Amazon’s benchmarks,” says Vanessa Kuykendall, Chief Engagement Officer at Market Defense. “There’s a clear throughline—but it’s not what most people expect.”

Big-Time Beauty: The Professional Brands Breaking $100M

Dyson

Dyson flipped the typical strategy in that they started in consumer before entering the professional category. Airflow technology has been at the heart of Dyson’s success since it launched its first mass-produced vacuum in 1993. The company continued to leverage its technology, releasing multiple vacuum models, hand air dryers, and fans. Dyson entered the haircare category in 2016 with the launch of the Supersonic hair dryer—instantly iconic for its thermal sensors that monitor airflow temperature, thereby reducing the risk of heat damage. When Dyson introduced its professional version of the Supersonic in 2018, hairdressers coveted it for its exceptionally long cord and for replacing the usual bulky motor at the head of the dryer with its smaller, yet more powerful V9 motor. Since the success of the professional Supersonic, Dyson has launched professional versions of its Airwrap Multi-Styler and Dryer, the Airstrait Straightener, and its most recent launch, the Supersonic r, a lighter and faster-drying upgrade to the original Supersonic.

The Data:

• 98% Estimated 12-Month Growth

• #2 Hair Multi-Styler on Amazon

• Average Selling Price $406.62

• 47k+ Reviews

The Winning Formula:

Dyson may be best known for revolutionizing vacuums, but its dominance in beauty is unprecedented. The brand’s Supersonic Hair Dryer and Airwrap Styler have redefined professional hair tools on Amazon, combining cutting-edge engineering with salon-grade results. With a 13% market share in the Hair Dryers category and the second-highest conversion rate on this list at 24.8%, Dyson stands out as both a premium and high-performing brand. Thousands of glowing reviews support its position, and despite premium pricing, demand remains strong, proving that when innovation meets performance, consumers are willing to invest.

EltaMD

With an origin story tracing back to rural Switzerland in the 1800s, EltaMD was initially used as a healing ointment passed down through generations of farmers, evolving into a wound-care company in 1988. In 2007, the business's medical heritage and science-backed formulas became the EltaMD brand we know today. Acquired by Colgate in 2017, EltaMD claims to be the #1 dermatologist-recommended professional sunscreen brand in the US, and the #1 sunscreen brand dermatologists use personally.

The Data:

• 88% Estimated 12-Month Growth

• #1 Facial Sunscreens on Amazon

• Average Selling Price $50.50

• 237k+ reviews

Winning Formula:

EltaMD seized a significant moment during Prime Day 2024, as "sunscreen" surged to the top of Amazon’s skincare search terms and TikTok trends, racking up 5.4 billion views. The brand dominated sales with four of the top ten best-selling sunscreens on Amazon, led by its hero product, EltaMD UV Clear. By focusing on a single hero SKU with strategic variations—such as tinted and untinted formulations—EltaMD has become nearly synonymous with facial sun protection on the platform. It now owns 40% of the Facial Sunscreen market share on Amazon and 15% of the Facial Night Cream Market. As summer 2025 approaches, searches for “EltaMD UV Clear” are already up 20% month over month, signaling strong continued momentum for the brand.

Redken

Created in 1960 by actress Paula Kent, Redken was the first-ever hair brand to utilize the combined power of protein, moisture, and acidic pH. Launched with an intensive educational program for hairdressers, the brand has consistently been regarded as an elite professional line since its inception. In the 1980s, Redken established itself as a staple for professional colorists by introducing Shades EQ Equalizing Color Gloss. Acquired by L’Oréal in 1993, the brand continues to innovate in every facet of professional haircare.

The Data:

• 20% Estimated 12-Month Growth

• #3 Color Conditioner on Amazon

• Average Selling Price $34.52

• 369k+ reviews

Winning Formula:

Redken has long been a salon staple, and its legacy continues on Amazon with strong sales and deep consumer loyalty. As the oldest brand on this list, Redken proves that heritage brands can thrive in e-commerce just as much as indie newcomers. With a wide range of shampoos, conditioners, and treatments, Redken owns 10% of the hair conditioner market and holds the second highest number of reviews among brands featured here. Interest is accelerating, too—searches for Redken Length Shampoo are up 95.9% in the past month. Its continued success reflects the power of brand trust, product performance, and professional credibility in the digital space.

Moroccanoil

Co-founder Carmen Tal started the brand after receiving an argan oil treatment in Israel that completely transformed her hair. She and her husband, Ofer Tal, contacted the manufacturer of the treatment and acquired distribution rights in North America in 2006. The couple then purchased the entire company in 2008, and the power of argan oil made the brand an instant must-have with hairdressers. Its signature scent led to the addition of a bodycare line in 2016. Since then, the brand expanded its reach beyond salons by selling to consumers through retail channels, including Amazon.

The Data:

• 1% Estimated 12-Month Growth

• #2 Hair Styling Creams & Lotions on Amazon

• Average Selling Price $35.98

• 506k+ reviews

Winning Formula:

Moroccanoil has translated its salon-rooted identity into a polished, consumer-friendly Amazon experience. With a storefront that mirrors the brand’s official website, Moroccanoil delivers a seamless, elevated shopping experience that reinforces its premium positioning. The brand is consistently represented across Amazon’s top charts—including ranking #3 in Hair Treatment Oils, #4 in Dry Shampoo, and #8 in Hair Styling Clay. Its expansion into bodycare and tools has further broadened its reach, while its dominance in niche categories like Hair Color Refreshing Masks (where it owns 30% market share) shows the power of specialty innovation. It may have the lowest YoY growth of the brands on this list, but it also boasts the highest number of customer reviews at over half a million, reinforcing both trust and visibility.

Color Wow

After co-founding and selling John Frieda Professional Hair Care in 2002, industry veteran Gail Federici founded Color Wow as a problem-solver in the haircare industry. While most haircare companies farm out product development, Color Wow keeps product formulation in-house, led by renowned biochemist Dr. Joseph Cincotta. Celebrity hairdresser Chris Appleton (an ambassador for the brand), says the brand’s hero product, Color Wow’s Dream Coat, is “glass hair in a bottle," and according to the brand, one bottle of the anti-frizz potion sells every five seconds.

The Data:

• 90% Estimated 12-Month Growth

• #1 Hair Spray on Amazon

• Average Selling Price $31.43

• 252k+ reviews

Winning Formula

Color Wow continues to command attention on Amazon with standout performance in styling. The brand owns a dominant 58% share of the Hair Styling Mousse category, fueled by rising interest in its XL Bombshell Volumizer—searches for which are up 71% in the last 30 days. It also controls 11% of the Hair Spray category, with three products in the top ten, including Dream Coat Supernatural Spray, which ranks as the #60 top-selling item across all of Amazon. With the highest conversion rate on this list at 25.7%, Color Wow mirrors its Amazon investment with a strong TikTok user-generated content (UGC) strategy that amplifies the same hero products, reinforcing awareness and accelerating conversion. It’s a prime example of how modern channel alignment drives category dominance.

Next In Line: The Professional Brands on the Rise

Amika

Inspired by individualism and diversity, Amika, which means “friend” in Esperanto (a constructed language created at the turn of the century to unite the world), was co-founded in Brooklyn in 2007 by Vita Raykhman, followed by CEO Chelsea Riggs in 2010. Amika filled a void when it entered the market as a supplier for hair salons, approaching haircare with all hair types, textures, and styles in mind while bringing high-quality, responsible formulations at an affordable luxury price point. Adored by consumers for its shelfie-worthy packaging and embraced by professionals for its efficacy, Amika is a robust haircare line, best known for its dry shampoo.

The Data:

• 50% Estimated 12-Month Growth

• #1 Dry Shampoo on Amazon

• Average Selling Price $39.78

• 110k+ reviews

Winning Formula:

Amika is making serious waves on Amazon with a focused strategy built around its hero SKU: dry shampoo. The brand owns 20% of the category, driven by a multitiered approach with Perk Up, Perk Up Plus, Perk Up Ultra, and value-sized options all ranking as top sellers. By anchoring awareness in a single, high-performing product family, Amika creates an efficient funnel for discovery and keeps customers engaged as they expand into adjacent categories. That strategy is paying off, with Amika’s hair shampoos and treatment masks steadily climbing the charts. It’s a smart example of how a strong hero can open the door to long-term brand loyalty.

K18

Between bleaching, chemical straightening, and heat styling tools, consumers often complained to their hairdressers about dry, frizzy, damaged hair—but that was before K18 hit the market. Touted by stylists as the holy grail for hair repair, biotechnology brand K18 was founded in 2020 by Suveen Sahib and Britta Cox. The company’s proprietary K18 Peptide was developed by applying computational models with probabilistic structure/sequence analogy to the molecular structure of human hair, renewing chemically damaged hair from the inside out. There was such a massive demand from hairdressers recommending the line to their clients that the company began selling to consumers at the end of the same year. Unilever acquired the brand in December 2023.

The Data:

• 120% Estimated 12-Month Growth

• #2 Hair Treatment Mask on Amazon

• Average Selling Price $57.56

• 26k+ reviews

Winning Formula:

K18 is gaining rapid traction on Amazon with a focused, high-performing assortment and operational precision. Searches for K18 hair products are up 48.6% in the last 30 days, and the brand now owns 15% of the Hair Treatment Mask market. With the smallest assortment on this list, K18 maintains a 98.4% in stock rate—the highest among all brands featured. You can’t sell what you don’t have, and K18 proves that operational excellence, paired with a tight, science-driven product lineup, can drive visibility and conversion in a competitive category.

BIO IONIC

World-renowned hairstylist Fernando Romero discovered the science and power of harnessing natural negative ions while on a trip to Japan. Founded in 1997 by Romero, the professional styling tools utilize negative ion therapy, arming hairdressers with “moisturized heat” that doesn’t damage the hair. The brand’s proprietary NanoIonic Mineral Technology hydrates the hair from the inside out by emitting natural negative ions. The brand was acquired by JD Beauty Group, the parent company of WetBrush, in 2017.

The Data:

• 152% Estimated 12-Month Growth

• #4 Hair Curling Iron on Amazon

• Average Selling Price $155.71

• 10k+ reviews

Winning Formula:

Bio Ionic is carving out a strong position on Amazon by staying laser-focused on professional-grade hair tools. With a tight assortment of just 29 products—the third smallest on this list—the brand owns 15% of the Hair Curling Iron category and currently holds the #4 in the rankings. Its signature long-barrel design and focus on hair health set it apart from competitors, and it’s clearly resonating: searches for “Bio Ionic hair curler” are up 98.3% in the last 30 days. By leaning into what it does best, Bio Ionic is proving that category depth and product clarity drive meaningful results.

Colorescience

Founded by Diane Ranger—the same woman who coined the term "mineral makeup" in 1977 with the creation of her first brand, Bare Escentuals—Colorescience is considered a pioneer in mineral makeup. Used and recommended by dermatologists and estheticians, Colorscience’s brush-on mineral sun protection has gained iconic status for its ability to protect patients’ post-procedure skin, as well as the most sensitive skin and scalp. SkinMedica was acquired by the brand in January 2012, and at the end of the same year, Colorescience became part of the Allergan family of brands when the conglomerate acquired SkinMedica.

The Data:

• 115% Estimated 12-Month Growth

• #13 Facial Sunscreen on Amazon

• Average Selling Price $66.01

• 24k+ reviews

Winning Formula:

Colorescience built its reputation with the iconic Brush-On Shield, but it’s the Face Shield Flex that’s now leading the charge on Amazon. This innovative tinted sunscreen, featuring encapsulated pigments and medium coverage, blends skincare with cosmetic performance. The brand owns 9% of the facial sunscreen market and is riding a wave of growing interest—searches for “Colorescience SPF” have been up 95.9% in the last 30 days. With dermatologist credibility and a clear focus on high-performance sun protection, Colorescience proves that science-forward innovation converts in the beauty aisle.

Innersense Organic Beauty

Born in a salon in 2005, hairdressers Greg and Joanne Starkman created Innersense Organic Beauty out of frustration with the harsh chemicals that hairdressers handle daily. The founders prioritize gentle yet effective plant-based ingredients as well as sustainability and community. A fan favorite among professionals and consumers for its transparency regarding ingredients and efficacy, the brand expanded its collection to the bodycare category in 2024. It is sold mainly in professional salons and spas, as well as direct-to-consumers (DTC), and in select Walmart and Ulta Beauty locations.

The Data:

• 82% Estimated 12-Month Growth

• #4 Hair Styling Foam on Amazon

• Average Selling Price $38.75

• 24k+ reviews

Winning Formula:

Innersense is quickly expanding its footprint on Amazon, led by its clean, salon-grade formulations and strong positioning in natural haircare. The brand owns 15% of the Hair Styling Foam category and is steadily gaining ground across others, with a 4.5% share in Hair Styling Gels and a 2.1% share in Hair Conditioner. Consumer interest is rising fast—searches for “Innersense Organic Beauty” are up 64.9%, while interest in their travel-sized products has jumped 87.8% in the last 30 days. Innersense’s rapid growth shows that conscious formulations and consistent performance can scale fast in a crowded marketplace.

IGK

In 2016, four hairstylists created IDK—Leo Izquierdo, Franck Izquierdo, Aaron Grenia, and Chase Kusero—alongside Tev Finger, CEO of Luxury Brand Partners, a brand kingmaker who has incubated and exited brands including Bumble and Bumble. The founders set their intention to create products that would be integral to fellow hairdressers while building a salon footprint with flagships in NYC, Miami, and Las Vegas. A social media darling, IGK is known for its high performance and efficacy and is sold in salons and top retailers including Sephora, Ulta Beauty, and Amazon.

The Data:

• 26% Estimated 12-Month Growth

• #2 Hair Thermal Protection on Amazon

• Average Selling Price $43.29

• 32k+ reviews

Winning Formula:

IGK is poised to dominate the Hair Thermal Protection category on Amazon, owning 15% of the market thanks to its powerhouse Good Behavior product family. With multiple SKUs in the subcategory’s top 10 and searches for Good Behavior Spray up 23.5% in the last 30 days, IGK’s styling-first strategy is clearly resonating. While its shampoos and conditioners rank lower, the brand has carved out authority where it counts—and is beginning to branch out, with its Hair Color Refreshing Mask now ranking #6 in its category. However, with a conversion rate of just 11.2%, IGK will need to improve how it turns interest into purchases before it can pose a serious threat to more established haircare players.

The Understudies: One Tweak Away from Their Big Break

RevitaLash

RevitLash was founded in 2006 by physician Dr. Michael Brinkenhoff and his wife, Gayle, when she was battling breast cancer. Dr. Brinkenhoff developed the original lash conditioner to build his wife’s confidence during treatment, and the positive results led to the creation of RevitaLash Cosmetics. Sold in physicians' offices, spas, salons, and specialty retailers across more than 70 countries, Revitalash has achieved a loyal following for its consistently effective results.

The Data:

• 90% Estimated 12-Month Growth

• #11 Eyelash Primer on Amazon

• Average Selling Price $101.12

• 16k+ reviews

Winning Formula:

RevitaLash is riding a wave of search momentum on Amazon, with “RevitaLash” up 73.5%, “RevitaLash Mascara” up 58.4%, and “RevitaLash Advanced” up 59.1% in the last 30 days. But while interest is high, the brand currently has the lowest conversion rate on this list at 10.5%—a signal that there’s significant untapped opportunity. If RevitaLash can better align its PDPs, pricing, or promotions to convert that traffic, it could quickly become a significant competitive threat to lash growth leaders like Grande Cosmetics.

L3VEL3

Built by artists for artists, L3VEL3 was established in 2011 and began selling products in 2020. Built around its iconic hero SKU, Hair Root Lifting Powder, L3VEL3 was founded by professional hairdresser influencers Jay Nouri and A-Rod, who have a combined social media following of over 4 million followers. The brand began as a men’s grooming line and has since expanded into hair color, skincare, and apparel, and is available in barber shops and homes in over 30 countries.

The Data:

• 130% Estimated 12-Month Growth

• #1 Hair Root Lifting Powder on Amazon

• Average Selling Price $16.39

• 40k+ reviews

Winning Formula:

L3VEL3 dominates the Hair Root Lifting Powder category on Amazon with the #1 ranked product and a commanding market share. While their shaving category picks up steam, the brand remains a one-product story. Their hero SKU strategy has clearly worked, but long-term growth will require more. Starter sets or bundles with free travel sizes could introduce customers to additional products and increase basket size. If L3VEL3 diversifies while keeping its brand focus sharp, it has a bright future ahead in professional grooming.

DESIGNME

Canadian professional haircare brand DESIGNME was founded in 2016 by lead stylist Amy Stollmeyer and CEO Safir Shnayderman to foster diversity and inclusivity while delivering innovation without compromise. In North America, over 100,000 stylists in 20,000 salons use DESIGNME, and the brand is sold through its website and at Nordstrom.

The Data:

• 38% Estimated 12-Month Growth

• #10 Hair Root Lifting Powder on Amazon

• Average Selling Price $36.74

• 17k+ reviews

Winning Formula:

DESIGNME is gaining attention fast, with DESIGNME seeing some of the highest search increases on this list—up 96.9% in the last 30 days. While the brand still has ground to cover in the Hair Root Lifting Powder category, the fundamentals are there: standout packaging, compelling before-and after visuals, and inclusive lifestyle imagery. If DESIGNME can boost traffic and improve rankings, it has the brand assets in place to become a real contender in styling.

MAC Cosmetics

From its inception in Toronto in 1984, MAC Cosmetics founders, makeup artist and photographer Frank Toskan, and beauty salon owner Frank Angelo, created the brand as an inclusive professional line for “All Ages, All Races, All Genders.” The founders aimed to create makeup that held up well under studio lights, and word spread quickly. MAC gained its cult following from word-of-mouth endorsements from influential makeup artists, photographers, models, and journalists who raved about the brand’s quality and efficacy. Acquired by Estée Lauder Companies in 1994, the brand is sold today in more than 120 countries and territories, with over 13,000 makeup artists using MAC globally. The brand has experienced explosive growth over the last 40 years, making it a “must-have” in every professional makeup artist’s kit and in consumers’ makeup bags.

The Data:

• Estimated 12-Month Growth Unclear

• #23 Eye Concealer on Amazon

• Average Selling Price $32.26

• 91k+ reviews

Winning Formula

MAC is the only unintentional brand on this list—yet it generates over $25 million annually on Amazon through third-party resellers alone. With no official control of the brand’s presence, it’s still seeing strong momentum: searches are up 38% for Face & Body Foundation and 24% for the recently rebranded Studio Fix Powder. The demand is undeniable, but it raises key questions—are shoppers chasing discontinued Studio Fix shades, or is this untapped opportunity? If Estée Lauder brings MAC officially to Amazon, it could become one of the channel’s most powerful professional beauty launches, bringing with it a loyal community of pro-makeup artists who still swear by the brand.

The Success Signal: What High-Performing Pro Brands Get Right

Professional beauty brands—those traditionally rooted in salon, spa, or clinical environments—care deeply about a few core pillars when it comes to their retail strategy:

Professional Reputation

Top-performing professional beauty brands on Amazon are winning by staying true to their roots. Rather than diluting their identity for mass appeal, they use their storefronts to highlight their legacy, brand story, and salon credibility. Strong imagery reinforces this positioning—products are shown being used behind the chair, not just in polished flat lays, reminding consumers that these are formulas trusted by professionals. Tutorials demonstrate expert application techniques, bridging the gap between salon and home. Most importantly, these brands ensure that Amazon isn’t stocked with products meant exclusively for professional use, protecting both the consumer experience and the integrity of their professional channel. It’s this balance of accessibility and authority that builds trust and drives conversion.

Aimee Gonzalez, Director of Business Development, said, “Coming from the professional beauty world, I know education is at the heart of everything. The brands that win on Amazon are those that don’t just sell—they teach. They translate pro-level knowledge into PDPs, videos, and guided routines that build loyalty at scale.”

Channel Control

Professional beauty brands winning on Amazon understand that distribution control isn’t optional—it’s foundational. Top performers either maintain a clear, enforceable authorized seller policy with the tools to back it up or they leverage Amazon’s Premium Beauty gating benefit, which makes unauthorized resellers invisible to consumers. But gating alone isn’t a silver bullet. Even when rogue sellers are hidden on Amazon, they’re still active in other markets, often sourcing products through diverted salon inventory or unauthorized distributors. That undermines brand equity, confuses consumers, and can lead to negative reviews or customer service issues when products are misused. Leading brands are proactive, policing their channels, training distributors, and cutting off partners who don’t comply. This relentless focus on channel integrity protects pricing, supports professional relationships, and ensures the brand experience is consistent, no matter where a customer buys. Maintaining a selective presence in retail helps preserve their premium positioning and protect professional relationships.

Shelley Swallow, VP of Brand Protection at Market Defense, said, “Brand protection needs to be prioritized alongside marketing and sales—because if you’re not protecting your image, who are you really marketing to? I work with a brand in NYC that uncovered a major diversion issue through surprise spot checks of their authorized partners. They discovered a retailer purchasing products, then rerouting them to a separate warehouse to resell on Amazon and Walmart, while the shelves in their actual store sat empty. Professional brands using product coding and tracking can now pinpoint the exact source of diversion. It’s becoming a must-have, not a nice-to-have.”

Prescriptive Selling

Professional beauty brands know their products were never meant to be self-explanatory, and their Amazon strategy reflects that. Because many SKUs were initially sold with the guidance of a stylist, esthetician, or derm, top brands replicate that education-first approach online. They build detailed PDPs, layer in A+ content with how-to videos and regimen guides, and use tutorials and UGC to show real-world application. They don’t assume the customer knows what to do—they teach, just like they would in the treatment room or salon chair. Brands also stay close to the customer by actively responding to reviews and questions, using that feedback to continuously optimize product content and clarify usage. Many go further by offering regimens and complementary product suggestions, turning a single purchase into a full solution. It’s this thoughtful, guided approach that builds trust and bigger baskets.

Amy Rudgard, SVP Client Delivery, Market Defense, said, “A way to translate the power of professional experts over to Amazon is with a problem-solution marketing strategy. Create a sponsored brand video ad that leverages the expert highlighting a core problem facing consumers and teeing up the solution. Link the video to a page in the brand store that breaks down the problem and serves up the solution through tips, product education, and product recommendations. The power of Amazon is that the data will highlight the problems consumers are searching the most and enable tailored campaigns like this to target those search terms with content and solutions that speak directly to consumers' main concerns."

Premium Presentation

Professional beauty brands understand that every visual touchpoint—on shelf or on screen—is a reflection of their credibility. On Amazon, that means investing in premium storefronts, A+ content, and consistent packaging across all channels to maintain brand integrity. They ensure their products don’t just perform well—they look exceptional, especially on mobile, where most beauty shoppers browse. Knowing that many customers land on their PDP after seeing a TikTok or influencer mention, top brands design for scroll-stopping impact: clean hero images, polished swatches, and elevated content that reinforces their pro positioning. Influencers they partner with are carefully selected—not just for reach, but for their ability to communicate product benefits, demonstrate usage, and speak to the brand’s unique value. In a space where no professional is standing by to recommend a product, the content is the expert, and the best brands make sure it earns the customer’s trust.

Nicole Howard, Creative Director at Market Defense, said, “The power is in strong, consistent branding across Amazon creatives and other channels. Without consistent branding, the consumer is left to wonder if they are getting the real deal or a dupe. Ensure your main image is clean and clear, and that A+ content tells a compelling story of the current product but also cross-promotes your brand’s larger catalog or full beauty regimen. Everything about your creative content, from brand store to A+ content, should feel like the brand your customers have grown to know and love.”

Strategic Growth with Guardrails

Professional beauty brands are scaling smart, not fast. Their growth strategies are built with intention—selective retail partners, pricing controls, and a disciplined promotion cadence that protects brand equity. They participate in moments like Prime Day not just to drive volume, but because they understand the broader impact. Those red Prime Day badges attract new, engaged beauty shoppers, and the resulting halo effect drives incremental growth well beyond the event. Tools like “Subscribe & Save” serve as loyalty drivers, echoing replenishment behavior in salons and dermatology offices. And when it comes to advertising, they’re disciplined but not timid—often reinvesting 15%–20% of topline Amazon revenue to drive smart, sustainable growth. For these brands, marketplace success isn’t just about moving units—it’s about moving forward without compromising who they are.

Dave Karlsven, SVP of Client Marketing and Data Science at Market Defense, said, “Brands that set their ad budgets based on a percentage of total sales (TACoS) guardrail unlock the ability to scale with both aggressive confidence and control. This approach ties ad spend directly to performance, allowing for more aggressive budget increases as paid, organic, and repeat sales grow. By using advertising to fuel new-to-brand customer acquisition and accelerate sales velocity, brands not only drive top-line growth but also climb in organic rankings while locking in profitability with the TACoS guardrail. The result is a compounding effect—more visibility, more customers, and stronger long-term profitability.”

Professional Loyalty and Channel Harmony

Professional beauty brands know their roots—and they don’t forget them as they grow. Built in partnership with salons, spas, and estheticians, these brands prioritize moves that support—not sideline—their pro community. That means offering their off-Amazon channels backbar-only SKUs, exclusive pro incentives, and maintaining education as a core brand pillar. When expanding into retail, they’re careful not to undercut their pros, but they also recognize that being present on Amazon isn’t disloyal—it’s inclusive.

Kuykendall said, “With 80% of US households holding a Prime membership, it’s about keeping the customer connected between appointments. If a shopper can’t find the product when it’s time to replenish, she will buy something else—and everyone loses. The smartest brands know that channel harmony protects both sales and long-term loyalty.”