According to Circana data, the US prestige beauty market grew by 2% to $16 billion, while sales at mass merchants increased 4% to $34.6 billion in the first half of 2025.

“The beauty industry’s latest results are indicative of a consumer who is focused on efficacy and elevated value,” said Larissa Jensen, global beauty industry advisor at Circana. “Only 14% of US beauty buyers believe that higher prices indicate a better-quality product. The mass and prestige markets are converging, with premium-priced brands in mass retail and value-priced prestige brands outperforming their counterparts. As the industry faces tariff uncertainties and shifting consumer sentiment, adaptability and strategic agility are essential for success in 2025.”

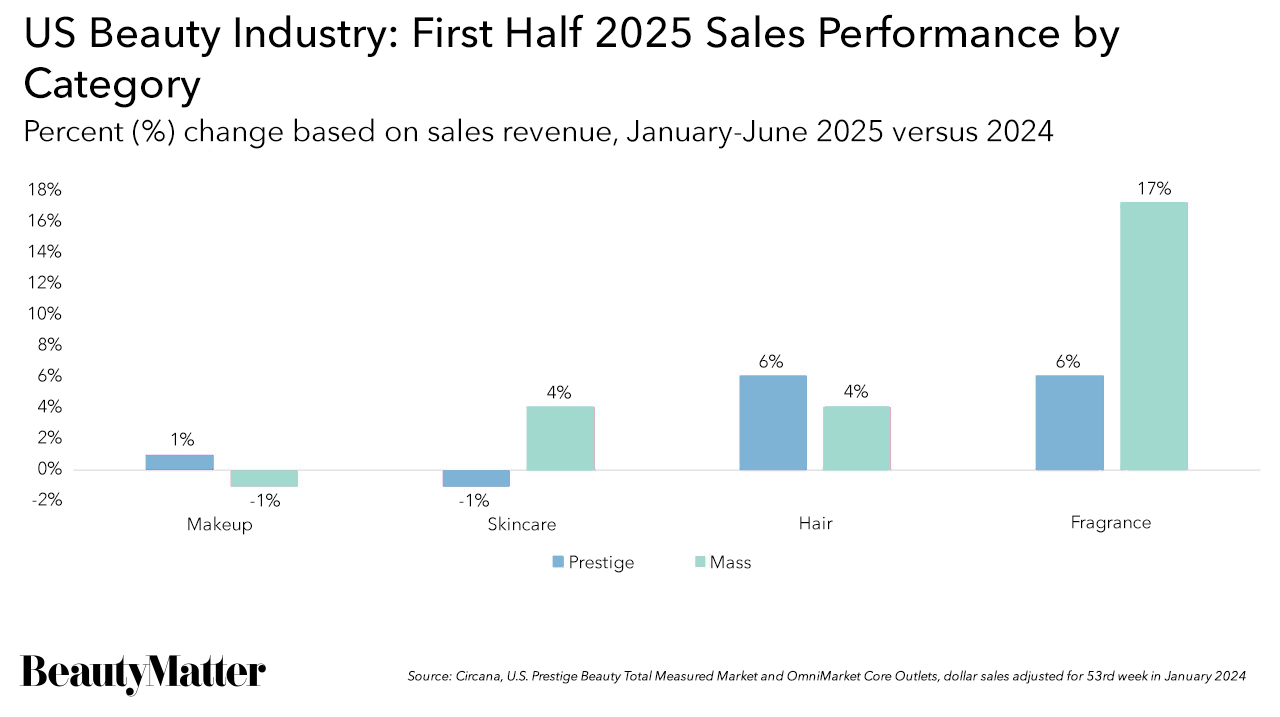

Fragrance

Hair

Makeup

Skincare