Vanilla’s time in the sun is far from fleeting. Once considered safe and predictable, vanilla has been recast by Gen Z as the anchor of modern gourmand, layering, and comfort-driven fragrance rituals. On Amazon, vanilla-based SKUs are capturing record search volumes and sales, fueled by TikTok layering hacks, #PerfumeTok’s 4.7 billion views, and a market where 65% of consumers now say they prefer sweet, gourmand scents.

“Fragrance lifts people’s mood, and vanilla delivers that emotional payoff,” says Vanessa Kuykendall, Chief Engagement Officer at Market Defense. “It’s versatile enough for layering, and delivers a sense of comfort and sensuality, which makes it a perfect beginner-friendly fragrance and ideal for #PerfumeTok.”

Across Market Defense’s Amazon trend reports in 2024 and 2025, vanilla consistently rose to the top. From Dossier’s Ambery Vanilla leading Cyber Week to Phlur’s Vanilla Skin climbing Prime Day rankings, vanilla has proven itself not just a note, but a true category driver.

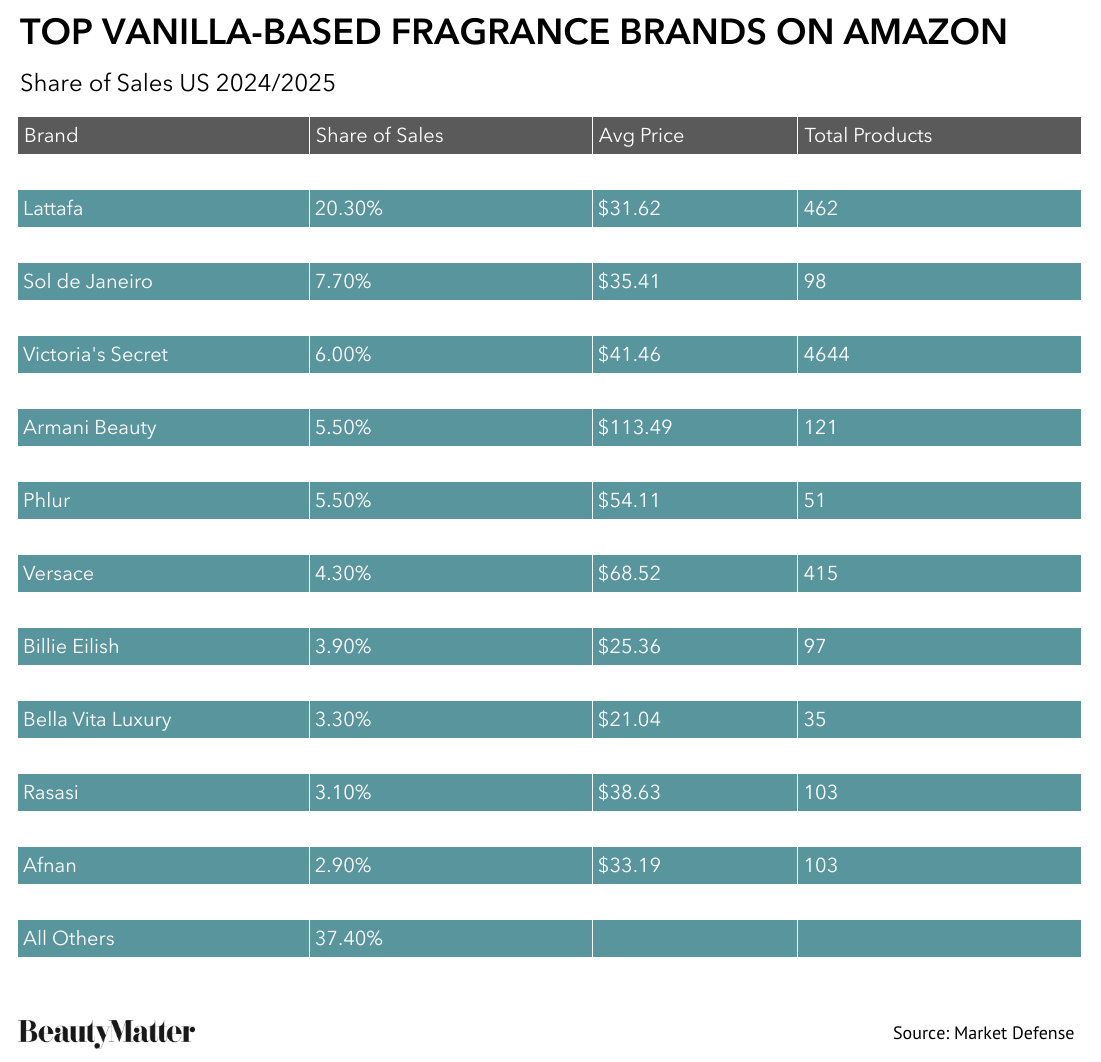

Market Defense, the full-service marketplace agency, unpacked the fragrance brands driving the vanilla trend on Amazon, tracking every product that ranks for “vanilla” searches, from vanilla perfume to vanilla body spray, and measuring their share of the market. “We zoomed in on every fragrance that wins on ‘vanilla’ searches and measured who’s capturing the most share,” said Kuykendall.

1. Lattafa

Founded in the 1980s by Sheikh Shahid Ahmad and Shoaib Iqbal, Lattafa, a family-owned business for three generations, is steeped in rich Emirati heritage. Rooted in tradition, Lattafa blends the richness of Arabian culture with modern scent profiles, making it a top-performing brand on TikTok. With a portfolio of more than 2,000 products—from mass-market favorites to exquisite luxury collections—every brand under Lattafa’s umbrella is distinct, catering to a unique fragrance story. Positioned as a global powerhouse, Lattafa has a global reach, bringing the mystique of Arabia to more than 120 countries.

The Data:

The Winning Formula:

Lattafa turned a viral hit into sustained growth by following the success of Yara with Angham, proving it wasn’t a one-off wonder. Its rise is powered by TikTok, where views on Arabian perfumes are up +64% and Lattafa itself has grown +137.6% year over year (YoY), now holding 88.6% of its share of voice from TikTok. This cultural momentum translated into marketplace dominance: Lattafa ranked #2 in branded search during Prime Day 2025, solidifying its visibility on Amazon. By pairing social-driven discovery with catalog expansion, the brand has built lasting traction that continues to set it apart in the growing Arabian fragrance wave.

2. Sol de Janeiro

Founded by Heela Yang, Marc Capra, and Camila Pierotti, the Brazilian-inspired Sol de Janeiro built its brand around giving customers a joyful, sensorial experience through bright, cheery packaging and floral, sweet fragrances. Launching with just three products in 2015, the brand experienced instant success, with its Brazilian Bum Bum Cream becoming the number-one-selling skincare product in Sephora after just three months. In 2021, Sol de Janeiro sold an 83% stake to L'Occitane in a transaction that valued the company at $450 million, with Yang committing to continue on as CEO. In 2023, the brand proved it was a category creator when it pivoted to fragrance and scented body mists. Beloved by millennials, Gen Z, and Gen Alpha for its bold aesthetic, instant virality, and sought-after scents, Sol de Janeiro has hit icon status.

The Data:

The Winning Formula:

Sol de Janeiro has transformed body mists from an entry-level format into a prestige powerhouse. While best known for its cult-favorite Bum Bum Cream, the brand dominates Amazon’s body spray category with a 32% share, fueled by multiple variations of its Cheirosa Hair & Body Fragrance Mists. Bright, gourmand-driven scents optimized for TikTok aesthetics keep the brand culturally relevant, while expansion into hair perfumes broadened its reach. Sol de Janeiro’s resonance shows up in the data: It ranked as the top branded search term during both Cyber Week 2024 and Prime Day 2025, proving its ability to convert cultural buzz into marketplace dominance.

3. Victoria’s Secret

While Victoria’s Secret is most often associated with lingerie, Victoria’s Secret Beauty is a significant pillar of the brand. Known for its signature sweet and spicy scents, Victoria’s Secret Beauty has been a top-selling fragrance producer in the US since its inception in 1989. By 2006, the Victoria’s Secret Beauty division generated nearly $1B in US sales, according to CNBC. And, in fiscal 2021, the brand achieved similar numbers generating close to $900M in US sales, accounting for 15% of Victoria’s Secret total revenue. Victoria’s Secret fragrance remains iconic for its sweet scent profiles that appeal to generations of women.

The Data:

The Winning Formula:

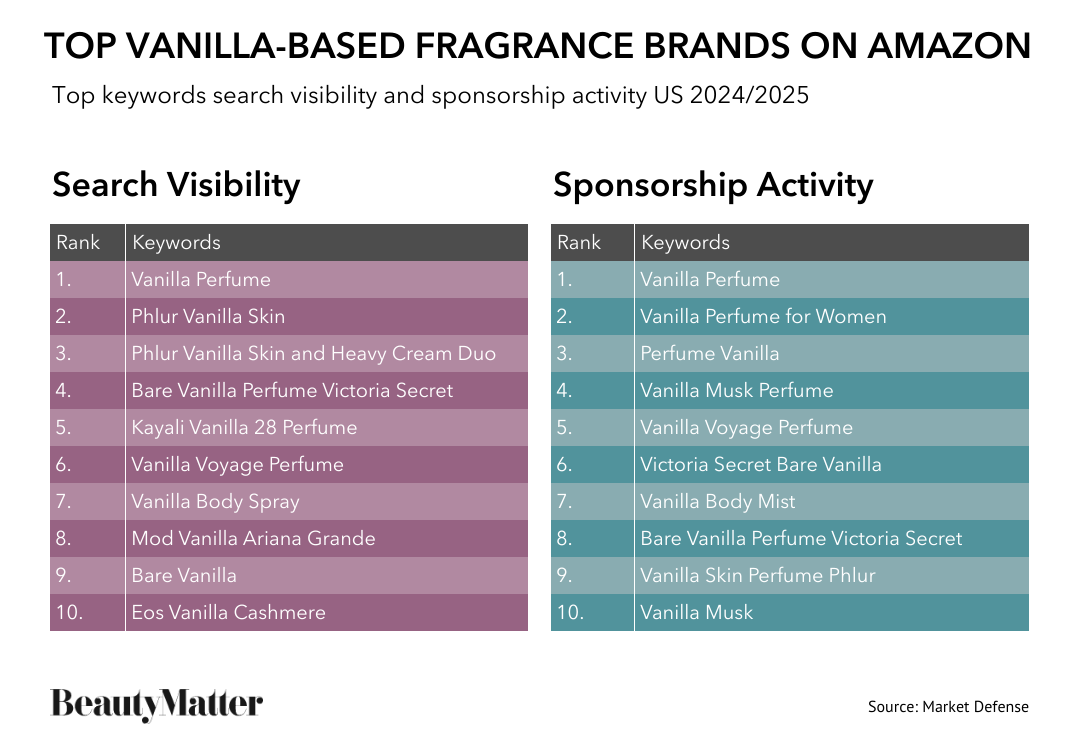

Victoria’s Secret has successfully brought its iconic fragrances onto Amazon, launching its beauty business on the platform in 2023. Hero SKUs like Bare Vanilla and Love Spell keep the brand relevant, tapping into nostalgia while doubling as layering staples for younger consumers. Aggressive sponsorship ensures the brand stays visible in a crowded vanilla keyword landscape. The strategy is paying off: Bare Vanilla is now Amazon’s #4 fragrance search term, commanding 27% organic share of voice, the highest in that metric.

4. Armani Beauty

Armani Beauty, which includes makeup, skincare, and fragrance, was created through a licensing agreement with L’Oréal in 1980. Launching its first women’s fragrance in 1982, followed by a men’s fragrance in 1984, Armani Beauty has dominated the male fragrance segment for decades and stands out for its longevity and evolution.

The Data:

The Winning Formula:

Armani Beauty leverages blockbuster fragrances to maintain prestige equity while taking a selective approach to Amazon distribution. Anchored by global icons like Acqua di Giò—the #1 YTD fragrance on Amazon in 2025—Armani balances trend relevance with luxury positioning. Vanilla-forward launches such as Stronger With You Intensely for men and My Way for women demonstrate how the house plays in gourmand while staying true to its DNA. By moving aggressively into men’s fragrances, Armani stands out from the largely female-focused vanilla trend, broadening its reach while reinforcing its reputation for timeless sophistication.

5. Phlur

Known for its storytelling through scent, masstige indie brand Phlur began its journey of virality on TikTok when it was acquired and rebranded by brand accelerator The Center, founded by Ben Bennett, along with influencer Chriselle Lim, in 2022. By illustrating the experience of wearing Phlur as an emotional moment, the fragrance house challenges customers to write their own narrative through Phlur’s “wardrobe of scents.” In July2025, Phlur was acquired by private equity firm TSG Consumer Partners and is expected to hit $150M in revenue this year, according to the private equity firm.

The Data:

The Winning Formula: Phlur is one of the fastest indie fragrance breakouts on Amazon. After launching on the platform in 2024, the brand surged into top-of-page positions by August, fueled by influencer-driven buzz and social-first storytelling. Its hero, Vanilla Skin, quickly became a cultural and commercial anchor, ranking as the #2 top seller during Prime Big Deal Days 2024. It then converted that momentum into steady growth, becoming the #4 top-selling fragrance YTD in 2025. Phlur’s ability to turn TikTok virality into sustained Amazon performance shows the power of aligning content with execution and how a single, well-optimized hero SKU can carry an indie brand into the mainstream.

6. Versace

With a longstanding legacy of creating provocative fragrances for women and men, Versace gained instant iconic status since it launched Gianni Versace for Women in 1981. Partnering with luxury beauty manufacturer and licensing company EuroItalia in 2005, Versace fragrance added a 15-year extension to its licensing agreement in 2021. The brand continues to resonate by delivering its sexy and exotic scents to longtime customers and building relationships with younger generations of shoppers.

The Data:

The Winning Formula:

Vanilla has been in Versace’s DNA for over a decade—Eros for Men blends warm vanilla into its profile, while Eros Flame layers vanilla with tonka bean—positioning the brand ahead of today’s gourmand wave. That early embrace is paying off: Eros for Men ranked as the #3 top-selling fragrance YTD in 2025, proving that trend alignment doesn’t have to come at the expense of heritage. By balancing consistency in its icons with trend relevance, Versace continues to capture share while reinforcing its luxury equity.

7. Billie Eilish Fragrances

Billie Eilish launched her namesake fragrance in 2021 with Parlux Ltd, a licensor that designs, manufactures, and distributes fragrances for names like Paris Hilton and Jason Wu. According to Parlux Ltd., Eilish had full creative control and was heavily involved in the fragrance’s development. Created to appeal to Eilish’s millions of young fans, the fragrance embodies Eilish’s persona.

The Data:

The Winning Formula:

Billie Eilish Fragrances connects with Gen Z through authenticity and star power, with vanilla as its signature note. Searches rose +18M YoY, and it ranked as the #2 most searched branded fragrance during Cyber Week. The brand keeps its lineup tight and focused on the juice, not ancillary products, giving it clarity and impact.

8. Bella Vita Luxury

Indian company Bella Vita launched in 2018 as a skincare brand but then pivoted to fragrance in 2021, which proved to be a successful move. The company’s monthly revenue increased from ₹25 lakh ($28,327) to ₹45 crore ($5,098,810) within 18 months of entering the fragrance market, according to The Economic Times. Marketed as luxury for less, Bella Vita fragrances are beloved for high quality and frequent launches, which are promoted on social media and by well-known influencers.

The Data:

The Winning Formula:

Bella Vita appeals to aspirational shoppers with prestige-inspired packaging at an accessible price. As the lowest-priced brand in the top 10 and with the smallest assortment, its focused lineup resonates with value-conscious consumers. Messaging around eight-hour wear taps directly into the longevity trend, helping Bella Vita carve space alongside challenger peers like Bodycology.

9. Rasasi

Founded in 1979 by Abdul Razzak Kalsekar, Dubai-based fragrance house Rasasi Perfumes Industry is a renowned family-owned business loved for its unique fragrance profiles, which blend Arabian and Western-style scents into intoxicating fragrances. The company famously collaborated with acclaimed perfumers Amandine Galliano and Raphael Haury to create its robust scent library. Rasasi operates more than 115 showrooms in malls and market locations across the GCC (UAE, Kingdom of Saudi Arabia, Oman, Kuwait, Bahrain, and Qatar). Products are exported to more than 50 countries across the globe through a strong distribution network, supported by a 16K-square-meter (172K-square-foot) manufacturing facility in Jebel Ali Free Zone, Dubai.

The Data:

The Winning Formula:

Rasasi rides the same Arabian fragrance wave fueling Lattafa, appealing to US shoppers who want authenticity, high concentration, and long-lasting wear. Known for weaving vanilla into its DNA, the brand’s newest Hawas Elixir layers vanilla, tonka bean, and musk at the base. After breaking into the Prime Day 2025 top 10, Rasasi now holds 6.7% of the men’s perfume market share on Amazon, proving its growing weight in the category.

10. Afnan

Founded in 2007 by Imran Fazlani, Afnan is a UAE-based fragrance house, priding itself on creating unique fragrances that combine traditional Arabian notes with modern Western-inspired scents. Beloved by customers for being a “luxury for less” brand, and for its reputation for creating quality dupes, Afnan manufactures, distributes, and exports fragrance under its own brand as well as white-labeled for other companies. Afnan fragrances are sold in over 30 countries, across the Middle East, Asia, Europe, and North America.

The Data:

The Winning Formula: Afnan shows how smaller fragrance houses can cut through on Amazon with tight assortments and sophisticated vanilla-forward profiles. By leaning into search traffic for “vanilla perfume,” Afnan meets shoppers where demand is surging. The brand’s content strategy goes beyond notes: It paints vivid pictures of how a fragrance develops and when to wear it in their content, with messaging like “Whether you’re heading out for an evening gathering, a formal dinner, or simply looking to make a lasting impression …” This approach builds aspiration while guiding purchase, proving that even newcomers can create impact.

How to Claim Your Share of the Vanilla Boom

Many of the brands leading the vanilla fragrance trend on Amazon are Market Defense clients. “We’ve seen firsthand what it takes to gain ground in this competitive category,” says Kuykendall. Here are their team’s top strategies for brands looking to do the same.

1. Define your audience.

Before creating content, be clear about who you’re speaking to and what you want them to do. For brand awareness, the goal is to build an emotional connection: Content should feel relatable and lifestyle-driven not just transactional. For consideration or purchase, focus shifts to proof: highlighting unique differentiators, benefits, and why your product is the right choice. Increasingly, brands are leaning on user-generated content (UGC) and influencer storytelling to strike this balance, blending authenticity with education and showing products in the context of real life.

“One way for brands to cut-through is to use influencers to drive awareness, traffic, consideration, and trial. Critical to any influencer outreach is scale and taking an evergreen, always on approach,” says Amy Rudgard, SVP of Client Delivery. “Then leverage the UGC in Sponsored Brand Video ads on Amazon; UGC in videos has been shown to perform well. UGC and video content can help shoppers imagine what it smells like and encourage trial.”

2. Match storytelling to your campaign objective.

Even as consumers become more knowledgeable about fragrance notes and terminology, they want more than information; they want to feel something. Elevate your product by taking a list of features and turning it into an experience worth owning.

“Storytelling has evolved to be purpose driven for e-commerce,” says Joshua Fulmer, Executive Creative Director. “We can no longer just list our features; designs need to educate and inspire. Highlighting notes of vanilla with warm, sensory-focused imagery, creates a better connection and drives customers from awareness to purchase."

3. Invest in your hero SKU, then expand.

Many of the top-performing fragrance brands are proving that growth comes from focus. They’ve built families of flankers, body products, and limited editions, but always around a consistent hero SKU that serves as the entry point to the brand. That anchor product is where they invest in search, content, and ads year-round, ensuring it remains top of mind and discoverable. The halo from that hero drives awareness and trust that lifts the rest of the line.

“Amazon rewards focus. Secure badges and rankings for your hero, then use that halo to grow your line,” says Dave Karlsven, SVP of Client Marketing and Data Science. “The brands that win are disciplined. They don’t chase every new idea. They double down on what works, then expand in a way that reinforces, not distracts from, the entry point.”

4. Keep distribution clean to protect equity.

Fragrance has traditionally relied on distributors and licensing models to expand reach, but in 2025 brands are rewriting those rules. With Amazon and other marketplaces driving so much growth, the risk of diversion and reseller undercutting is too high to ignore. More fragrance houses are pulling distribution closer, setting clear policies, and tightening control of authorized channels to protect price, brand image, and customer experience.

“If resellers undercut price or confuse customers, it erodes everything you’re building. Tight channel control is non-negotiable,” says Shelley Swallow, VP of Brand Protection. “We help brands set up their own accounts so they can fully own their IP and their consumer relationships, protecting equity while still fueling growth.”

5. Treat ad spend as brand investment.

The strongest brands reinvest 15%-20% of topline into ads; it’s what keeps them competitive and discoverable. They don’t separate Amazon from the rest of their channels because they know today’s consumer journey is fluid: Discovery happens on TikTok, Instagram, or through influencers, but checkout often happens wherever it’s most convenient. That’s why marketplaces like Amazon and Walmart are essential touchpoints, and why visibility, especially on mobile, requires consistent paid investment.

“Brands like Lattafa partner with Market Defense because they know we understand the customer journey,” says Karan Raturi, Chief Operating Officer. “We look at a brand’s Amazon business as part of a holistic approach. Customers no longer shop in silos, and your strategy should reflect that reality.”