Amazon’s Top 25 in the US Beauty & Personal Care saw very little shift in the top 10 in Q3, as consumers stayed loyal to beauty pantry items from household names like Neutrogena, Maybelline, and Bio-Oil. With more than 350 million products sold on Amazon, how do brands retain loyalty like this? A main reason is product reviews.

Consumers rely on reviews to make buying decisions, and four out of five consumers have changed their minds about a recommended purchase after reading negative online reviews. There are about 250 million reviews, and growing, on Amazon. Reviews in the Top 25 grew 21% from Q3, with Softsoap growing the most at 38%.

Vanessa Kuykendall, COO at Market Defense, shared insight on the art of reviews, “The best way to get Amazon reviews is to simply ask for them. Amazon feedback software can be implemented that solicits reviews from customers after purchasing, and the best part is that you can specifically target the customers who are more likely to write you a good review. You can set up rules to only email customers who have left you reviews in the past, those who received their order on-time, and those who bought a product that tends to produce positive feedback on Amazon.”

TikTok’s influence on Amazon continues. Leaning into the app’s virality, last spring Amazon launched the cross-category hub of trending products called “Internet Famous - The Latest To Go Viral.” TikTok favorite CeraVe added two more products to the Top 25 to make four in total, the most the brand has had in the Top 25 all year. Essential oils are also having a moment on TikTok, with over 140 million views on the subject, driving interest and sales on Amazon.

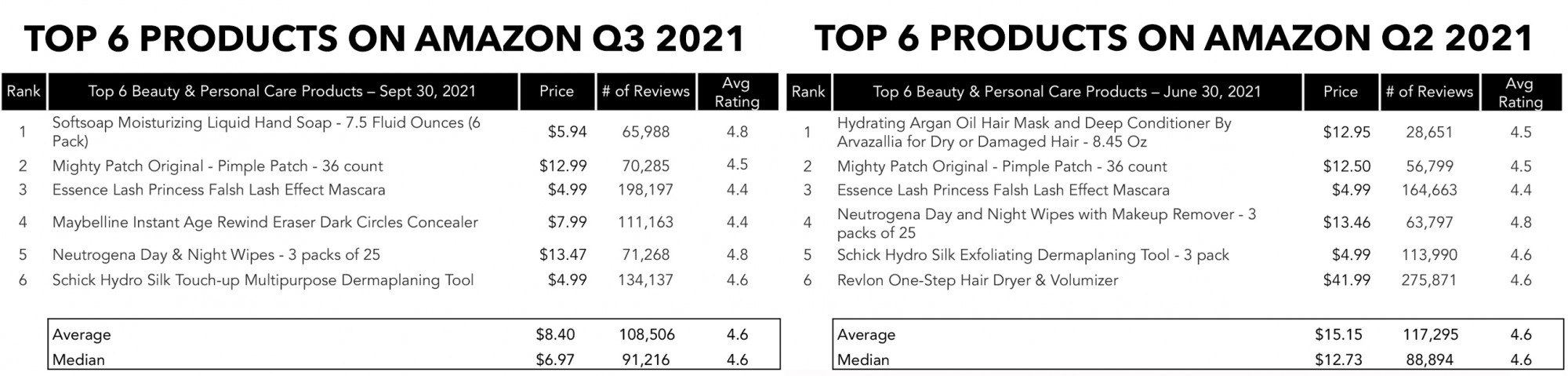

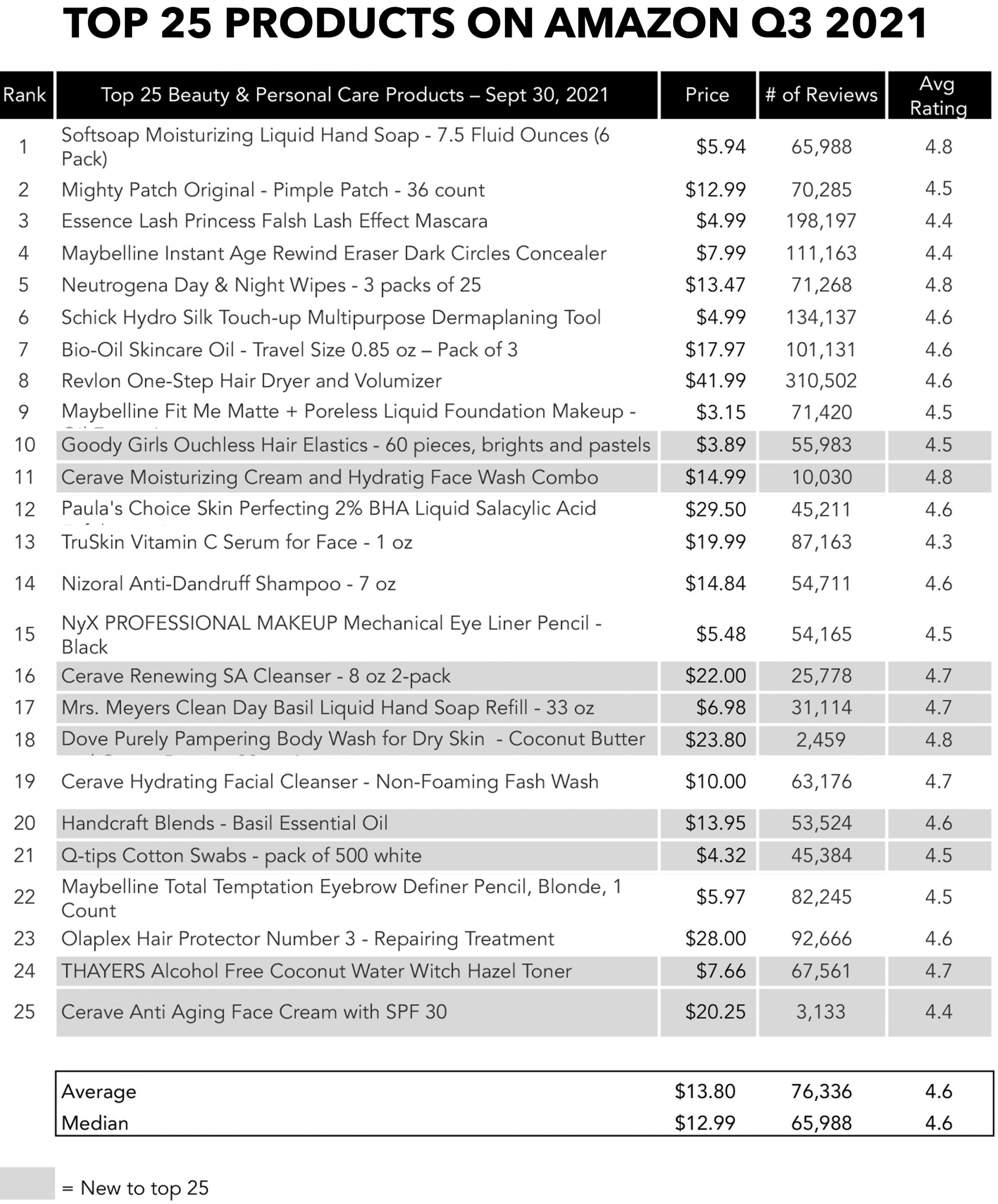

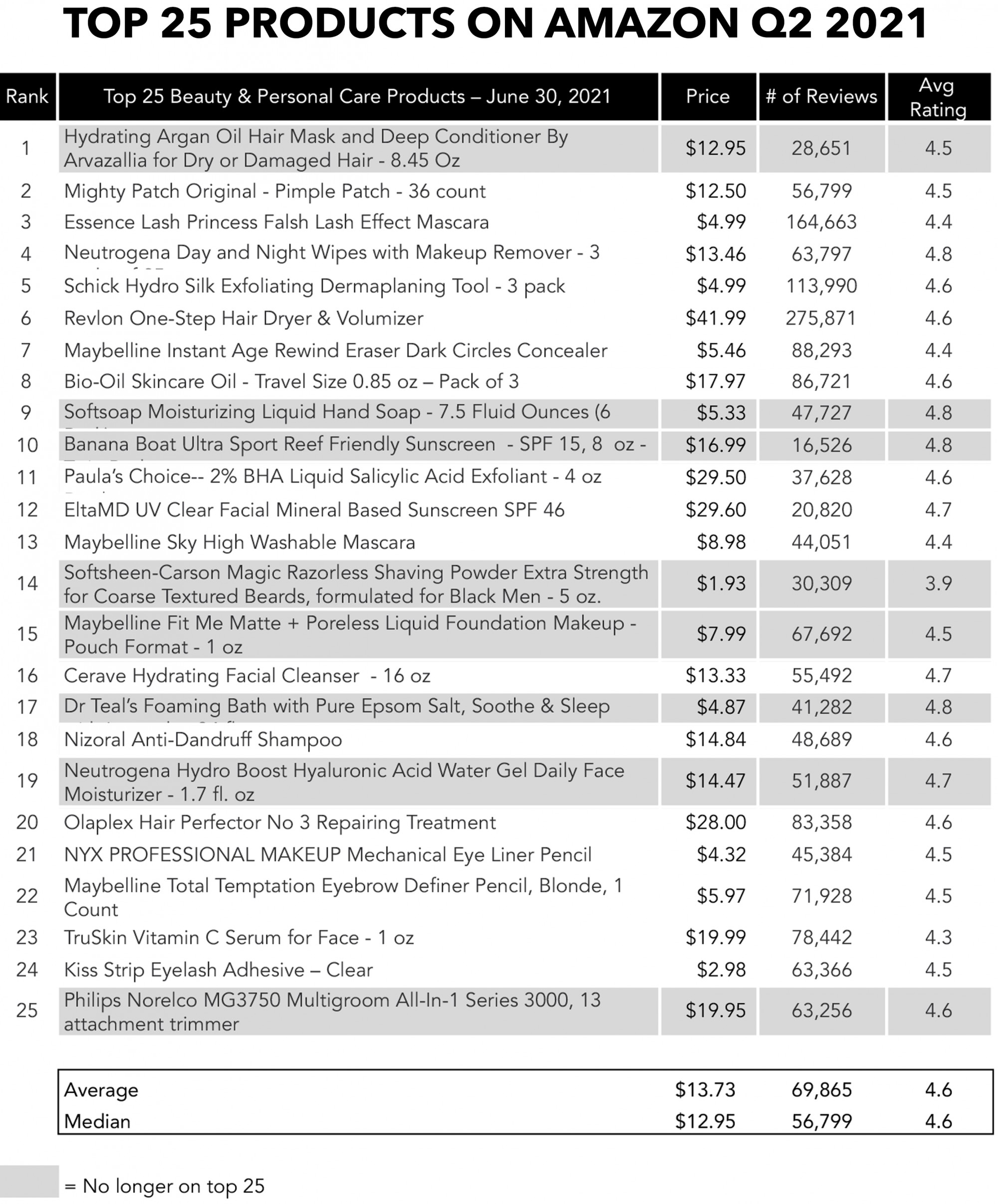

Softsoap Moisturizing Liquid Hand Soap was new to the Top 25 list in Q3, shooting up to the #1 position and unseating Hydrating Argan Oil Hair Mask and Deep Conditioner by Arvazallia for Dry or Damaged Hair, which fell off the list completely. Mighty Patch Original Pimple Patch maintained #2 after moving up in Q1 from the third spot. Maybelline Instant Age Rewind Eraser Dark Circles Concealer is new to the top 6, ranking fourth moving up from #7 last quarter.

Still heavily weighted with mass products, the average price point for the Top 25 increased slightly to $13.80 but still below $14.24, which we saw in Q1. CeraVe increases its hold on the Top 25 this quarter, increasing representation to 4 products from 3. CeraVe Moisturizing Cream and Hydrating Face Wash Combo and CeraVe Renewing SA Cleanser - 8 oz 2-pack and CeraVe Anti-Aging Face Cream with SPF 30 are new to the list, while CeraVe AM Moisturizing Facial Lotion and CeraVe Moisturizing Cream - Body and Face, which were new to the list in Q2, fell off the list this quarter.

On the prestige side, Mighty Patch Original Pimple Patch remains at #1, with Paula's Choice 2% BHA Liquid Salicylic Acid Exfoliant still in the center of the pack, dropping one position to #12. Olaplex Hair Perfector No 3 Repairing Treatment fell again in ranking this quarter to #23 from #20, while EltaMD UV Clear Facial Mineral Based Sunscreen SPF 46 fell out of the Top 25.

An interesting outlier this quarter is Handcraft Blends - Basil Essential Oil at #20 which can anecdotally be attributed to essential oils trending on TikTok.

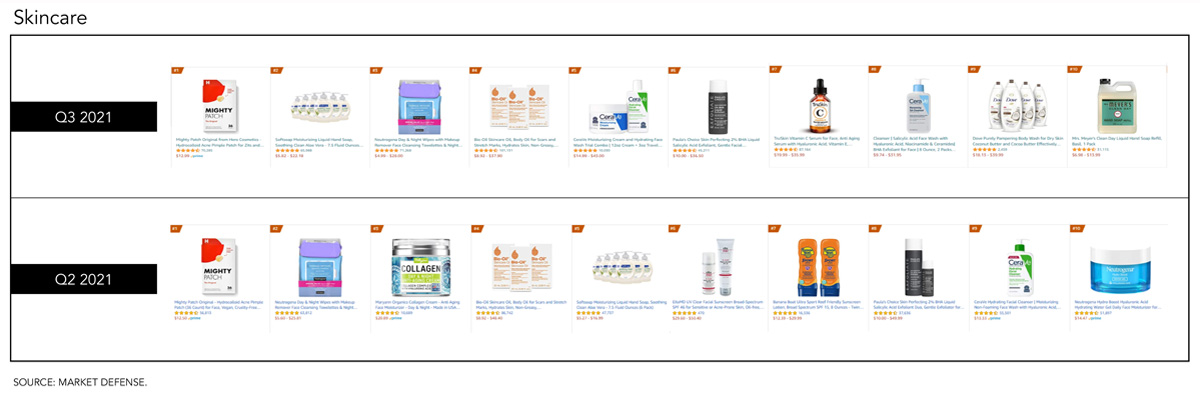

Mighty Patch Original Pimple Patch keeps its hold on the #1 position for the third quarter in a row. CeraVe increased representation from one product to three this quarter in the Skincare Top 10. Suncare dropped off the list entirely, indicating it’s still a seasonal purchase. Handcraft Blends - Basil Essential Oil also broke onto the skincare list at #10.

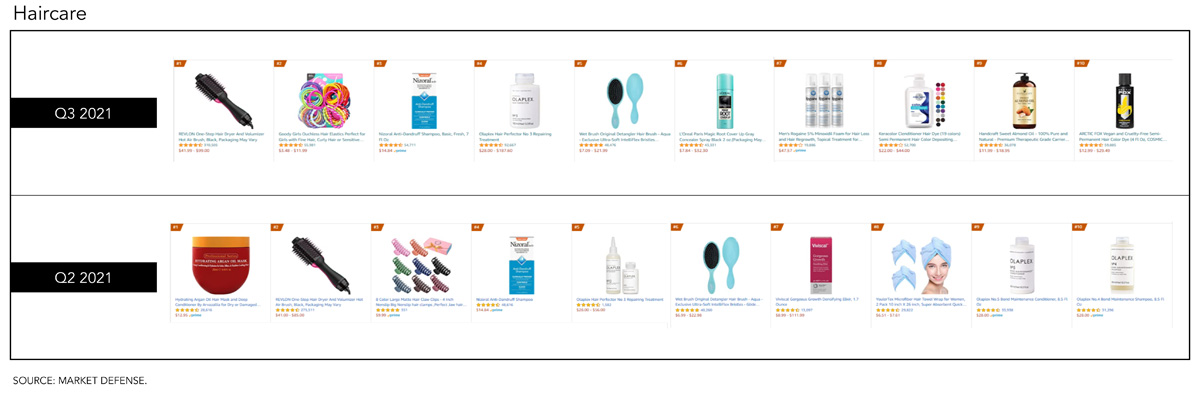

Revlon One-Step Hair Dryer and Volumizer keeps its hold on the #1 position for the third quarter in a row. Olaplex went from 3 products to 2 in the Haircare Top 10 with Olaplex Hair Perfector No3 Repairing Treatment. This quarter saw an increase in hair loss and at-home hair color products back on the list after falling off in Q2.

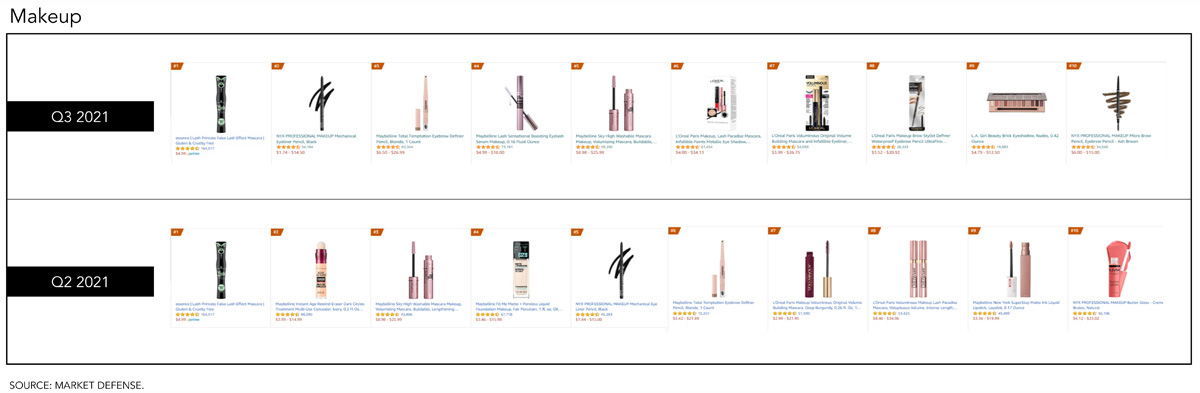

The Top 10 Makeup SKUs saw a return to an eye focus, including lash growth serum. Sephora favorite Grande Lash growth serum appeared in the Top 10 for the first time this year. The remaining Top 10 were eyeliner and mascara products, dominated by mass brands L’Oréal, Maybelline, and NYX.

As we head into the holiday home stretch, beauty will get an extra boost with Amazon’s first-ever Holiday Beauty Haul which started on October 4 with new deals dropping every week until October 24. The event is designed to kick-start the holiday shopping season and solidify Amazon’s place in the beauty retail ecosystem. The event will feature curated categories like Holiday Look, Winter Skin Care, Men's Grooming, Appliances, and Fragrances.

“We want to draw customers back to Amazon during Black Friday week but also long term with additional marketing levers,” Amazon wrote in the slide deck sent to select beauty brands about the event. “This is a unique opportunity for selected brands to reach both more shoppers and new customers.”

Reference: Q1 2021 Amazon Top 25 Beauty & Personal Care Q2 2021 Amazon Top 25 Beauty & Personal Care