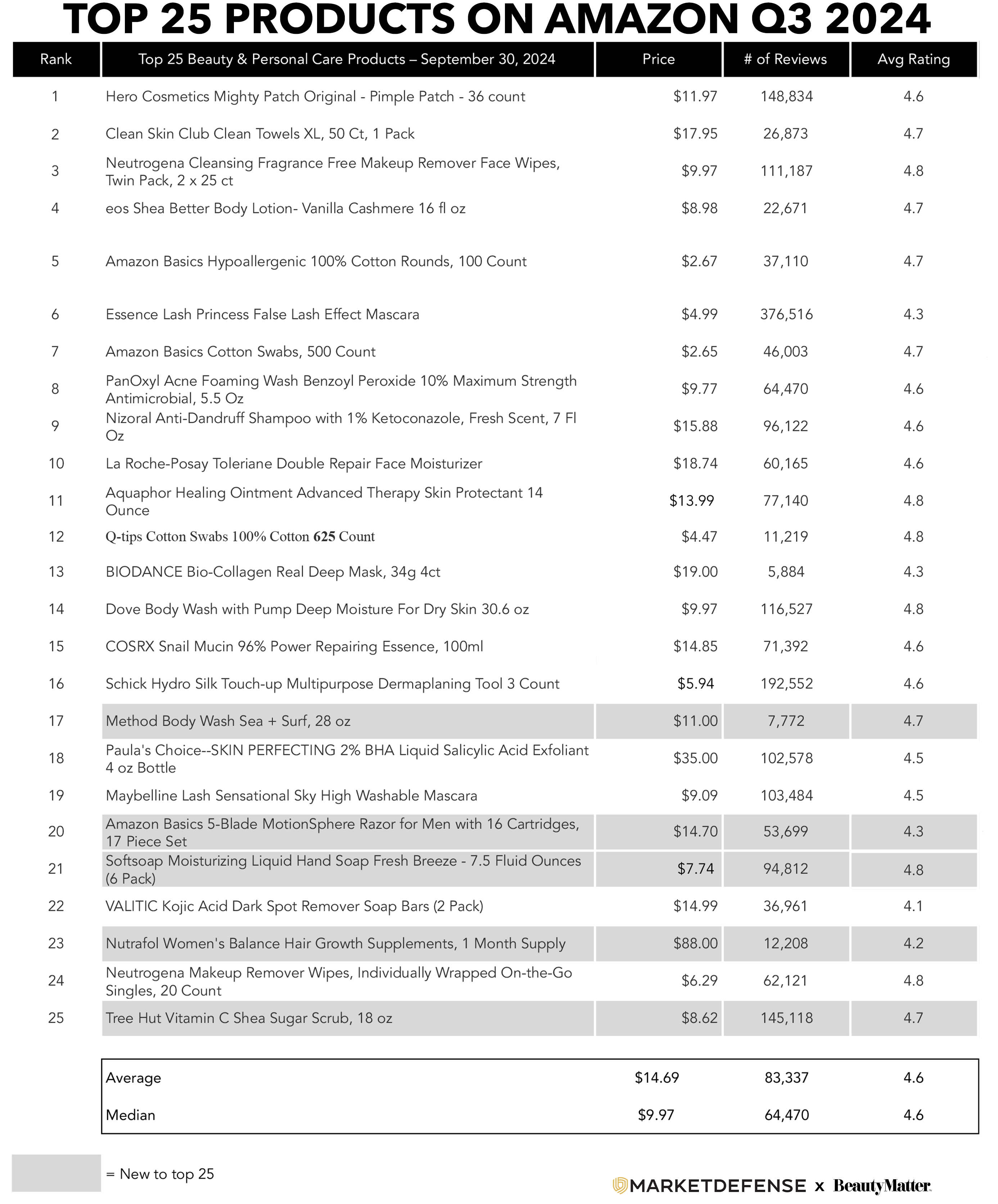

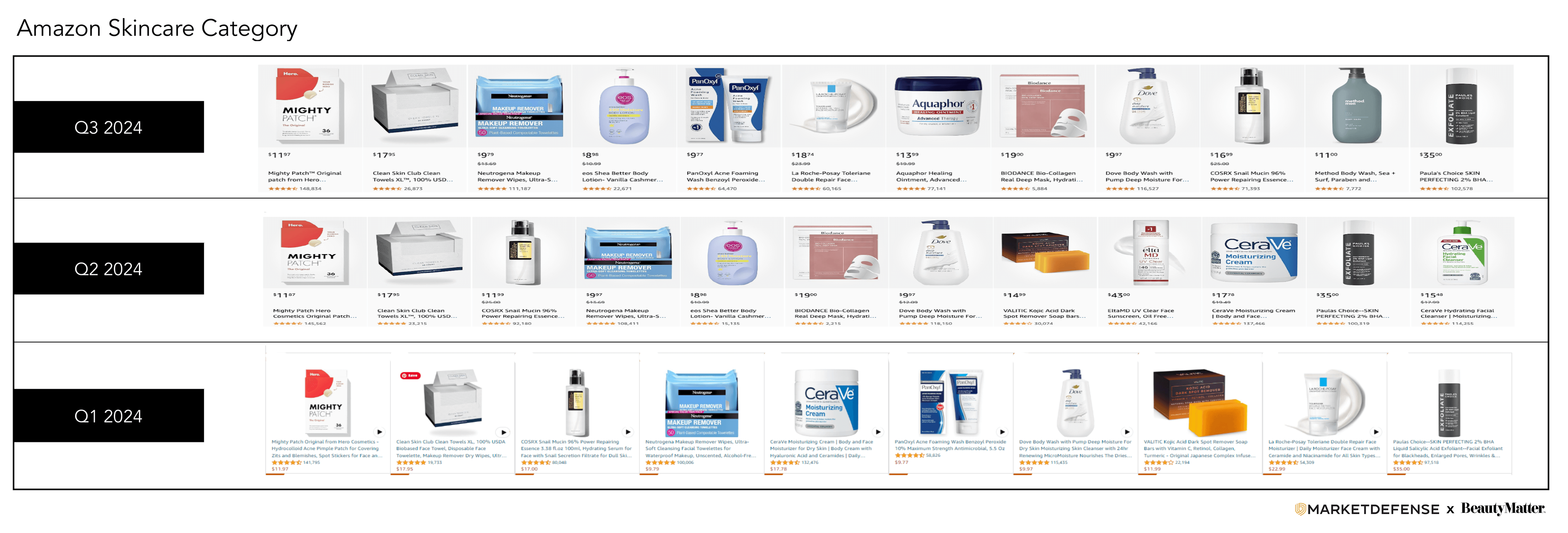

Leading the list of Amazon’s Top 25 Beauty & Personal Care products during Q3 2024 was Hero Cosmetics’ Mighty Patch pimple patches, continuing their reign as #1 since the beginning of 2024. Clean Skin Club Clean Towels XL was the #2 selling product, and Neutrogena’s Makeup Remover Facial Wipes rose two spots to #3. Coming in at #4 is eos Shea Butter Body Lotion in Vanilla Cashmere. AmazonBasics 100% Cotton Hypoallergenic Rounds in 100 count rounded out the top five.

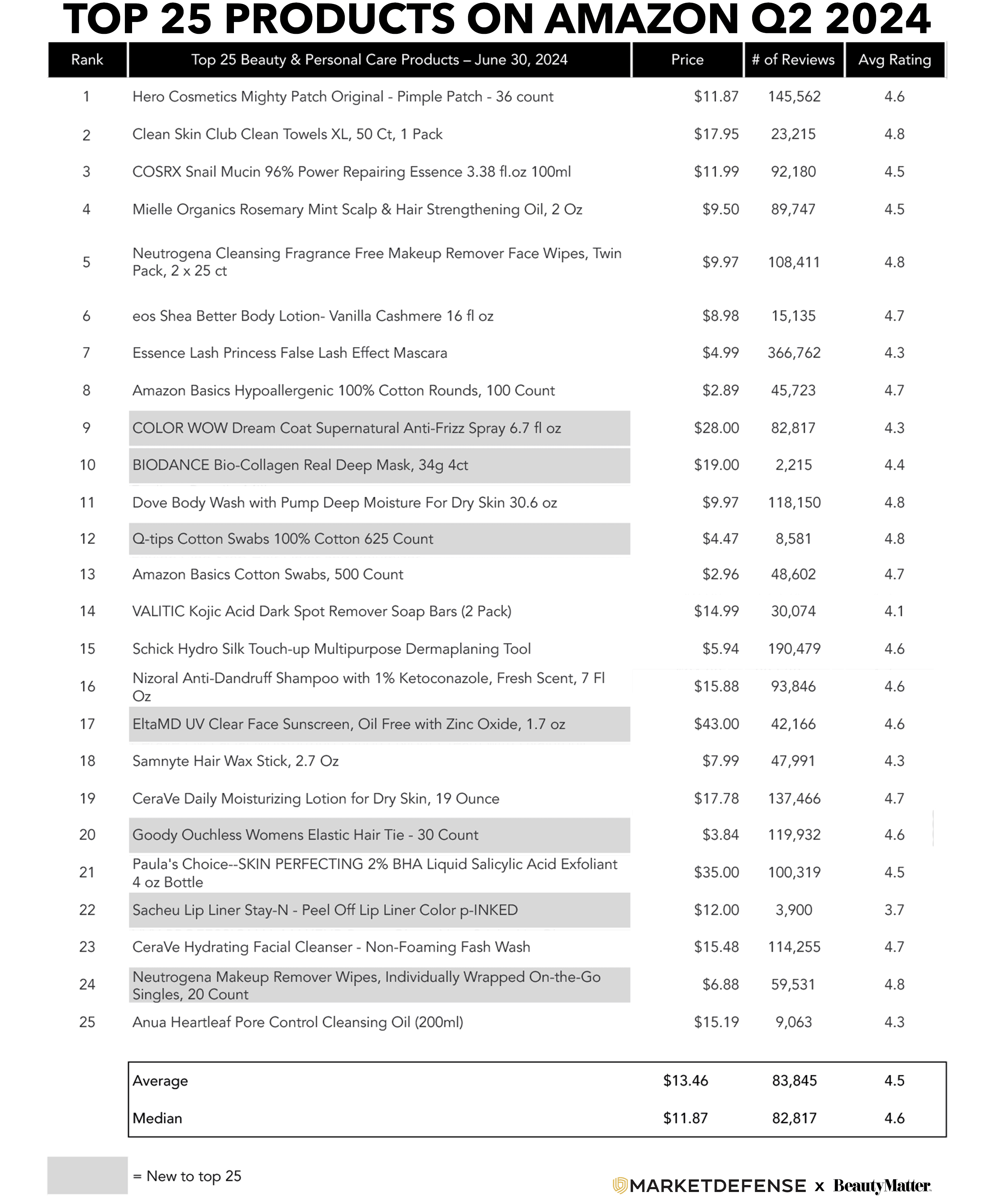

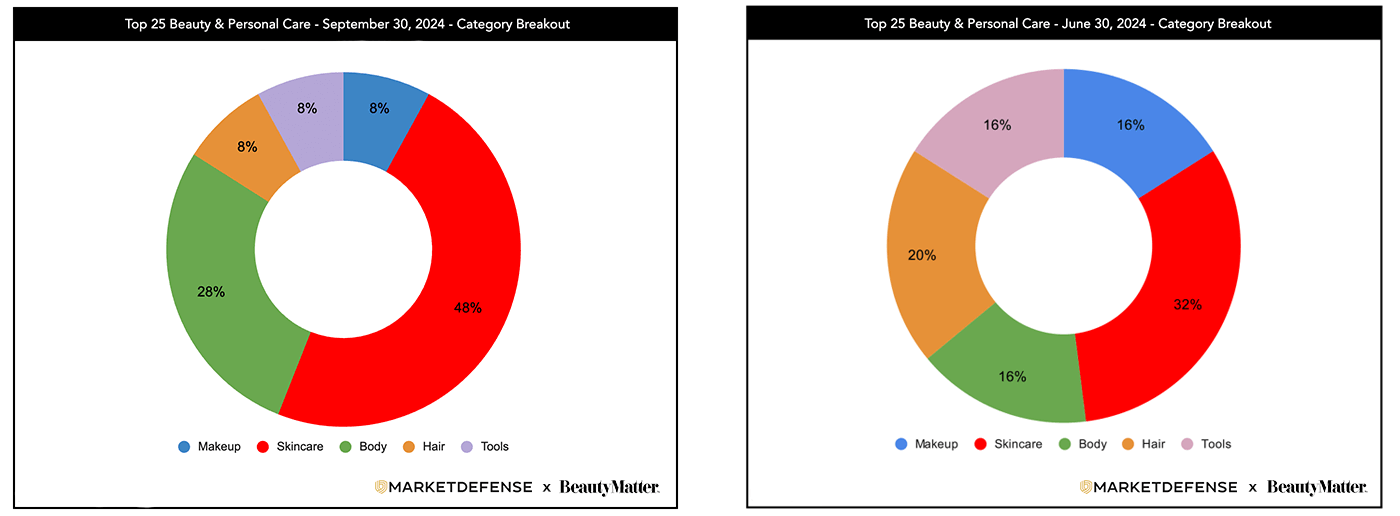

In a twist, several top sellers from earlier in 2024 dropped off the list this quarter, including Mielle Organics Rosemary Mint Scalp & Hair Strengthening Oil, which remains the #1 hair oil on Amazon, and COLOR WOW Dream Coat, which debuted at #9 last quarter. TikTok favorite Sacheu Stay-N-Peel Off Lip Liner also dropped off the list, as did the only sunscreen on the list last quarter, EltaMD UV Clear Facial Sunscreen.

Five products made their first appearance in the top 25 in Q3, with Method Body Wash in Sea & Surf debuting highest at #17. AmazonBasics 5-Blade MotionSphere Razor for Men was #20, followed by Softsoap Moisturizing Liquid Hand Soap in Fresh Breeze. Nutrafol Women’s Balance Hair Growth Supplements at #23 was the highest priced product on the Top 25 at $88. The remaining newcomer was Tree Hut Vitamin C Shea Sugar Scrub. Nutrafol (ranked as Amazon’s #1 hair regrowth treatment) helped to drive the average price of the top 25 list up by $1.23 from last quarter, to $14.69 in Q3.

Mass brands like Mighty Patch, eos, Neutrogena, PanOxyl, and Aquaphor made up the majority of the top sellers in the skincare category in Q3. Newcomer, Method Body Wash joined the top brands at #11. The average price point of the top skincare brands was $15.26, down about 15% from Q2.

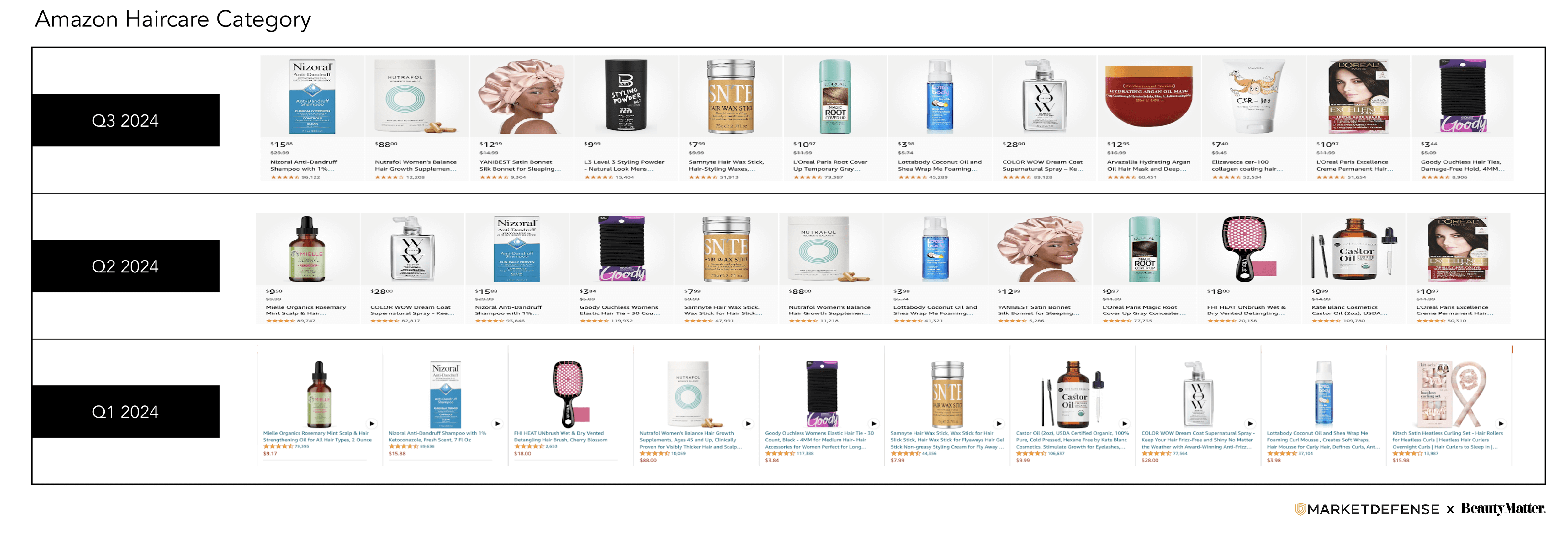

For the first time in 2024, Mielle’s Organics Rosemary Mint Scalp & Hair Strengthening Oil didn’t make the top haircare list, but mainstays like Nizoral Anti-Dandruff Shampoo, Samnyte Hair Wax Stick, and Lottabody Coconut Oil and Shea Wrap Me Foaming Curl Mousse held their spots at the top. Nutrafol’s Women’s Balance Hair Growth Supplements with an $88 price point was, by far, the most premium product on the top haircare products list. The top haircare average price point was $17.71 in Q3, a 3% decline from Q2.

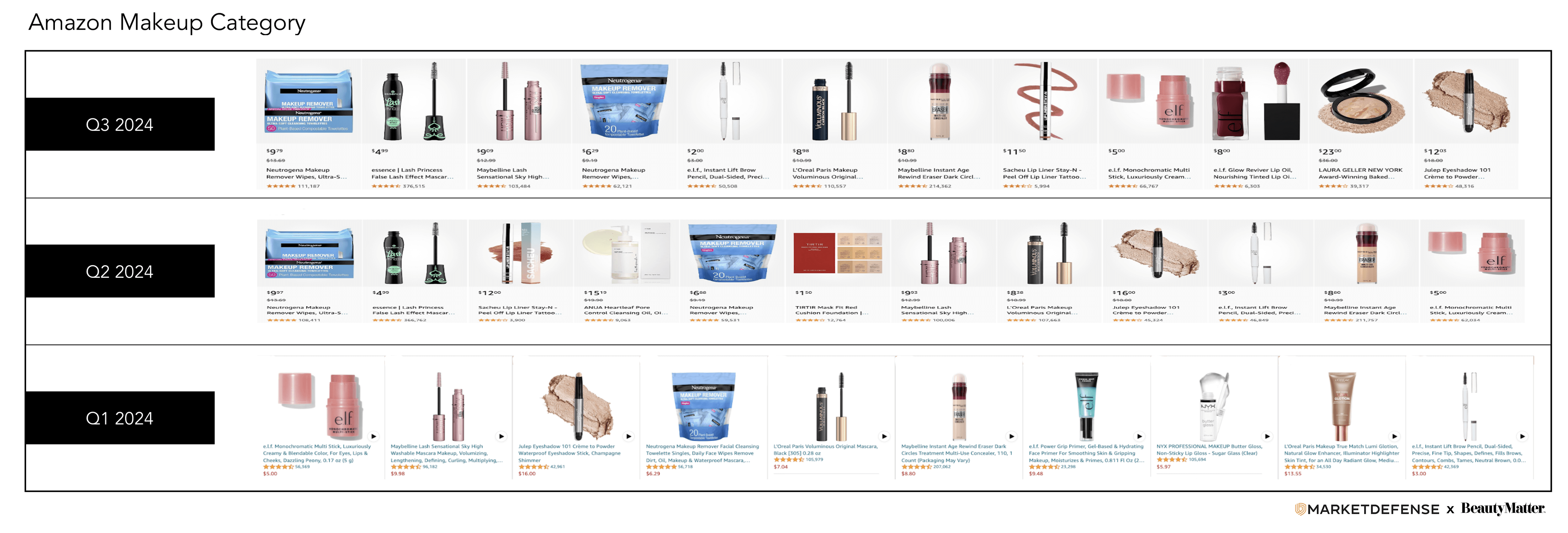

Mass mainstays from Maybelline, L’Oréal, Neutrogena, e.l.f., and Essence continued to rule the top makeup products list during Q3. The average price point of the top makeup products was $9.12, an 8% increase from Q2.

Interest in Hair Regrowth Treatments on Amazon has grown rapidly since late 2021, sparked by consumers looking for long-Covid hair loss solutions. In late 2022, Mielle Organics Rosemary Mint Scalp & Hair Strengthening Oil went viral on social media for the hair growth benefits of its leading ingredient, rosemary oil, leading to an unexpected surge in demand and driving it to be the #1 selling beauty product on Amazon for six straight months.

By early 2023, the hair growth market on Amazon had seen a 44% annual increase. Along with sales came competition: the number of hair growth products increased by 19% and the number of brands competing in this category grew by 21%. By 2024, the growth in products formulated to address hair loss exceeded the growth of the total haircare category on Amazon. “Haircare is seeing single-digit growth this year, but hair loss products are in a league of their own, surging ahead with an impressive 40%+ growth rate. This subcategory is rapidly outpacing the broader haircare market on Amazon, proving that demand for targeted hair growth solutions is stronger than ever,” stated Vanessa Kuykendall, Chief Engagement Officer at Market Defense, a global marketplace solutions agency that grows brands on Amazon, Walmart, and Mercado Libre.

On Amazon, 65%+ of the market share of hair loss treatments are owned by five brands: Nutrafol, Rogaine, Viviscal, Kirkland, and Nioxin. “Ingredients like Minoxidil, biotin, and keratin remain top draws, but we’re also seeing a surge in demand for rice water, batana oil, and essential oils. There’s a clear shift towards clean and natural formulations, with shoppers increasingly looking for vegan and cruelty-free options that align with their values,” Kuykendall said.

Price points vary widely, but there’s a strong pull towards premium offerings, especially those marketed with clinical backing or natural ingredients. Budget-friendly options still make waves, but it’s evident that many consumers are willing to splurge for products they perceive as more effective. While the average price of the top five brands is $71.78, up and coming brands like Advance Trichology, MaryRuth Organics, and Hims & Hers are offering competing hair loss treatments for under $40.

How do newcomers to the category compete with such huge names? "Competing with established brands like Nutrafol and Rogaine in the highly competitive hair loss treatments category requires a focused, strategic approach that leverages your brand and product’s unique strengths,” states Dave Karlsven, SVP of Data Science and Advertising at Market Defense.

Here are a few tips from Karlsven that smaller brands can use to compete against larger brands, carve out more market share, and build a loyal customer base:

Identify and Focus on Your Top Converting, Niche Keywords with Exact Match, Single ASIN Campaigns: "Focus your optimizations and driving sales velocity on your top performing keywords with your top converting products. Niche keywords that highlight solutions specifically designed for women, vegan formulations, or products catering to different hair types and ethnicities. Specializing allows you to become the go-to brand for a specific audience or unique solution to the problem."

Innovate with Unique Ingredients or Delivery Methods: "Differentiate your products by incorporating innovative or natural ingredients or unique delivery methods (for example: yummy tasting gummy supplements rather than yucky pills) that are not commonly used by larger brands. This could attract consumers looking for alternative solutions."

Leverage Digital Marketing and Social Media: "Utilize social media platforms like TikTok and Instagram and influencer partnerships to build brand awareness. Engaging content and collaborations can help you reach a wider audience and effectively sell your product to new customers without the hefty marketing budgets of big corporations."

Focus on Product/Solution Quality and Leverage Testimonials "Ensure your products are of high quality and easily attract positive reviews and testimonials from satisfied customers. Positive feedback can significantly influence potential buyers, so leverage good testimonials in your product sales videos and other places people are becoming aware of your products both on and off Amazon."

What is on the horizon for Hair Loss Treatments on Amazon? Here are some key takeaways from Kuykendall:

Innovations and Emerging Trends: “Exciting trends are emerging, like hair growth devices, personalized treatments, and supplements that target overall hair and scalp health. Devices like laser therapy caps and supplements infused with adaptogens are gaining attention as consumers seek holistic solutions to hair loss.”

Seasonal Trends and Future Forecasts: “As we head into fall, we anticipate a spike in hair growth treatments as consumers prepare for seasonal shedding. Looking forward, we expect customized treatments and natural, clinical-grade ingredients to drive the next wave of innovation in hair growth.”

Brand Strategies that Stand Out: “Top brands are differentiating themselves through innovative packaging, subscription models, and unique ingredient blends that mirror a custom prescription. For brands entering this space, it’s an opportunity to elevate their profile and stand out from the crowd.”

Previous Reports:

Q2 2024 Amazon Top 25 Beauty & Personal Care

Q1 2024 Amazon Top 25 Beauty & Personal Care

Q4 2023 Amazon Top 25 Beauty & Personal Care