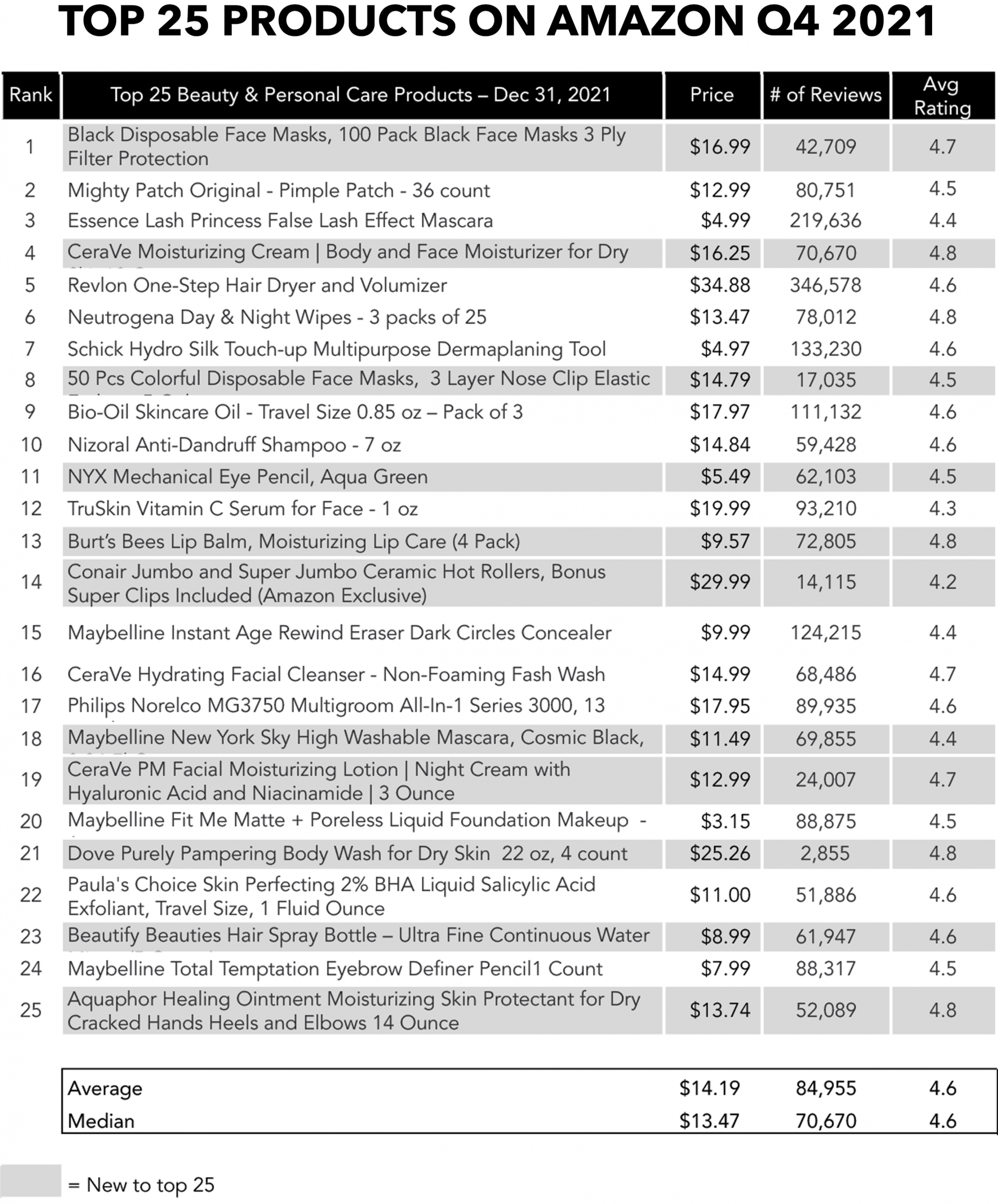

Health and wellness have been a top priority for consumers during the pandemic, and the late 2021 Omicron surge saw consumers return to more cautious behavior. Purchases of face masks in large quantities jumped into the top 25, driving packs of masks to #1 and #8. Disposable face mask sales have not appeared in Amazon’s Personal Care Top 25 since 2020, where they owned several top spots throughout the year. Two years into the pandemic, consumers opted for CDC recommended 3-ply masks in Q4, but they’ve also eschewed the look of traditional, blue surgical masks in favor of more fashionable black (#1) and colorful masks (#8)—an indication that masks are a way of life, but also an essential fashion accessory.

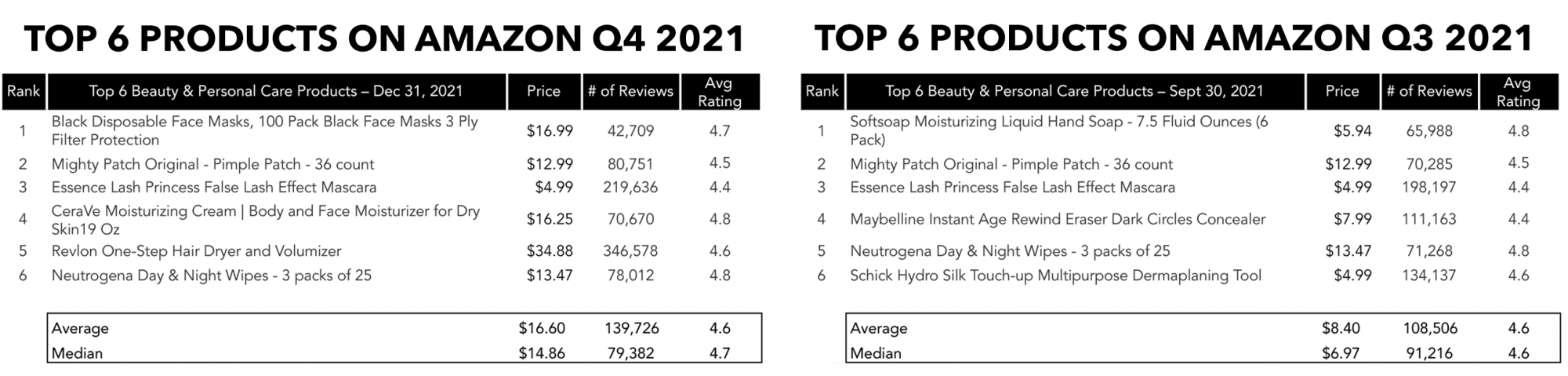

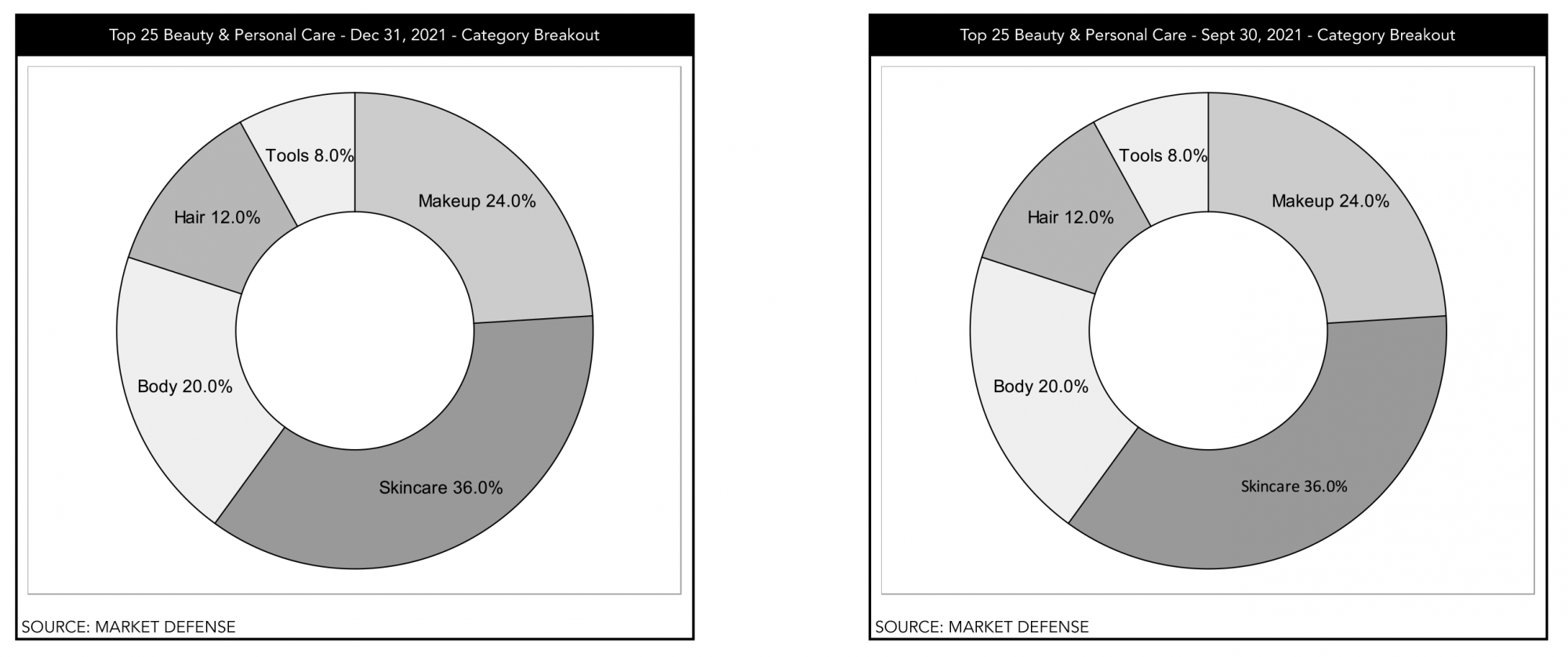

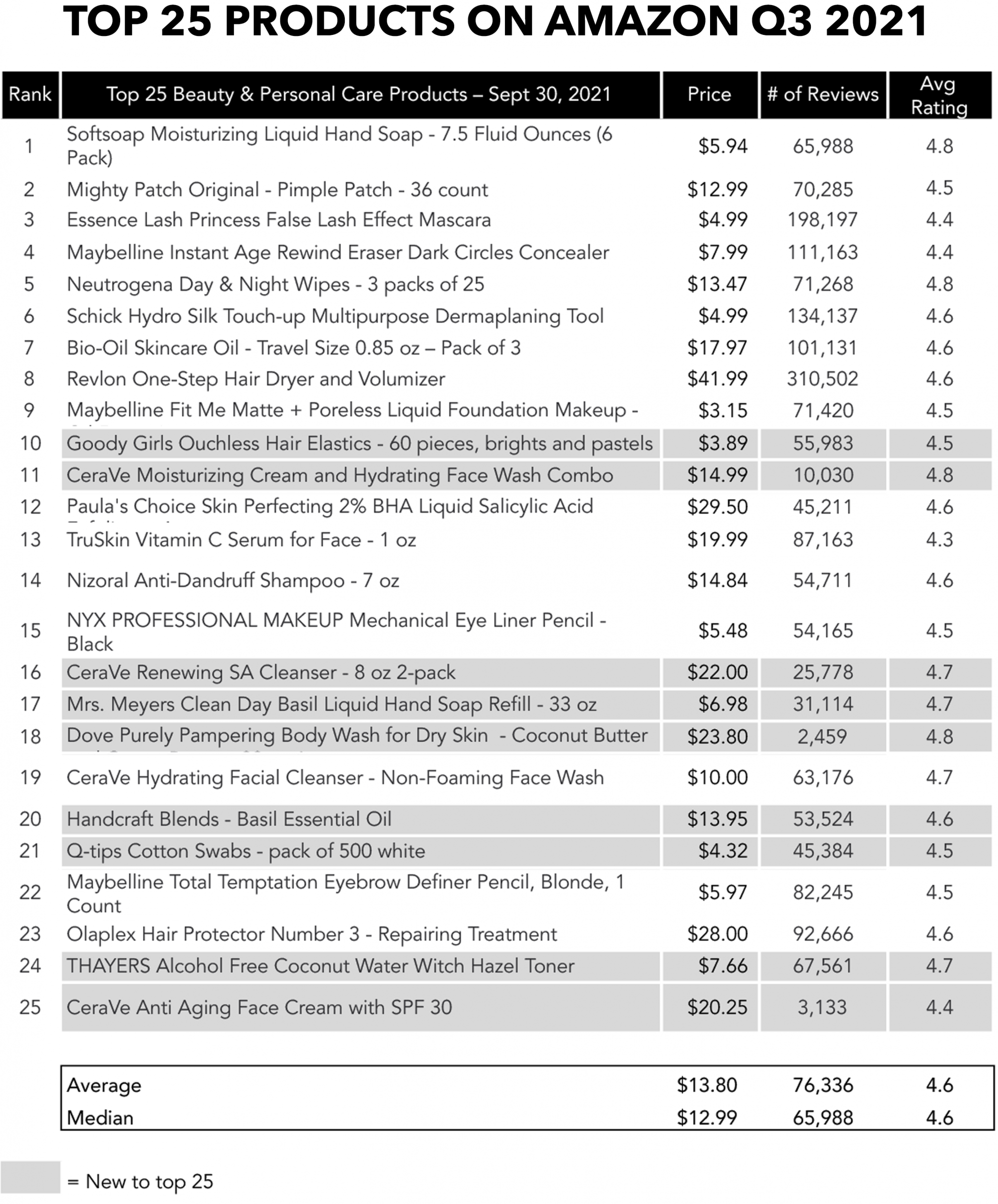

Maybelline and CeraVe dominated Amazon’s Top 25 throughout 2021, with new products on the list in every quarter. In Q4 2021, new products include Maybelline’s Sky High Washable Mascara, and CeraVe’s Moisturizing Body and Face Cream (for dry skin, a reflection of the winter weather taking hold in most of the US) and their PM Facial Moisturizing Lotion. Other newbies to the list in body care included mass legends like Burt’s Bees Lip Balm and Aquaphor Ointment. These legacy products average more than 96,000 reviews and a 4.6 rating. Body as a category fell slightly from last quarter, comprising 16% of Amazon’s Top 25 list in Q4 from 20% in Q3; Hair, Makeup and Tools showed growth, comprising 16%, 16%, and 24%, respectively in Q4. Growth in Hair, Makeup and Tools was likely the result of the consumer getting out more and preparing for holiday gatherings with friends and family, although the rise of Omicron late in the quarter likely put a damper on Q4 growth in these categories. The average price point of Top 25 products during Q4 increased by 2.8% from Q3 to $14.19 and the average price point of the Top 6 products nearly doubled, an indication of the consumer’s willingness to invest in beauty and the overall resilience of the category.

In Q4, consumers continued to use quarantine and work-from-home to experiment with their personal look. Social media, in particular TikTok, was a huge inspiration for this experimentation, and drove sales on Amazon. New to the Top 25 in Q4 was the NYX Mechanical Eye Pencil in aqua green (#11), Conair Jumbo and Super Jumbo Ceramic Hot Rollers (#14), and Sky High Washable Mascara in cosmic from Maybelline (#18). The search term “Green Eyeliner” was up 30% on Amazon, possibly driven by the over 3.6 million views on TikTok for this hashtag. TikTok’s #HairTok (with 10.6 billion views) drove an uptick in #HeatlessCurls (with 872.8 million views). These styles encourage misting the hair to a slightly damp state, which likely drove the Beautify Beauties Hair Spray Bottle (#23) onto the Top 25 list for the first time.

When shopping on Amazon, 79% of consumers are influenced by products with the best ratings and reviews. But industry experts say only around 0.5 percent to 3 percent of customers typically provide a review or rating for products bought online. Growing reviews is especially important when launching a new product; potential customers may be wary of purchasing a product with a strong rating if there are too few reviews to back it up. So, brands have had to make generating positive reviews on Amazon a priority and are taking advantage of native Amazon programs like the Vine Program, that enables brands to enroll products to be sent to up to 30 reviewers to get the conversation started and generate a critical mass of reviews for new product launches. Brands have also been using third-party automated email responders and product inserts to drive reviews. While Amazon has strict rules about asking for a five-star review or incentivizing reviews with financial rewards, brands can incentivize people to join their email lists or to follow them on social media to help drive engagement and encourage a positive review.

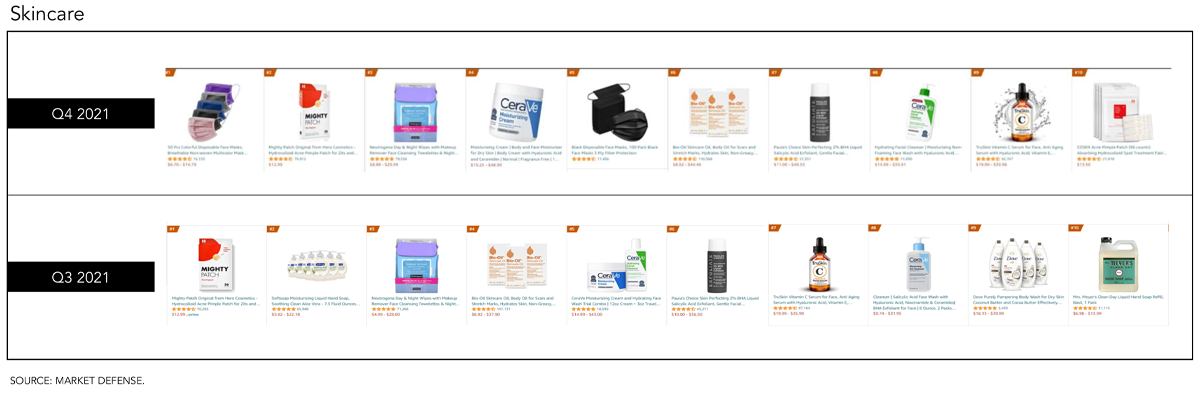

The Top 10 skincare SKUs during Q4 were heavily weighted toward mass and masstige brands, with perennial favorites CeraVe, Neutrogena, and Bio-Oil dominating the category. Acne patches remain a top performer, with Mighty Patch taking the number two spot (second only to face masks) and COSRX rounding out the category at number ten.

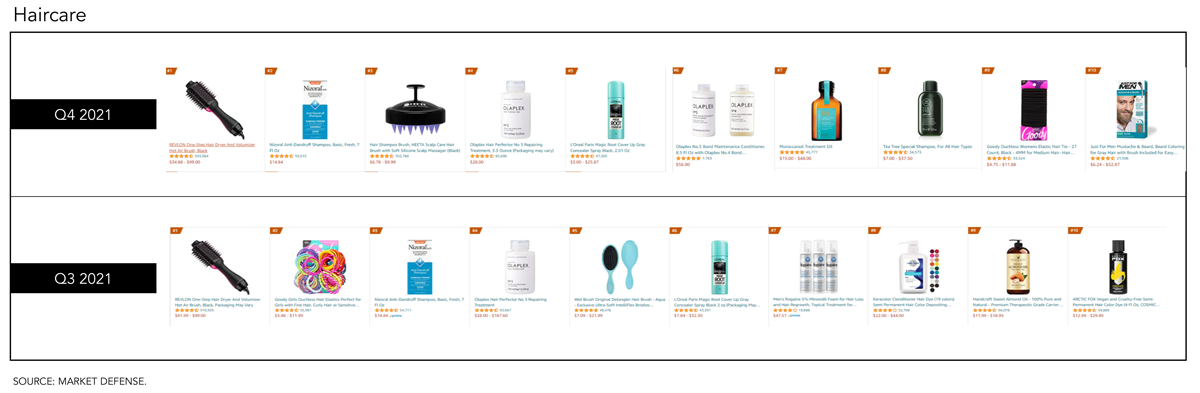

Revlon One-Step Hair Dryer and Volumizer kept its hold on the #1 position for the second quarter in a row. Olaplex went from a single product in the Top 10 in Q3 to three products in Q4. Elastic hair ties remained a top product in the category, and Just For Men Mustache and Beard Color joined the list as the only product specifically targeting men making an appearance in all of 2021.

The Top 10 makeup products continued to be dominated by eye and lash products, with mass brands like Maybelline and L’Oréal owning much of the category. Maybelline’s Fit Me Matte + Poreless Liquid Foundation and Instant Age Rewind Eraser Dark Circles Treatment Concealer returned to the list for the first time since early 2021.

From within the Market Defense brand portfolio, skincare products were the heroes of Q4, with richer moisturizers, acne patches, and high-tech beauty devices like the Dr. Dennis Gross Spectralite Faceware Mask leading the category. The fastest-growing category within skincare was beauty ingestibles, growing 89% from last year and led by supplements focused on acne. As consumers return to mask wearing, solutions focused on the dreaded “mask-ne” issue will likely continue to be top sellers.

Q4 was a great quarter for Fragrance, with the category showing the fastest growth across the Market Defense portfolio and tripling from Q4 2020. Individual fragrances were the sales leaders from both new launches like Lavanila’s new The Healthy Fragrance Vanilla Sugarcane perfume and Tocca’s Guiletta EDP. Hair Care brands saw a moderate increase over last year in Q4, with deep conditioners and hair masks leading the way. Products like Philip B’s Russian Amber Imperial Gold Masque was a top performer as customers sought products to help defend against winter weather’s effects on their hair and scalp.

Looking ahead into early 2022, we’re already continuing to see innovation around products that blur the lines between skincare and makeup, with new products like serum-infused primers and tinted undereye moisturizers launching on Amazon from Market Defense portfolio brands this year. Our data tells us that the Amazon customer wants to simplify their routine and is shopping for multiuse products that are both healthy for them and are solution oriented. In our incubation agency The Growth Atlas, we’re seeing the most growth from science-backed beauty brands, with sustainability and transparency as core values. Our marketing teams are focused on telling their unique stories with detailed content and working with these brands on their off-channel strategy to drive traffic to Amazon. These brands are not being shy about selling on Amazon; we are aligning them with micro-influencers who share similar values and audiences, and they are engaging on social with incentives to shop Amazon. In 2022, the biggest opportunity to grow your Amazon Seller business requires you to include Amazon in your DTC strategy and make it a prominent part of your social content.

Reference: Q1 2021 Amazon Top 25 Beauty & Personal Care Q2 2021 Amazon Top 25 Beauty & Personal Care Q3 2021 Amazon Top 25 Beauty & Personal Care

For more information Click Here