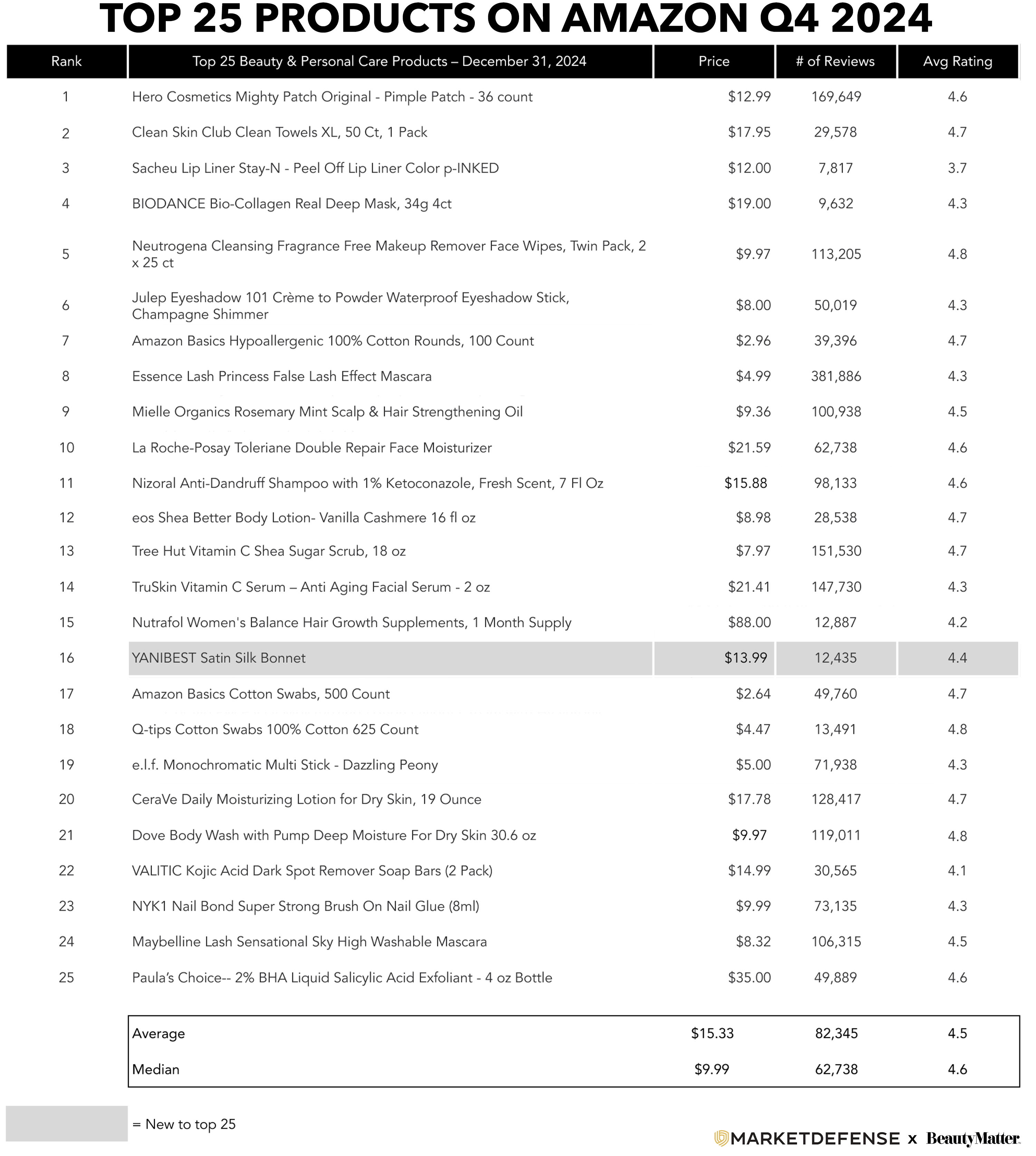

Hero Cosmetics’ Mighty Patch Original continued its streak as the #1 top-selling Beauty & Personal Care product on Amazon for Q4 2024, followed by Clean Skin Club Clean Towels XL at #2. Sacheu’s Stay-N Peel Off Lip Liner returned to the list at #3, marking its reappearance after dropping off in Q3. BIODANCE Bio-Collagen Real Deep Mask ranked at #4, with Neutrogena’s Cleansing Fragrance-Free Makeup Remover Face Wipes completing the quarter’s top five at #5.

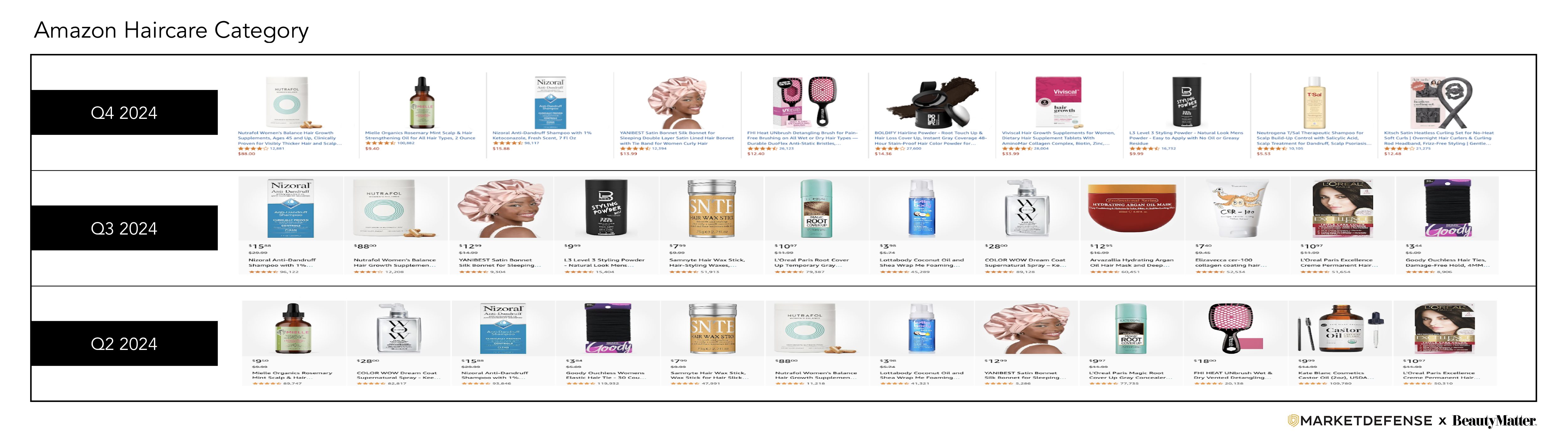

Mielle Organics Rosemary Mint Scalp & Hair Strengthening Oil also reappeared on the list this quarter, securing the #9 position after being absent in Q3. The only new entrant to the top 25 was the YANIBEST Satin Silk Bonnet, which debuted at #16.

Several other products continued to appear on the list, including Amazon Basics Hypoallergenic Cotton Rounds at #7, eos Shea Better Body Lotion in Vanilla Cashmere at #12, and Dove Body Wash with Pump at #21.

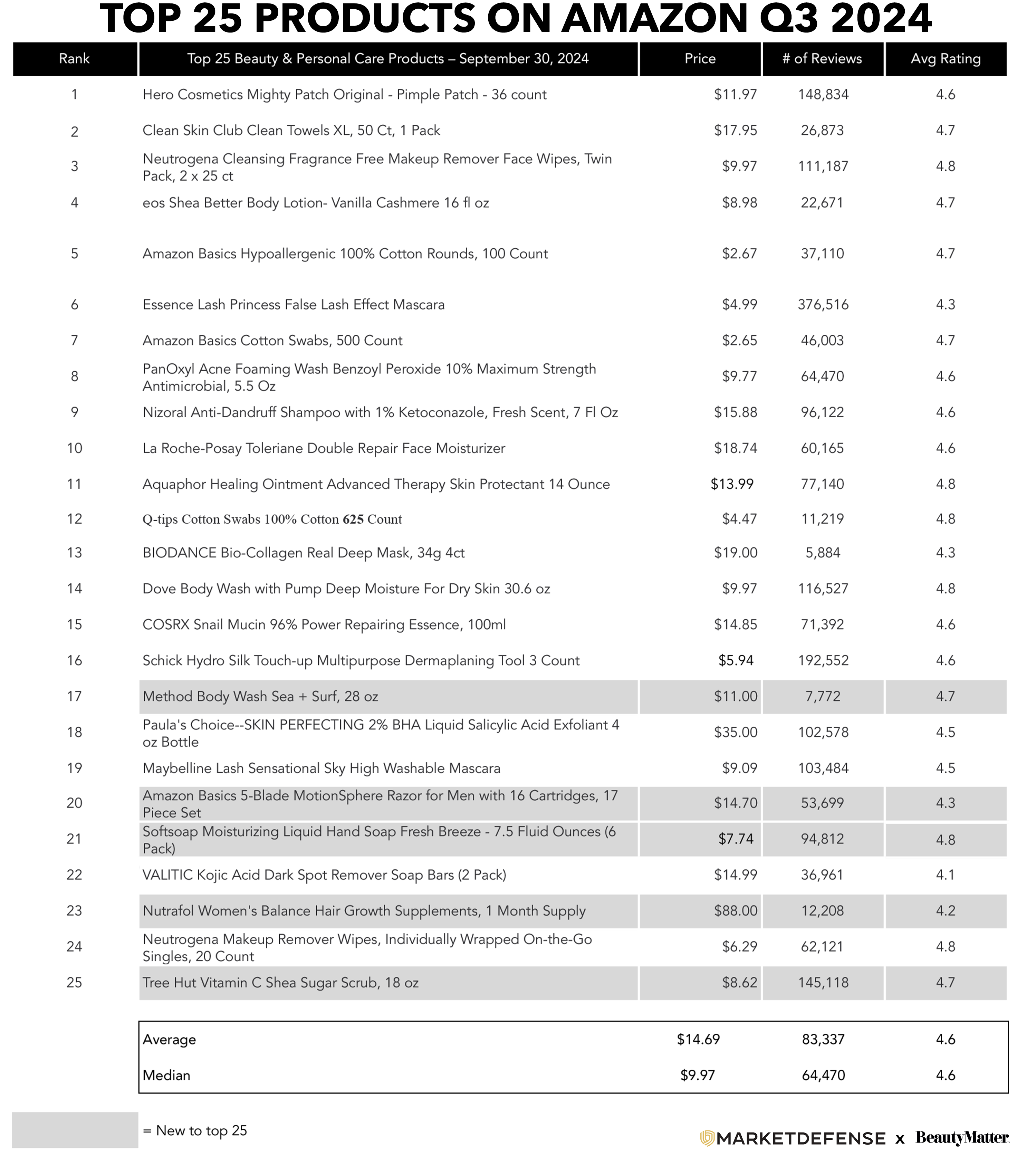

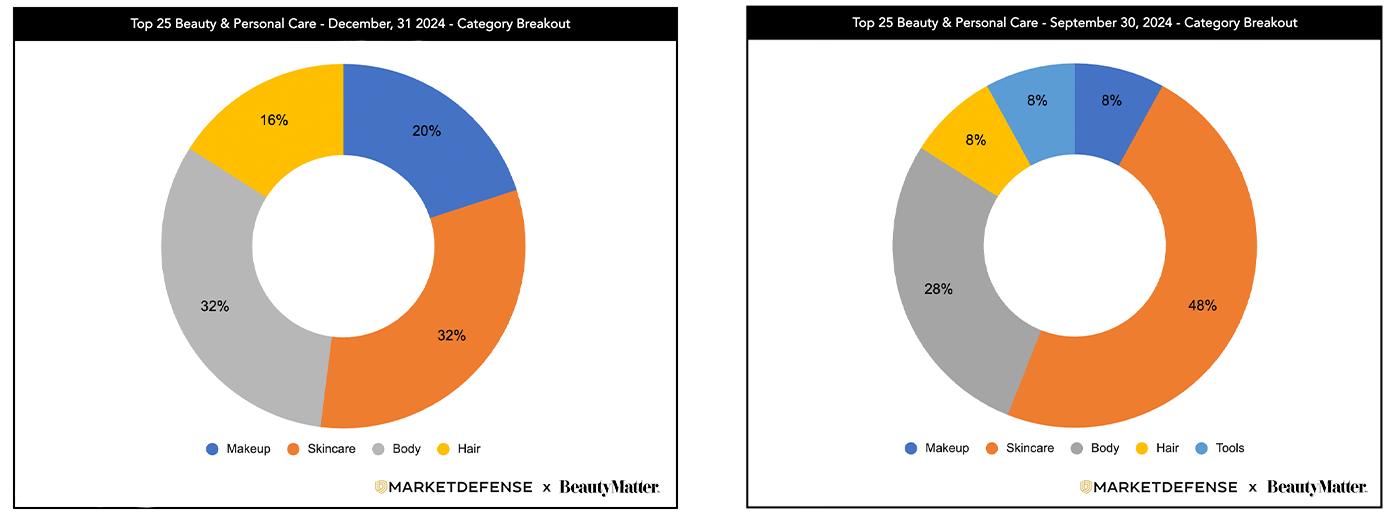

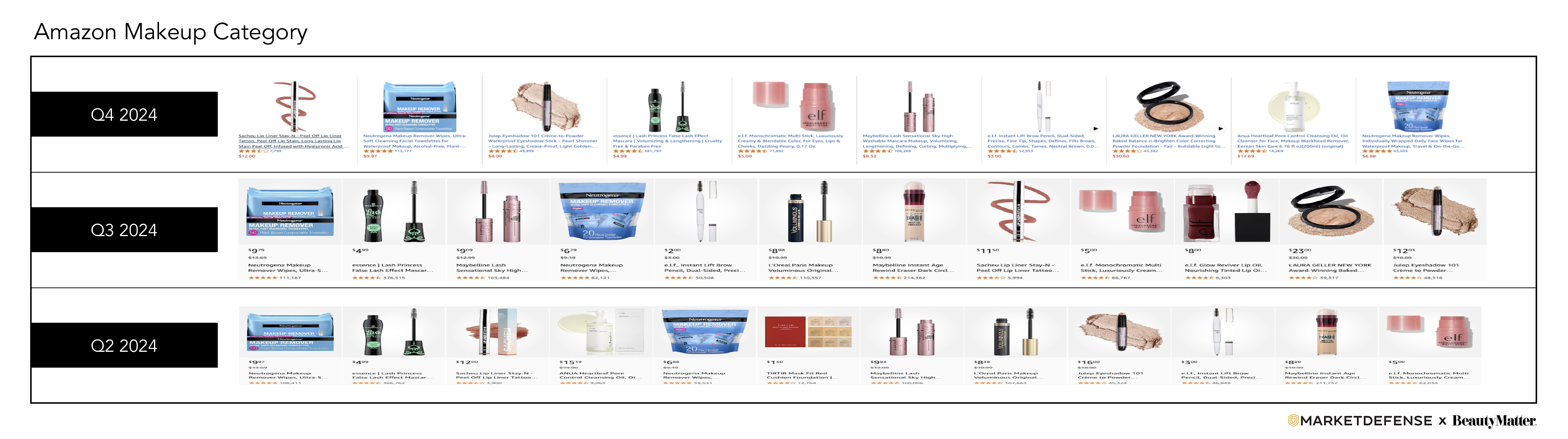

The skincare and body categories continued to dominate the top 25, with the two combined making up 64% of the list. The skincare category ceded some share to makeup and hair, which both saw an increase versus Q3. Interestingly, there were no tools represented in the top 25 in Q4. The average price point of the products on the top 25 list increased 4% from Q3 to $15.33.

In Q4, beauty brands selling on Amazon faced rising advertising costs, requiring them to be more resourceful with their investments. The holiday season saw a surge in consumer activity as shoppers were looking for gifts, deals, and seasonal products. To capitalize on this heightened demand, more brands were competing for the same ad placements, driving up CPCs through Amazon’s auction-based system. Many brands allocate a significant portion of their annual advertising budgets to Q4, and this influx of ad spend intensifies competition and leads to higher CPCs.

Brands were also focused on driving external traffic to their Amazon listings to boost organic rankings, which ultimately helped reduce their reliance on paid ads. Top-performing brands in their categories understood the importance of diversifying their traffic sources, leveraging social media and influencers to amplify visibility and direct consumers to Amazon. K-beauty brands provide an excellent example, using TikTok to create viral moments and build awareness. With 72% of K-beauty consumers influenced by recommendations from influencers and a strong preference for online shopping over physical stores, these brands have effectively prioritized investments in digital channels to capture demand and drive growth.

How should beauty brands approach Amazon advertising budgets in 2025? Dave Karlsven, SVP of Data Science and Advertising at Market Defense, offers expert insights into strategic budget planning for beauty brands navigating the Amazon ecosystem in the year ahead:

On Planning Ad Budgets for the Year Ahead:

"Brands should think beyond seasonal spikes and plan a more holistic, year-round approach. Budgeting for 2025 means anticipating higher ad costs, allocating funds for testing new ad formats (like Amazon Live or Sponsored Display), and building flexibility into the budget to capitalize on emerging channels like TikTok. The best approach is scenario planning—create tiers of spend, track performance closely, and be ready to shift dollars to what’s driving the best returns. Marketing budgets need to be as dynamic as the digital landscape itself."

On Rising CPCs and the Outlook for 2025:

"As the advertising ecosystem becomes increasingly competitive, CPCs are likely to continue their upward trajectory, especially for high-intent keywords in the beauty space. Brands will need to optimize aggressively, focusing on highly searched, long-tail keywords, expanding out ad types (for example: sponsored brand video ads) to get lower CPCs on the top keywords, and leveraging Amazon’s or third- party automation tools to stay cost-efficient. The brands that can navigate these higher CPC waters by investing in better creative, refining their product pages, and building a stronger organic presence will still come out ahead because they will have higher conversion rates and lower TACOS rates that allow them to be more aggressive with advertising while still being profitable."

Previous Reports:

Q3 2024 Amazon Top 25 Beauty & Personal Care

Q2 2024 Amazon Top 25 Beauty & Personal Care

Q1 2024 Amazon Top 25 Beauty & Personal Care