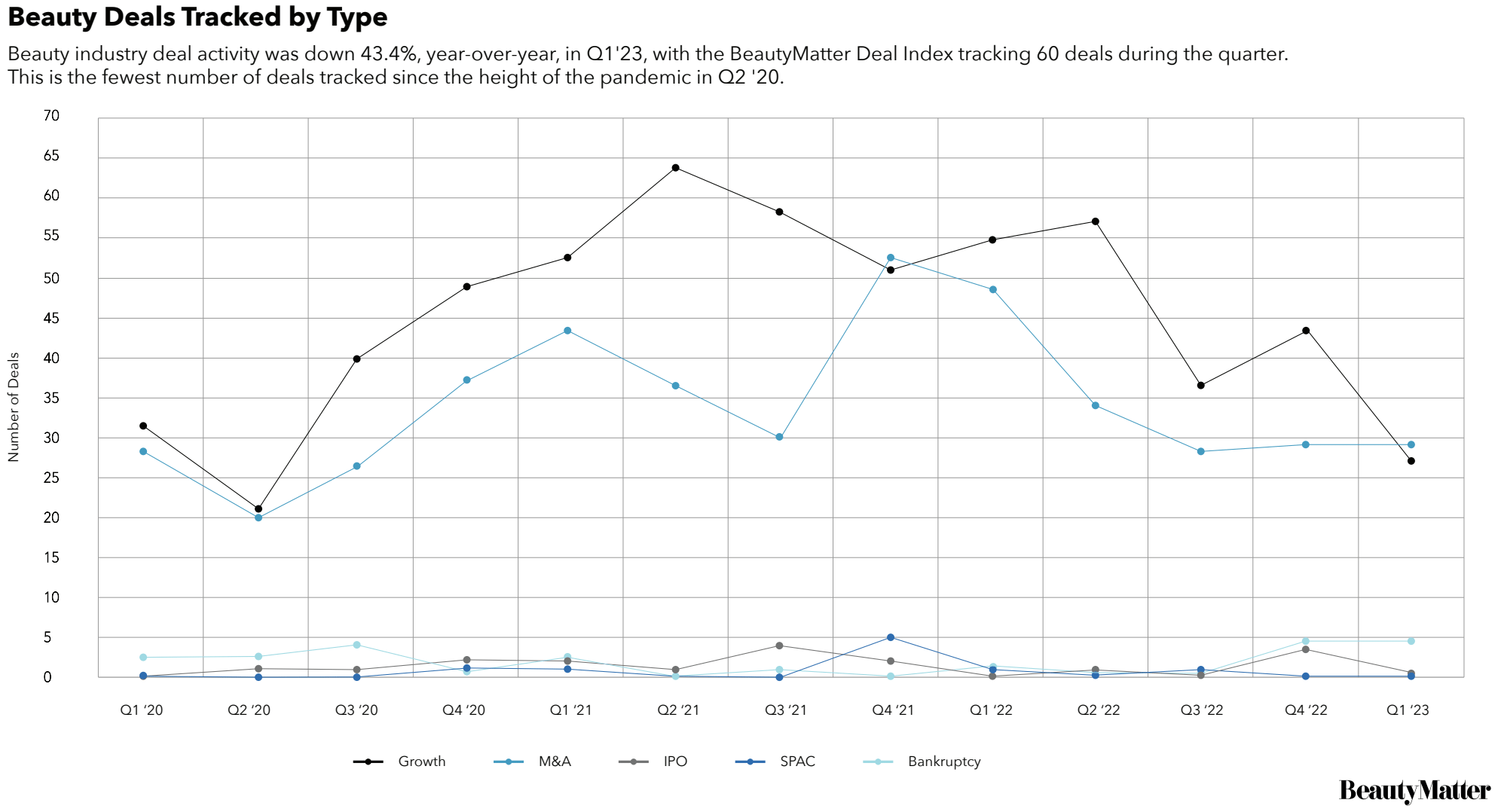

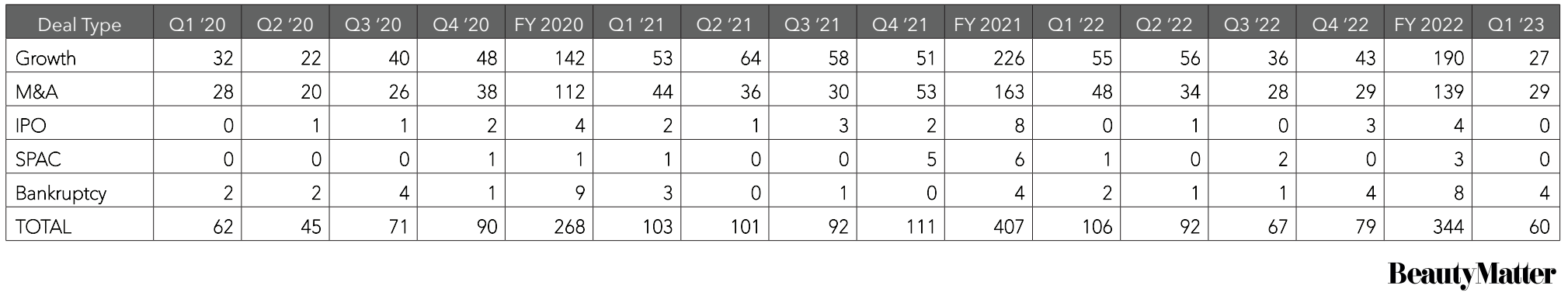

During the first quarter of 2023, the business of beauty remained remarkably resilient. In fact, perhaps the only thing as stubborn as the economy’s core inflation or the white-hot, US job market has been the consumer’s willingness to continue to spend on beauty, despite trading down or trading out of other consumer segments. This resilience, however, has not translated into beauty deal activity. During the first quarter of 2023, beauty deal volume fell 43.4% from the first quarter of 2022.

BeautyMatter’s Deal Index tracked a total of 60 transactions during the first quarter, a low not seen since the second quarter of 2020, during the height of the pandemic. M&A (traditional mergers, acquisitions, and majority stakes) edged out growth investments (seed, venture, minority stakes), comprising 48.3% of transactions versus 45.0% for growth. This is only the second quarter in the history of the index where growth deals have not dominated the quarter. This was largely due to the fact that supply side deals comprised a third of all deals tracked during the quarter and those transactions tend to be structured as more traditional M&A transactions and majority stakes. Standout supply side transactions during the quarter include Apollo’s $8.1 billion acquisition of Univar Solutions and Solenis’ $4.6 billion acquisition of Diversey. Beyond the supply side, the quarter also saw the high-profile acquisition of haircare brand, Mielle, by Procter and Gamble. The quarter also saw two bankruptcies and two brand shutdowns. Forma Brands filed for Chapter 11 bankruptcy protection in January and was subsequently acquired by its lenders for $690 million in March. Medly Health was forced to close all of its Pharmaca retail locations after filing for bankruptcy protection late last year. During the quarter, Walgreens announced that it would acquire select assets of Medly Health in February but did not bid on the Pharmaca store portfolio. In late March, it was announced that beauty discount retailer, Harmon Stores, would liquidate its stores as its parent, Bed Bath and Beyond, struggled. In January, actress Kristen Bell announced the shutdown of her CBD skincare business, Happy Dance, after just two years in business.

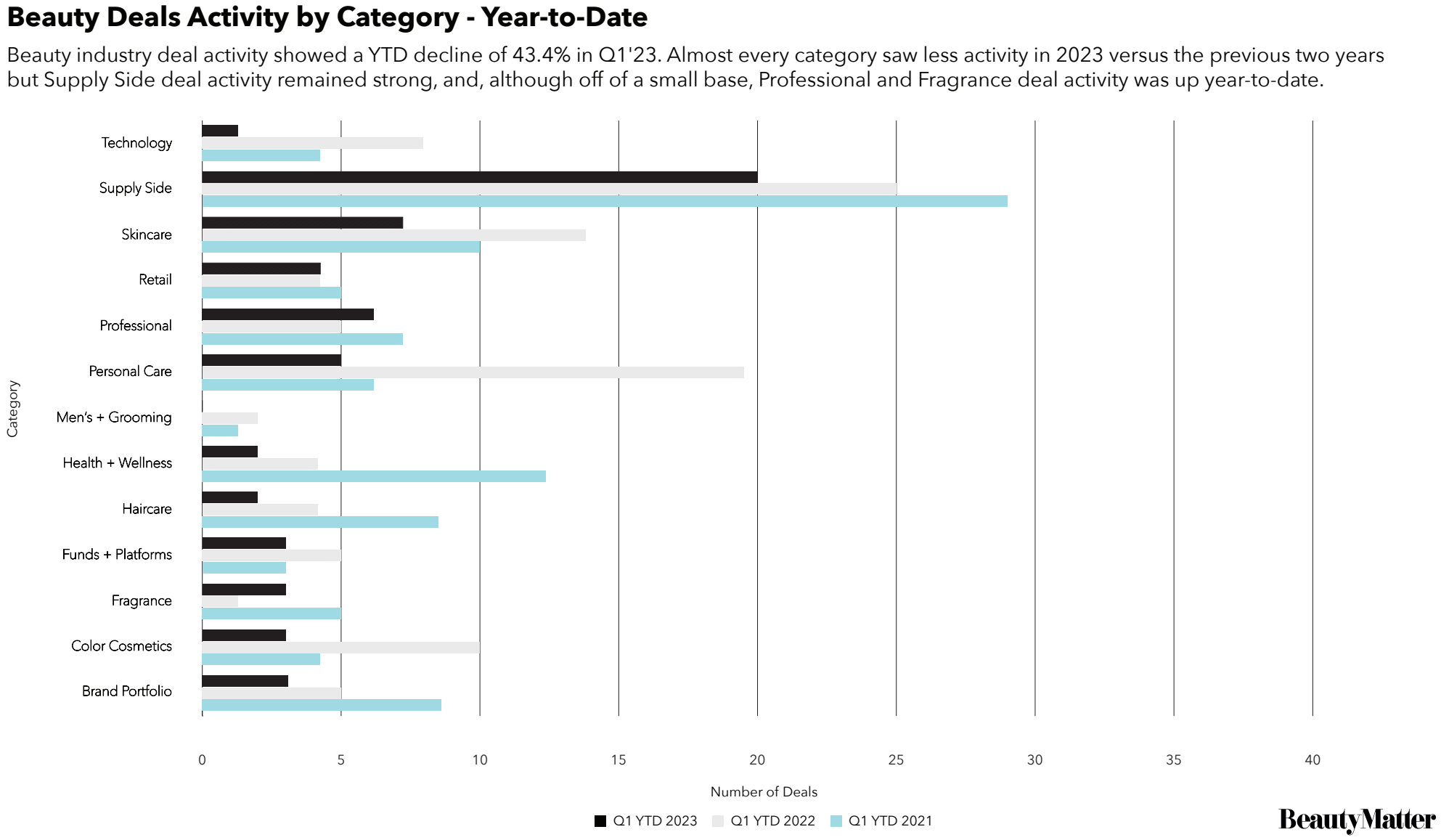

During Q1 2023, 33% of deals occurred on the supply side, by far the most prolific category tracked by the BeautyMatter Deal Index. Contract manufacturers, in particular, remain a popular target for M&A activity on the supply side, as private equity firms continue to build and enhance platforms in the space. Skincare deals comprised 11.7% of deal activity during the quarter, and professional deals comprised 10.0%. The only categories to show growth in deal activity for the quarter were the professional and fragrance categories, albeit off of a small base.

Deal Trends We’re Watching for 2023

For beauty and wellness dealmakers, the economy presents a confusing array of mixed signals. According to the University of Michigan, consumer sentiment in the US increased slightly in April, and the economy added 253,000 jobs, keeping unemployment at a record low 3.4%. At the same time, the economy just saw its third major bank failure in early May, and the Federal Reserve continues to raise interest rates to cool off a stubbornly resilient inflation rate. In March, Ulta reported record sales and profits for fiscal 2022, and comp store sales growth of 15.6%. LVMH’s Sephora reported “exceptional results” during the company’s first-quarter results reported in early April. In early May, however, Estee Lauder’s share price fell by over 20.0% when the company forecasted weaker-than-expected sales and profits due to a slow recovery at duty-free and travel destinations, especially in Asia.

If your head is spinning as you try to make sense of all of the seemingly contradictory signals the market is giving, you’re not alone. There are a few trends, though, that we’re keeping an eye on, that point in the direction of the back half of 2023 being a bit more active in terms of deal activity than the first half.

Strong Balance Sheets at Strategics

With interest rates at a 16-year high and the Federal Reserve giving mixed signals on future hikes, deals that rely on large amounts of leverage to get done will likely be on pause for the time being. That being said, strategics, with multi-billion-dollar cash hoards burning a hole in their balance sheets, can still afford to be opportunistic when the best assets become available. On the heels of blockbuster deals like L’Oréal’s recent $2.5 billion acquisition of Aesop and Procter and Gamble’s acquisition of Mielle, all indications are that the strategics remain open for business. At BeautyMatter’s FUTURE50 live event in late April, Carol Hamilton, L’Oréal’s Group Vice President, Acquisitions and West Coast Headquarters, said that despite a slowdown in merger and acquisition activity associated with the economy and bank issues, L’Oreal’s on the prowl for deals.

Investors Have Ample Dry Powder Waiting to Be Invested

According to Moody’s, nonbank corporates are holding onto approximately $2 trillion of capital right now. PitchBook reported that private equity firms globally are sitting on $1.3 trillion in dry powder. Will 2023 finally be the time to start putting some of that capital to work? With valuations reportedly becoming much more reasonable than they have been in the last several years and distressed assets in ample supply, now might be a great time for investors to execute on the proverbial “buy low, sell high” strategy. With financing costs continuing to rise, deals will likely be dependent on larger equity checks and reduced reliance on outside debt. They may also require other creative deal structures such as seller financing, earnout structures, club deals, or joint ventures. We might see more minority deals versus takeovers and larger investors like private equity firms focusing on smaller deals (and encroaching on VC territory).

Tightening Credit Will Force Deals to Drive Growth

In 2023, many companies, especially smaller companies that rely on regional banks for access to debt capital, will likely experience a credit crunch as their banks continue to tighten lending standards. This will either slow down growth or force companies to look for capital elsewhere, which might force them to go to the market and seek investment.

Distressed Assets Will Create Buying Opportunities

During the first quarter, we’ve already seen investors take advantage of distressed asset opportunities. Walgreens’s acquisition of select assets of Medly Health in February and Ariana Grande’s acquisition of R.E.M Beauty’s assets out of the Forma Brands bankruptcy, are examples of opportunistic dealmaking involving distressed assets.