Spring typically evokes flowers, decluttering, and renewal. However, for the average beauty shopper, spring means making room on one’s vanity for Ulta Beauty and Sephora’s Spring Haul events. Every spring, the powerhouse beauty retailers battle it out with deep discounts, vying for the attention and wallets of beauty consumers.

BeautyMatter spoke to Jacob St. John, CEO of Navigo Marketing, an agency providing multichannel, data-driven advertising strategies and implementation for beauty and wellness brands on Amazon, Ulta Beauty, and Sephora, to find out who won the 2025 spring sale face-off.

St. John and his team looked at the year-over-year (YoY) data based on the first week of Ulta Beauty and Sephora’s spring sales and found that brand partners on Ulta Beauty experienced double-digit growth across most categories. At the same time, Sephora faced a drop in visibility and YoY softness, but still saw success in high-AOV (average order value) categories and select hero SKUs, St. John said.

“Ulta Beauty executed a strong full-funnel push with increased sponsorship and organic growth,” said St. John. The brands that saw the most significant wins during Ulta Beauty’s spring event were Clinique, Ulta Beauty Collection, Redken, La Roche-Posay, e.l.f.. Cosmetics, OPI, and The Ordinary, St. John added.

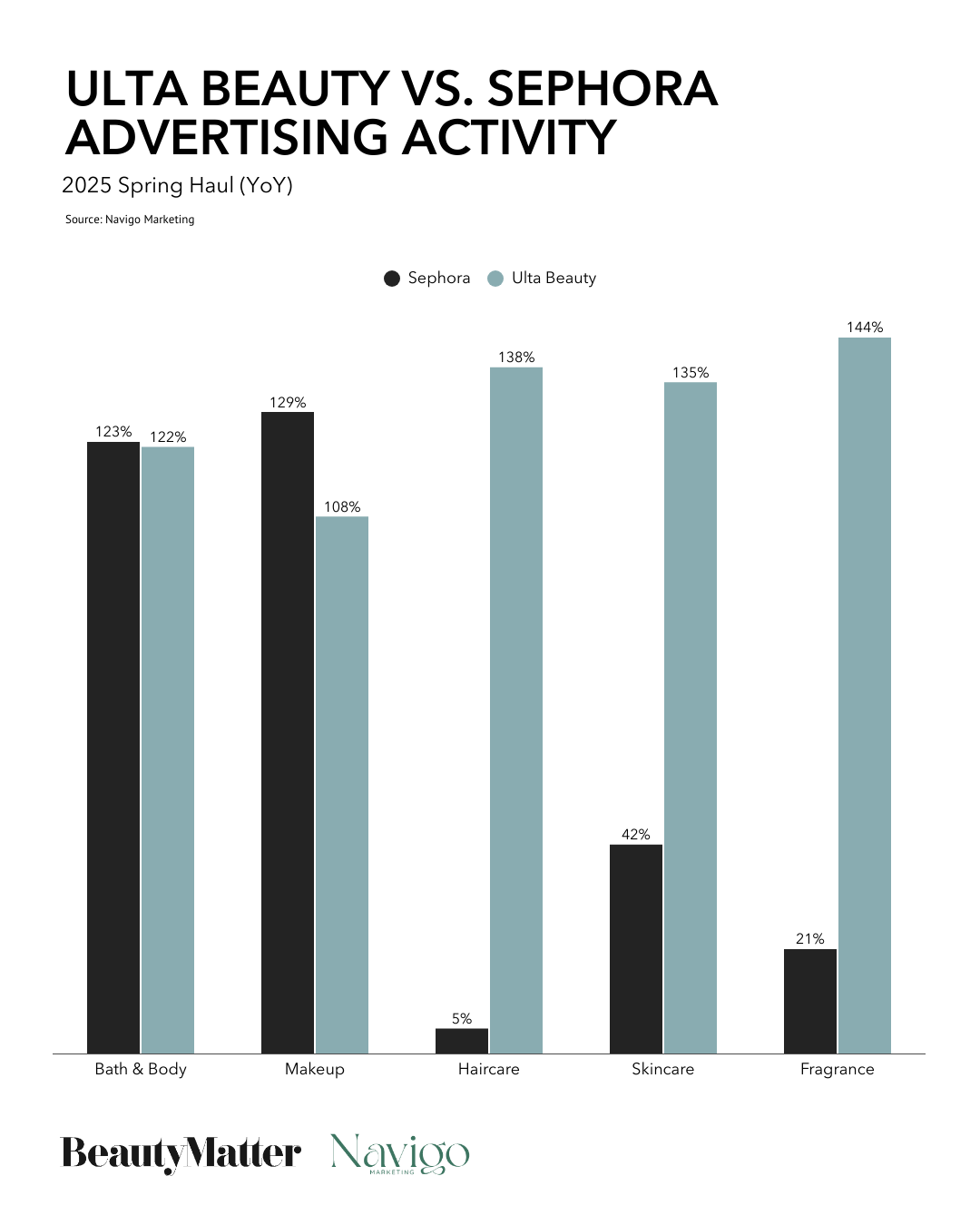

According to Navigo data, Ulta Beauty’s sponsorship activity was up 131.8% YoY. The retailer’s key category movements in sponsored searches during the spring sale included bath and body +122%, makeup +108%, haircare +138%, skincare +135%, and fragrance +144%.

While Sephora’s Spring Haul showed similar category movements YoY in bath and body with +123% and slightly topped Ulta Beauty in sponsored makeup searches with +129%, Sephora fell short in most categories compared to Ulta Beauty with only +5% movement in haircare, +42% in skincare, and 21% in fragrance.

According to St. John, the marketing strategy breakdown for the retailers’ spring hauls, in terms of sponsored search, Ulta Beauty came out on top with sponsorship investment up 131.8% YoY vs. Sephora, which showed 8.6% YoY.

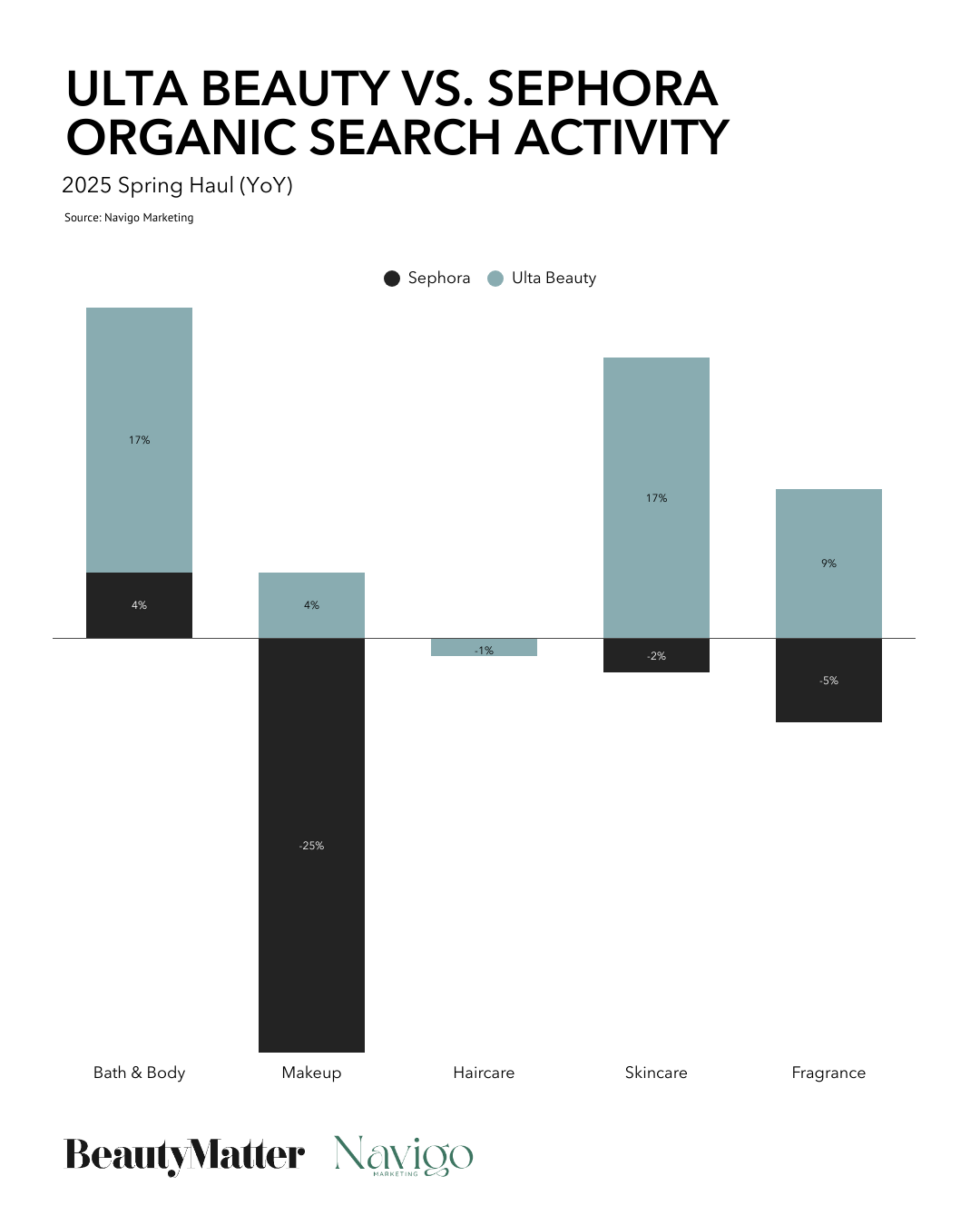

“Ulta Beauty’s sponsorship surge aligned with a rise in high-intent search terms,” explained St. John. “Sephora’s smaller ad lift wasn’t enough to offset large drops in organic traffic, highlighting an ecosystem breakdown.” St. John added that discovery softness hurt visibility and likely sales despite higher sponsored activity.

The gap between the two retailers tapered when it came to organic search movements in key categories YoY. In bath and body, Ulta Beauty was +17% vs. Sephora +4%; in makeup, Ulta Beauty was +4% compared to Sephora -25%; in skincare, Ulta Beauty was +17% vs. Sephora -2%; in fragrance, Ulta Beauty was +9% compared to Sephora -5%. Haircare was the only category where Sephora narrowly topped Ulta Beauty, with a +0% movement compared to Ulta Beauty's -1%.

So, how does a brand ensure its products drive search traffic on Ulta Beauty and Sephora? According to St. John, visibility is everything. “Ulta Beauty’s YoY gains were backed by search lift and sponsored scale. Sephora's traffic decline directly impacted category performance.”

What’s clear from looking at Sephora’s Spring Haul metrics is that ads alone do not equal growth. “Sephora’s modest ad increase (+8.6%) did not overcome a 22.4% drop in search visibility. Full-funnel strategy is key,” added St. John.

Hero SKUs and mini formats won the Spring Haul showdown, according to St. John. He recommended brands identify one or two clear multiuse or trend-driven items to lead event placements and optimize formats by investing in minis, bundles, and refillables “to support new customer entry.”

For brands sold at both Sephora and Ulta Beauty, St. John advised a retailer-specific strategy. Ulta Beauty is mass-leaning with volume SKUs, while Sephora is prestige-focused, and there is a need to build awareness, St. John said.

He also sees brand partners succeed when paid and organic media are aligned. “Don’t silo paid media,” he warned. “High-share brands also showed strong organic keyword relevance.” St. John said to align spending with traffic drivers, not just promotions. “Invest in visibility before and during key tentpoles, and tailor strategy by retailer dynamics and pricing tiers.”

Laura Schubert, co-founder of personal care brand Fur, who has worked with St. John and Navigo for several years and partnered with them for Ulta Beauty’s Spring Haul, sees the marketing agency as an essential partner in navigating the ever-evolving digital retail environment. “It’s [the digital retail environment] changed so much and will continue to do so. It’s nuanced in a way that it wasn’t before,” Schubert told BeautyMatter. “Navigo has smart, nimble people who help you make the right decisions. It’s a true partnership.”

So, how does Navigo help brands win in the ever-changing online retail environment? The agency maximizes visibility across paid and organic search through data-backed strategy, keyword optimization, and media planning. It also works with brand partners to build winning SKU strategies that drive trial and loyalty. Lastly, Navigo tailors strategies for Ulta Beauty, Sephora, and Amazon, recognizing each retailer’s unique dynamics, audience, and timing.

While Navigo’s data points to Ulta Beauty as the clear winner of the Spring Haul battle, the agency is already looking ahead, particularly by helping brands currently selling on Amazon get a jumpstart on Ulta Beauty’s new Marketplace. Navigo is currently working on strategies for its brand partners to conquer Ulta Beauty’s Marketplace, a new phase in retail competition slated to debut in fall 2025, which will significantly expand the retailer’s inventory. “We’re excited for what this [Ulta Beauty Marketplace] unlocks—more brand opportunity, innovation, and competition,” St. John said. “It’s much easier for brands that are already selling on Amazon to make this transition to the Ulta Beauty Marketplace.”

“Ulta Beauty Marketplace will be a land grab moment for brands,” said St. John. “Owning the shelf is no longer enough—own the algorithm or risk losing visibility.”