Beauty brands, it’s time to go global. With the total beauty and personal care market projected to reach $646 billion in revenue this year according to Statista, brands have opportunities for expansion and growth well beyond US borders. Online marketplaces provide a substantial path for growth, with 19% of total global revenue expected to come from e-commerce sales.

The Power of Global Markets

Did you know that UK-based retailer Cosmetify ranks Rare Beauty and Fenty Beauty, both US based, as among the most popular brands among European consumers on social media? Or that beauty retail sales in Africa and the Middle East are expected to grow by 12% by 2027? Considering that worldwide social commerce was valued at $726 billion in 2022, and is expected to expand at a rate of 31.6% until 2030, it’s time for beauty brands to make their mark on a global stage.

Global expansion is at the forefront for brands, but the real power lies within marketplaces. Many consumers use Amazon, Mercado Libre, OTTO, Zalando, Tesco, Allegro, and other marketplaces as search engines to comparison shop and discover new products. There are so many unique opportunities for brands to expand their reach and become the favorite product of new consumers.

Pattern, the leading e-commerce acceleration platform and #1 Amazon seller globally, offers insight into how marketplaces are being transformed by consumer behavior. Pattern’s Director for EMEA, James Bennett, notes, “Marketplaces are the go-to research hub for beauty enthusiasts. They are, essentially, shopping search engines driven by organic search. It’s imperative that brands leverage this platform and audience to acquire new consumers while also protecting their brand equity.”

While brick-and-mortar retail remains a strong and vital channel for beauty, consumers are increasingly willing to buy cosmetics and skincare products online, whether it’s through marketplaces, DTC sites, or even social shopping. Research from McKinsey suggests that e-commerce is the fastest-growing channel for beauty brands at approximately 12% per year, with the global market expected to reach nearly $600 billion by 2027.

Social media has also revolutionized the way brands are reaching new, global audiences. Consumers are increasingly turning to beauty influencers for tips, demonstrations, and product recommendations. Harvard Business Review reported that beauty brands went from spending $2 billion on influencer marketing in 2017 to $15 billion in 2022, with global brand Estée Lauder putting 75% of their marketing budget towards influencer marketing.

This presents a tremendous opportunity for beauty brands. E-commerce executives need to harness the power of online marketplaces to drive awareness, educate consumers, and convert sales in a sea of competition. If brands aren’t capitalizing on online commerce and social selling for international audiences, they are leaving value on the table.

Bennett suggests that certain brands have an easier path to international expansion. “We find that those with an established US presence are ready for this type of scale. You should have identified a target audience, and may already have a small international e-commerce presence. Global expansion is your next growth lever to pull, but you need to approach it strategically and sustainably.”

Key International Challenges

Launching or accelerating internationally comes with some key challenges.

For starters, beauty brands must look for transparency in any third-party (3P) partnerships to help them sell internationally. Look for a partner that will share detailed sales reporting, and not just a monthly overview. You should expect a quarterly business review where you can see month-over-month changes, get a sense for seasonality, and make informed decisions around quarterly forecasting. In addition to overall reports, a good partner should provide data by each platform, marketplace, or channel.

Brands going international may also find it difficult to combat price erosion or control the look and feel of their brand when working with some third-party partners. Keep this in mind when evaluating international options for growth.

Market knowledge is another hurdle beauty brands may face. They must consider a localized go-to-market strategy that takes into account cultural differences and expectations. For example, one major haircare brand launching in Brazil reformulated products and updated packaging to reflect afro/curly hair textures and types. Brands may need to look at different selling models, product offerings, image and content strategies, and marketing tactics.

Beauty brands should also ask themselves if they have the right talent in place. In a recent e-commerce industry survey, e-commerce accelerator Pattern found that 40% of North American brand leaders said being under-resourced was their biggest professional pain point. Understaffing was the second-biggest pain point, with 33% of respondents noting this concern. Hiring and retaining e-commerce talent is a key consideration for beauty brands looking for international growth.

Considerations for International Expansion

Pattern helps brands from all industries, including beauty, accelerate their businesses internationally. Here are some key tips for beauty brands looking for international growth.

Tip 1: Analyze Market Size and Prioritize by “Friction”

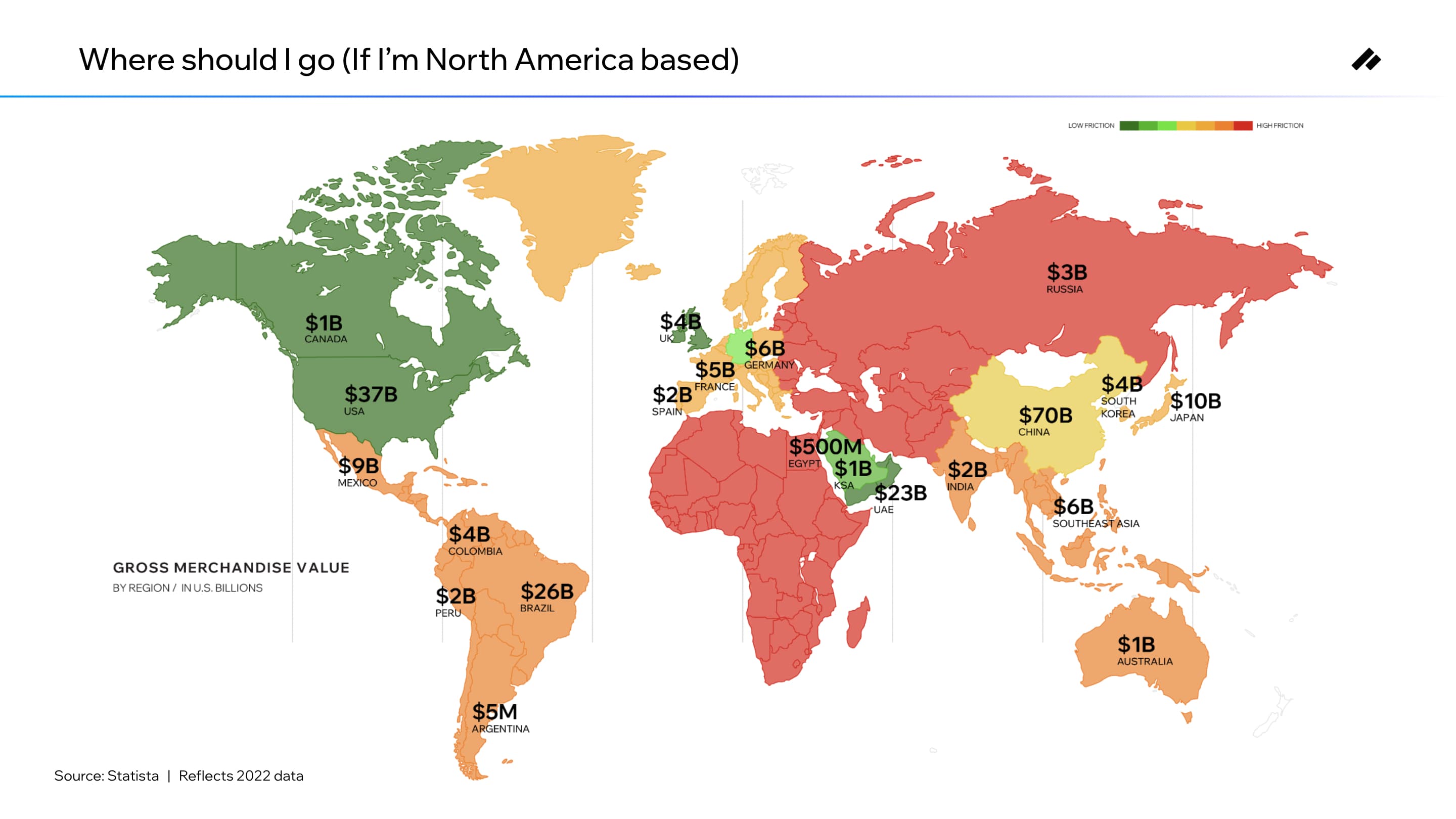

To determine where you want to focus, look for data on how big the “size of the prize” is in various regions. Make sure the market is big enough and there is enough opportunity on the table for it to be worth considering expansion into that marketplace or region.

Take a strategic approach to international growth by choosing countries with the lowest friction and highest addressable market when you expand. This map can help you see where the biggest, low-friction opportunities lie for beauty brands.

Tip 2: Gauge Pre-existing Demand for Your Brand

Consumers might already be searching for your brand in various regions and marketplaces, and are either unable to find it or are purchasing it from unauthorized sellers/manufacturers. You can gauge this pent-up demand by working with a partner who has tools to track and analyze your branded search traffic.

Tip 3: Determine Cultural Fit and Ranging Strategy

Your product and focus might be a better fit from some regions compared to others. For instance, Europe might be a better market for eco-friendly and organic beauty products, while products for a 10-step skincare routine may appeal more to Asian consumers. Think about how your product fits in the local market, and consider tailoring your range to meet regional demands and maximize sales.

Some beauty brands have found that pilot tests have helped them settle on the right product mixes, discount and holiday strategies, and product offerings for their various international marketplaces.

Tip 4: Understand Regulations by Region

Every region has different regulations to ensure safety, quality, and conformity. This could affect a product’s ingredients, packaging, and marketing. In the EU alone, every country has its own unique regulations, so it’s crucial to understand which marketplaces and regions might be easy wins vs. longer-term plays.

Labeling and producing international, SEO-optimized content is just the beginning. Many beauty brands run into issues with ingredient regulation when looking to expand internationally. Working with a 3P partner or trusted trade partner can help you proactively navigate local regulations and compliance issues.

Tip 5: Choose a Partner and Define Your Strategy

Most beauty brands will need to choose a partner to help them go international. It’s important to choose a partner that can help you meet your goals and execute your strategy. For example, maybe you’re interested in selling on OTTO, Germany’s popular marketplace, or explore the ins and outs of cross-shipping. You’ll want to focus on partners with the right expertise to help you achieve your aims.

Tip 6: Set a Localized Pricing Strategy

You will need to reevaluate your product pricing to successfully grow on a global scale. This means different prices for different markets based on local tax rates and policies, ever-shifting currency exchange rates, and higher logistics costs. A great 3P partner can help you do the research (and the math) to get it right no matter where you’re selling.

Tip 7: Create Demand with Advertising

Whether you’re working with a partner or tapping in-house resources, you can grow your presence in a marketplace through targeted, optimized advertising. Well-executed images, a solid SEO strategy, and sponsored ads can help you create product listings that convert customers.

Tip 8: Consider NARF and Other Pan-Continent Solutions

North American Remote Fulfillment (NARF) is a program through Amazon that allows brands to list their products on Amazon’s Canadian, Mexican, and Brazilian sites without having fulfillment or logistics in those countries.

“Using NARF or similar solutions is a good way to test your brand’s appeal internationally with little risk. And it’s not much extra work for your team,” said Bennett.

Tip 9: Look into FBA Export

Similarly, Amazon’s Fulfilled by Amazon (FBA) Export option lets international visitors to Amazon.com shop your products. Your existing inventory in Amazon’s fulfillment centers is shipped to customers worldwide at no extra cost to your business.

Tip 10: Rinse and Repeat

As you see success and growth in one region, you can use the same roadmap to continue your global growth.

The most successful beauty brands are those that embrace change as opportunity. Right now, there is an enormous opportunity to reach new customers all over the globe, but it requires the ability to change, adapt, and localize. Brands willing to take on this challenge will be rewarded with a world of possibilities.