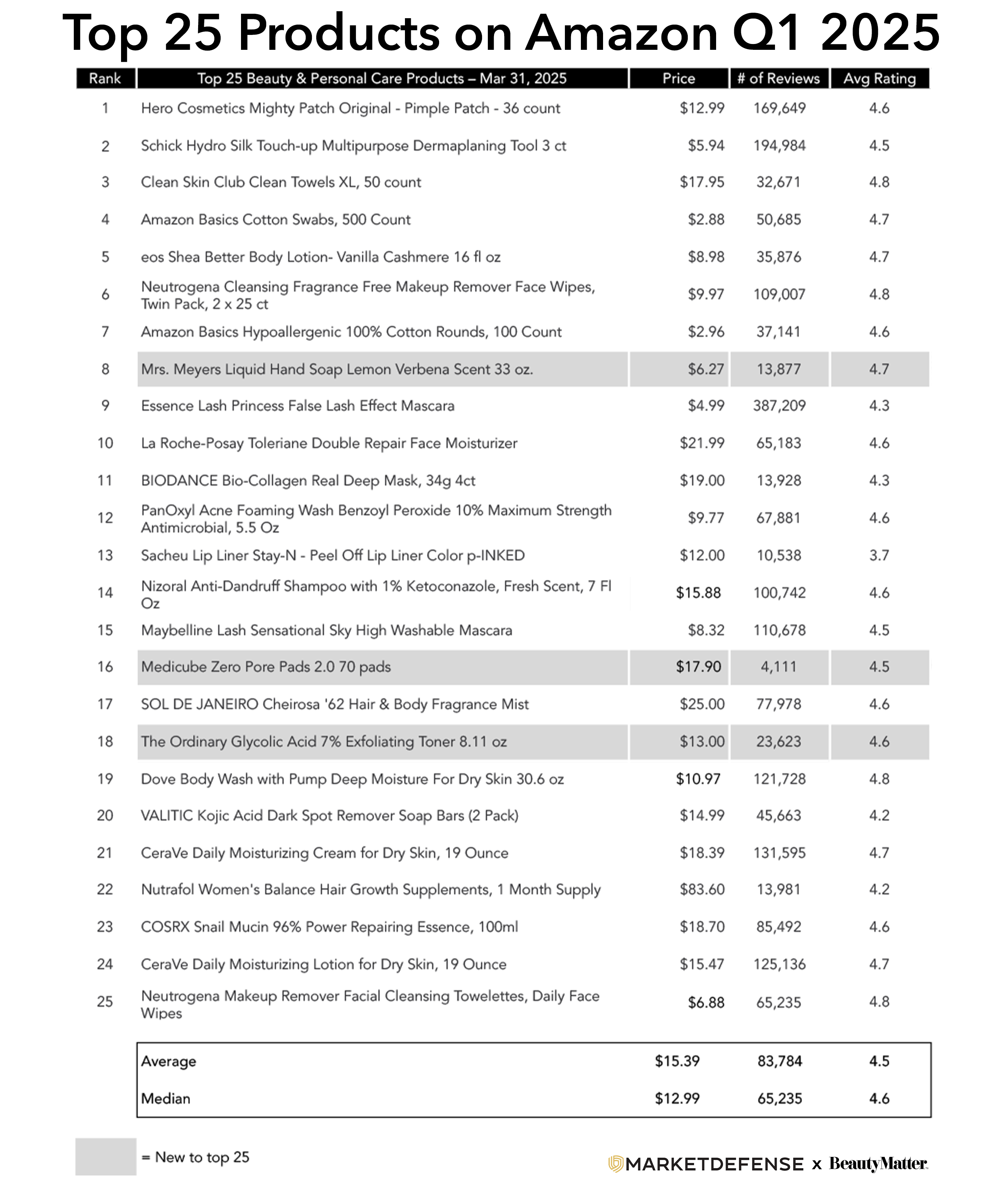

The Top 25 list for Q2 2025 reads like a well-stocked beauty pantry—familiar favorites, proven formulas, and a few strategic surprises that hint at what’s next. The average price of a Top 25 product dropped to $13.92, down from $15.39 in Q1. That’s the lowest it’s been since Q2 2024, and a signal that value is top of mind—even in beauty.

The exit of Nutrafol Women’s Balance Hair Growth Supplements from the Top 25 contributed significantly to the drop in average price. At $88, it had been one of the highest-priced items on the list and a consistent driver of the $15+ average over the past four quarters. Who knows if it will make it back to the Top 25 next quarter, but hair growth is not going anywhere on Amazon. It still accounts for the majority of Haircare category sales, and related searches total over 1.1 million per month, though volumes are flat to last year. Interestingly, more specific terms like “hair loss red light therapy” (+234%) and “hair loss therapy” (+807%) are seeing steep increases—evidence that consumers are becoming more savvy about solutions beyond supplements and oils. Overall, red light continues to shine bright, with searches up 34% year over year (YoY), now approaching 900K per month.

The warmer season brought SPF into focus. Sun Bum Original SPF 50 Sunscreen Body Spray entered the Top 25 for the first time at #17, joining EltaMD UV Clear Face Sunscreen at #23 as only the second SPF product in the Top 25. In prestige, the only new entrant was Medicube Peel Off Facial Mask, priced at $18.89, reflecting K-beauty’s appeal in offering trend-driven skincare at more accessible price points.

Medicube’s momentum goes far beyond pricing. The brand is known for several innovation-driven categories, including its collagen-based skincare, particularly the popular collagen line, which focuses on improving skin elasticity, hydration, and overall plumpness.

According to Spate, collagen skincare is having a major moment—up 36.6% YoY in interest across platforms, including +35.2% on Search and +37.2% on TikTok. On Amazon, the search term “collagen” now exceeds 1 million monthly searches, up 12% over last year. While “collagen peptides” remains the most searched term, the fastest-growing searches include “collagen supplements” (+122%) and “collagen mask” (+83%), signaling expanding consumer interest across formats and use cases.

That data shows that some of the top branded collagen-related searches across platforms include Biodance Collagen Mask, Medicube Collagen Mask, and Medicube Collagen Jelly Cream—an indication that consumers are searching by both brand and ingredient because they know exactly what they’re looking for. With TikTok virality driving interest and Amazon converting that interest into sales, brands like Biodance and Medicube continue to prove that cross-platform momentum can be sustained with the right product strategy. “Consumers are hearing about ingredients first on TikTok—so they’re shopping Amazon with intent, not browsing blindly,” says Vanessa Kuykendall, Chief Engagement Officer of Market Defense.

Another rising trend to watch: exosome skincare. While still early in its adoption curve, exosome-based products are gaining traction, especially among consumers looking for advanced solutions to pore care, hydration, and skin texture. Medicube is currently the brand dominating organic search on Amazon for the term “exosomes,” which means the platform is surfacing Medicube’s brand most often when shoppers are exploring this emerging category. That kind of brand-level visibility suggests strong consumer alignment, even if individual exosome products haven’t yet broken into the Top 25.

Amazon searches for “exosomes” have grown 108% over the past 12 months, now totaling more than 80,000 monthly searches, with the majority concentrated on the single term “exosomes.” While related terms like “exosomes serum” and “exosomes for face” still fall below 10,000 monthly searches, their growth rates—+177% and +817%, respectively—highlight the accelerating consumer curiosity around this emerging skincare ingredient.

But as with all trends, smart strategy matters. Chasing hype can feel like a sprint, but the wins come to brands that think like marathoners. Just look at pimple patches—once a niche term, now a category staple. Amazon searches for “pimple patches” are flat YoY but still total well over 500,000 a month. Hero Cosmetics Mighty Patch remains the #1 product in the Top 25, holding that position since Q4 2023. Hero turned a trend they helped ignite into lasting category dominance—proof that early investment and consistent execution can build enduring market leadership.

The Skincare Top 10

The average price point of the Skincare Top 10 was $14.25, up 3.4% from last quarter.

The Haircare Top 10

The average price point of the Haircare Top 10 was $19.17, down 1.4% from last quarter.

The Makeup Top 10

The average price point of the Makeup Top 10 was $8.57, down 3.6% from last quarter.

Ingredient-Led Discovery Is Reshaping Search Strategy

As ingredient-led shopping continues to shape the Amazon beauty landscape, Market Defense experts note that the rise of social media as a source of influence is fundamentally changing how consumers discover and evaluate products.

“Consumers aren’t just reading labels anymore—they’re hearing about ingredients first on TikTok or Instagram,” said Kuykendall. “Recent data shows that, for the first time, the majority of US adults say they follow at least one influencer. That shift may be tied to declining institutional trust, and it’s driving a wave of consumers who are looking to influencers for 1:1 advice that feels personal and credible. That’s why you’re seeing more dermatologists and doctors show up on TikTok—to counter misinformation with facts and reach an audience that’s hungry to learn.”

That demand for ingredient education is also shaping how brands need to structure their search strategies on Amazon.

“Knowing that today’s beauty shopper is highly educated, it’s critical to include ingredient keywords in your nonbranded strategy,” added Dave Karlsven, VP of Technology at Market Defense. “You want to be turning up bids the moment you see an ingredient trend emerging that your brand can authentically serve. Highly relevant, lower-funnel search terms have stronger click-through rates than upper-funnel, broad terms. If your strategy isn’t targeted, you’re not just missing an opportunity—you’re likely wasting money.”

Previous Reports:

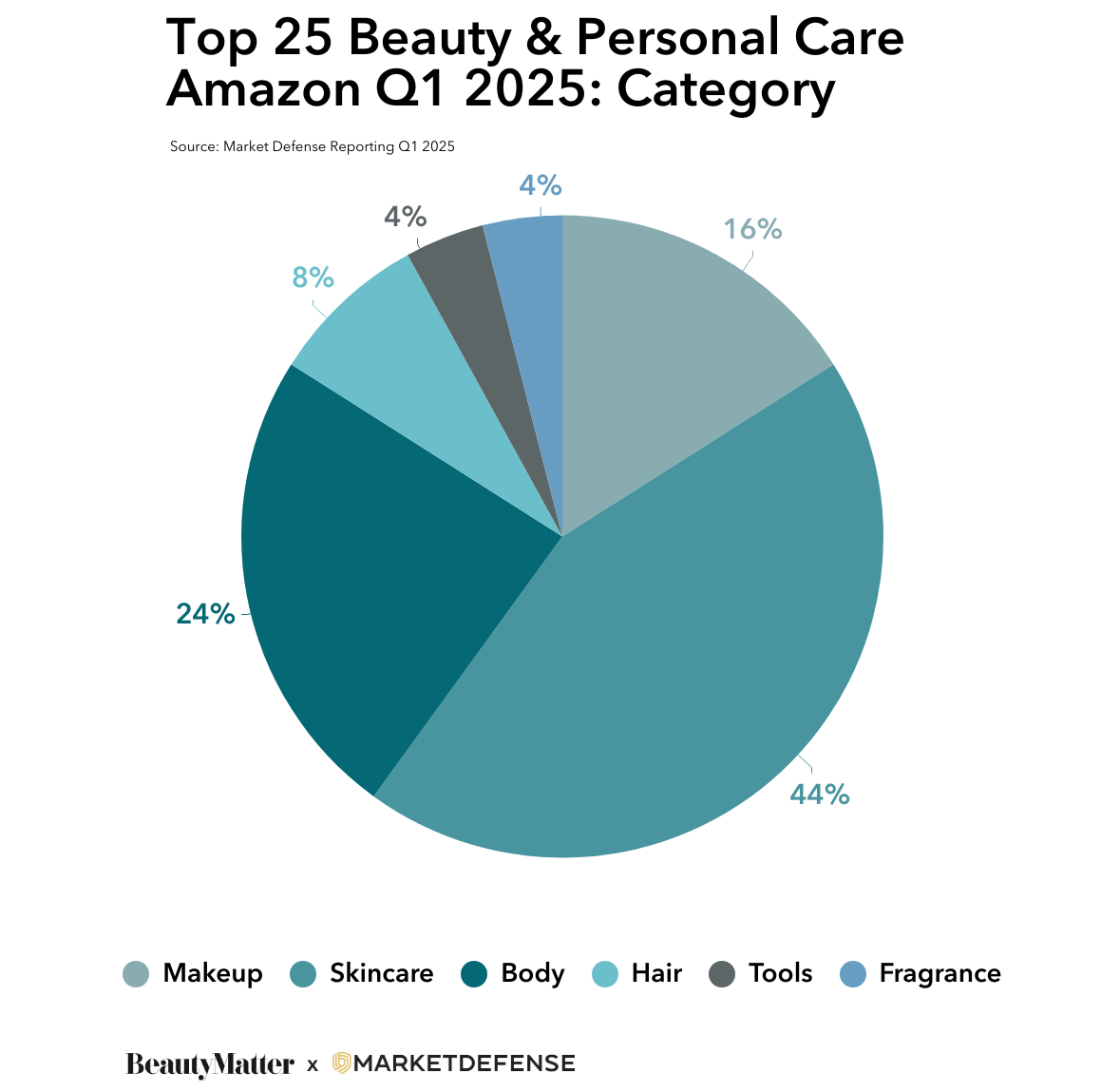

Q1 2025 Amazon Top 25 Beauty & Personal Care

Q4 2024 Amazon Top 25 Beauty & Personal Care