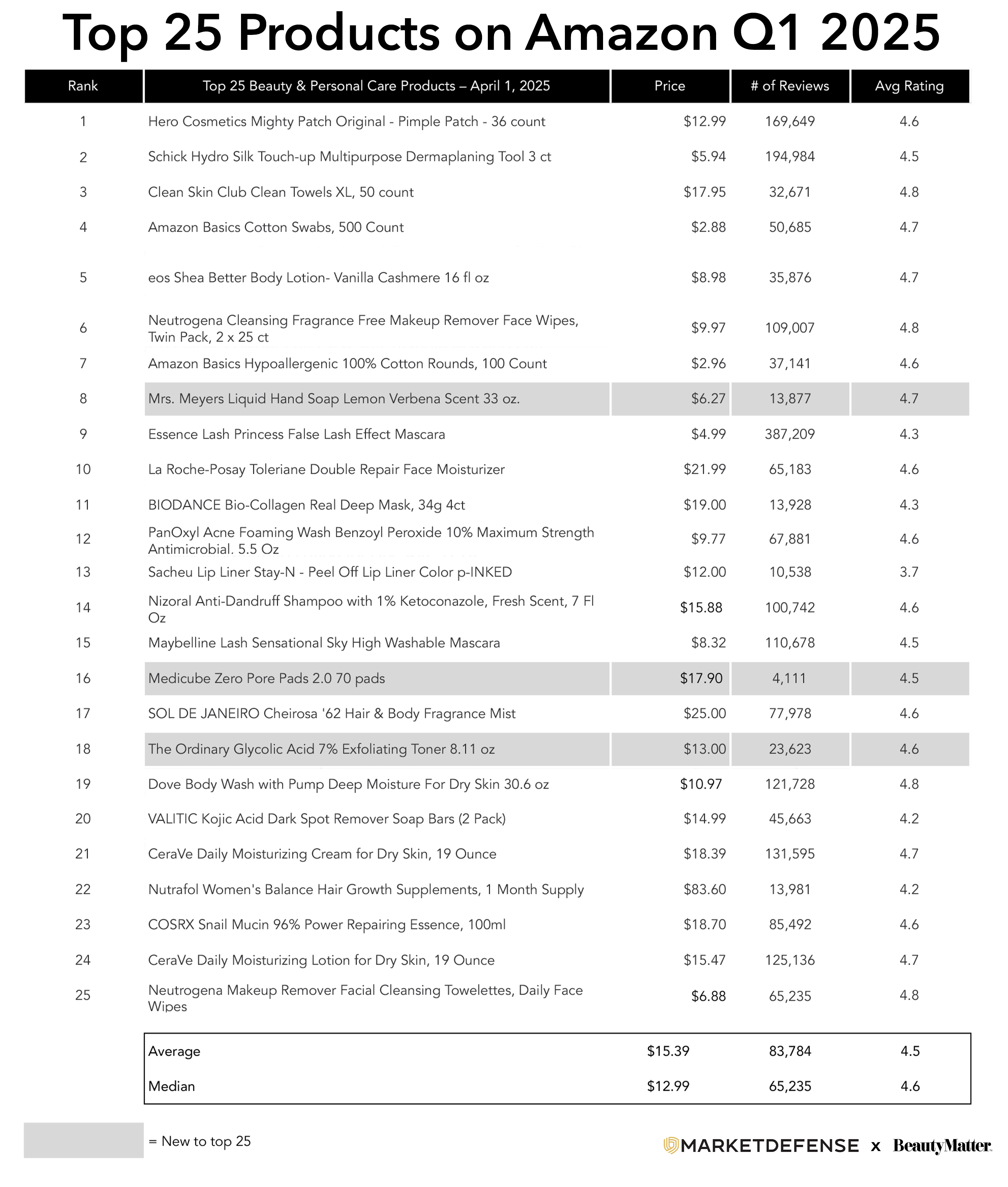

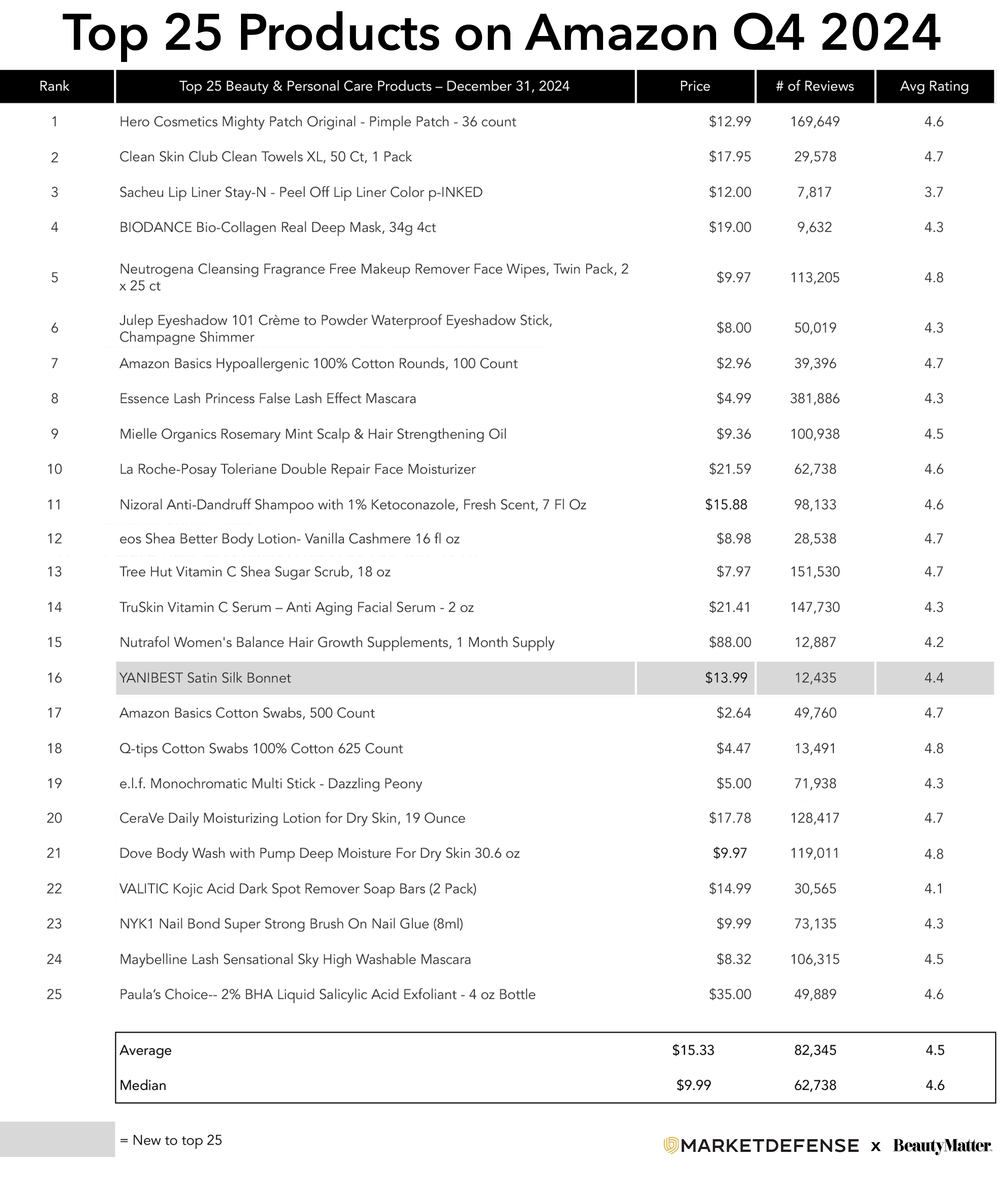

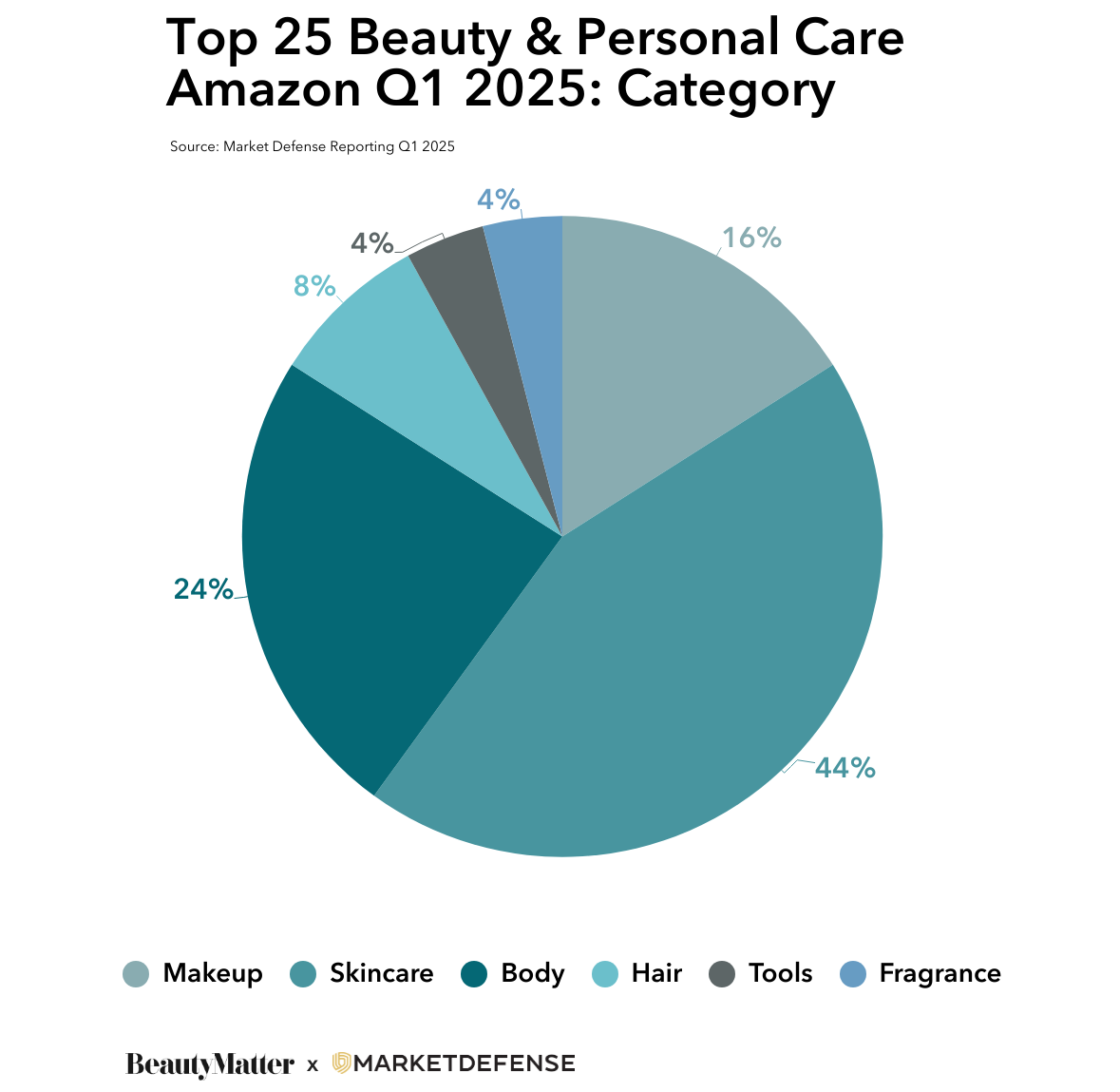

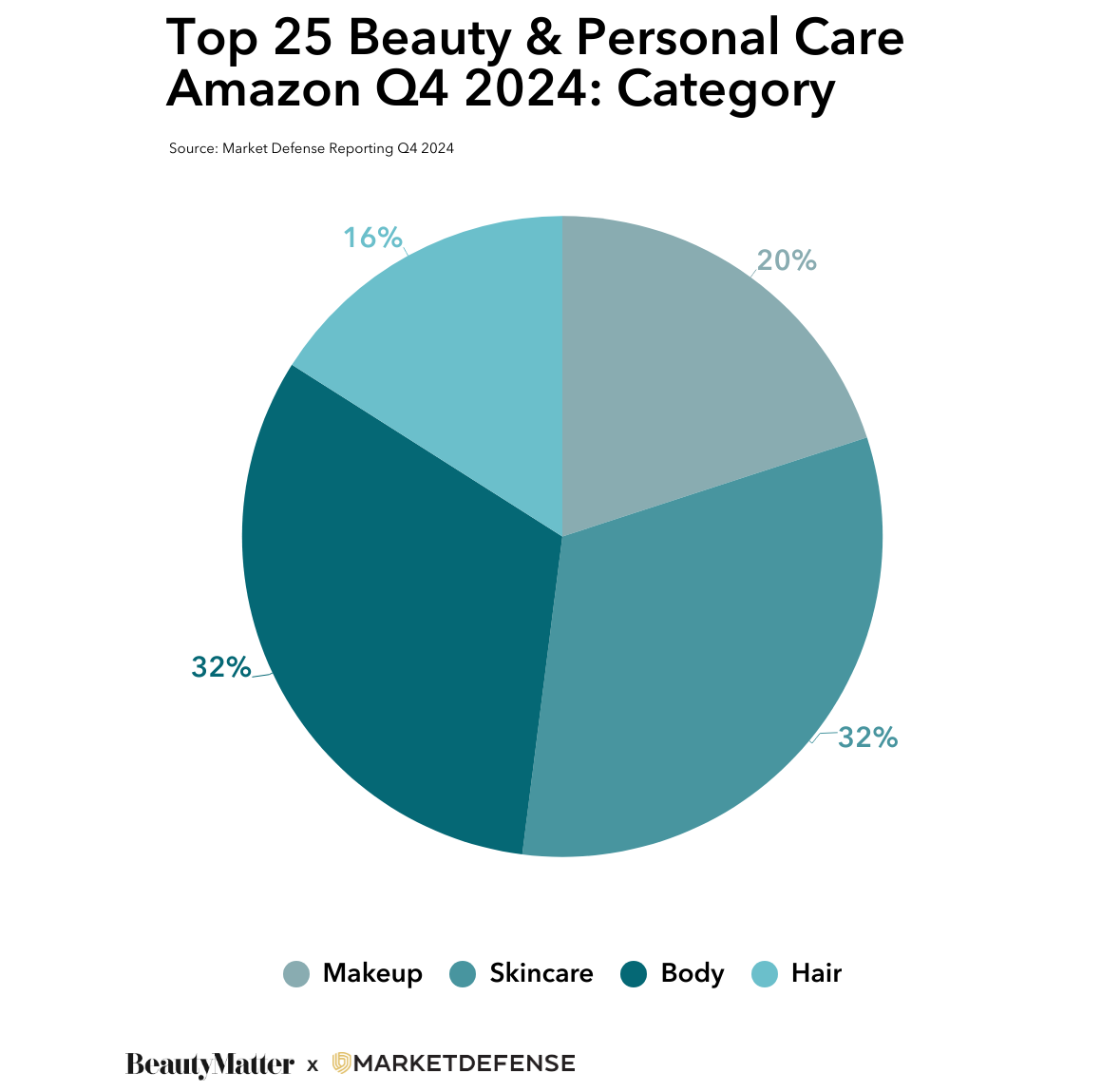

In Q1 2025, skincare was the star of the show on Amazon’s list of the Top 25 Beauty & Personal Care products. Forty-four percent of the list was comprised of skincare products, with Hero Cosmetics Mighty Patch Original Pimple Patches earning the #1 spot for the fifth consecutive quarter. Schick Hydro Silk Touch-Up Multipurpose Dermaplaning Tool was #2, Clean Skin Club Clean Towels XL was #3, Amazon Basics Cotton Swabs was #4, and eos Shea Better Body Lotion rounded out the top five products. The average price point of the Top 25 list was essentially the same as last quarter at $15.39.

This quarter, three new products broke into the Top 25: Mrs. Meyers Liquid Hand Soap (#8), Medicube Zero Pore Pads 2.0 (#16), and The Ordinary Glycolic Acid 7% Exfoliating Toner (#18). As in previous quarters, the list was largely dominated by mass brand heroes like Neutrogena, Essence, La Roche-Posay, PanOxyl, Maybelline, Dove, and CeraVe. The notable exception to this was Nutrafol Women's Balance Hair Growth Supplements (#22), with an $88.00 price point. Nutrafol Women’s Balance has been on the list for three consecutive quarters, since it joined the list for the first time in Q3 2024. The brands with multiple products on the list this quarter were Neutrogena, CeraVe, and Amazon’s private-label brand, Amazon Basics.

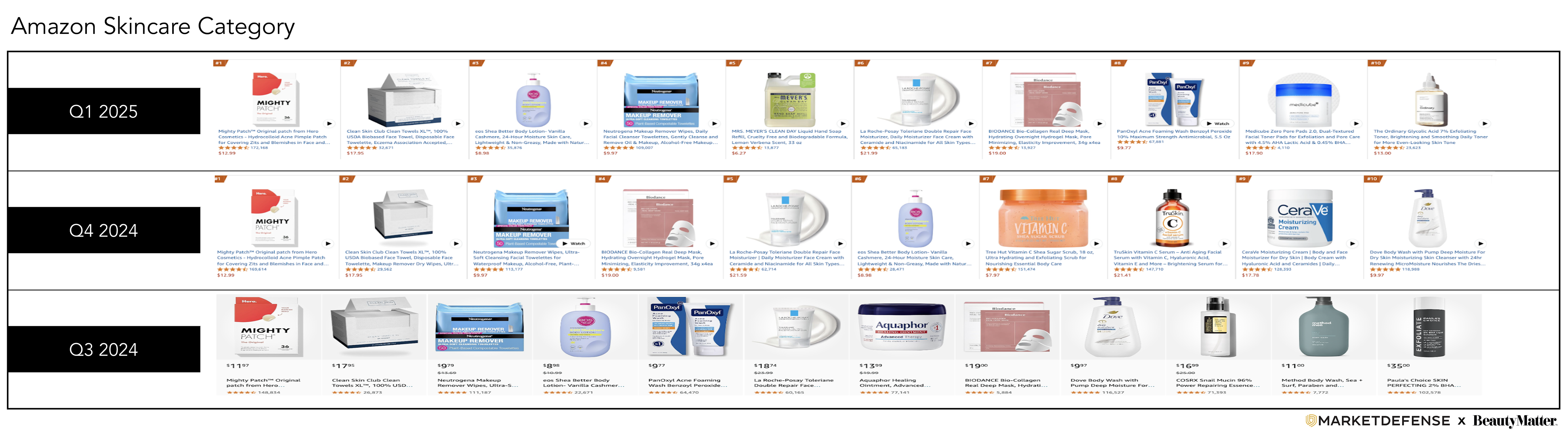

The Skincare Top 10

The average price point of the Skincare Top 10 was $13.78, down 6.6% from last quarter.

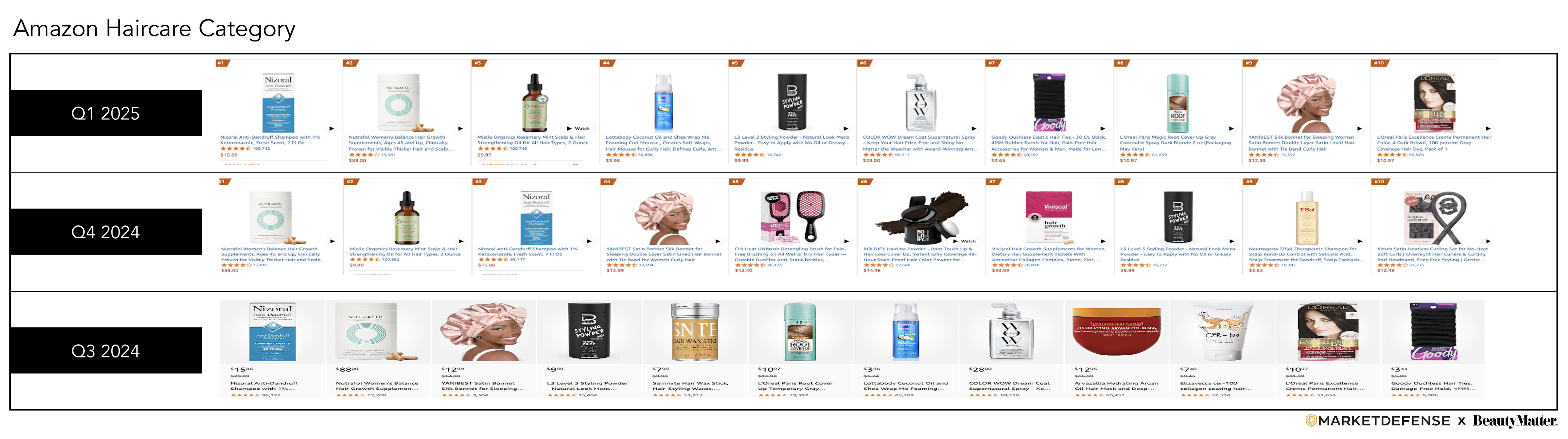

The Haircare Top 10

The average price point of the Haircare Top 10 was $19.44, down 10.0% from last quarter.

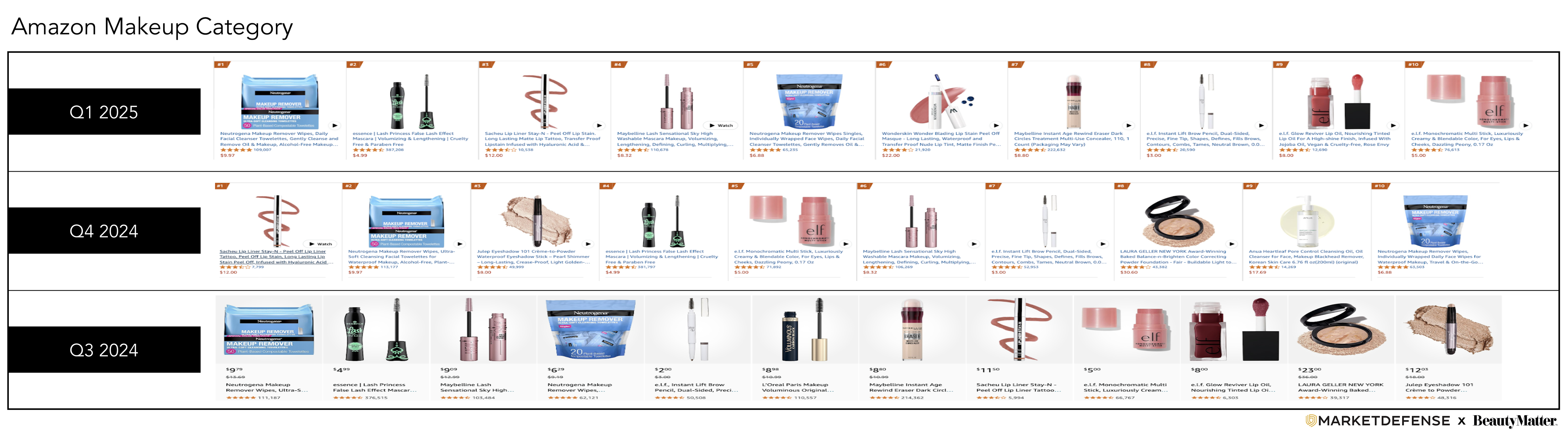

The Makeup Top 10

The average price of the Makeup Top 10 was $8.90, down 16.4% from last quarter.

Looking Ahead for the Year

As brands prepare for Q2 and beyond, the focus is increasingly turning to a more complex question: not just which products sell, but how to price them—and how to manage that pricing across channels amid shifting economic headwinds.

Why Pricing Strategy Will Define Amazon Beauty Success in 2025

With tariffs on Chinese imports back in the national conversation and a volatile economic environment heading into the second half of the year, pricing has re-emerged as a critical issue for beauty brands on Amazon.

According to the marketplace agency Market Defense, brands should approach 2025 with a clear pricing strategy and a calendar in hand—one that includes planned promotions for major sales events, contingency plans for cost increases, and coordinated pricing across Amazon and other sales channels.

Prime Day Expands—and so Do the Stakes

If internal Amazon memos circulating on the internet are to be believed, Prime Day will expand to four days in 2025, signaling not only a longer promotional window but also higher potential rewards—and risks—for beauty brands.

The extended Prime Day means brands need to forecast more aggressively, as 189 million Americans hold Prime memberships, making the stakes high. Underestimating demand could result in lost sales during one of the year’s most valuable shopping periods, while overestimating can lead to excess inventory and margin strain. Layer in the uncertainty around tariff-related customs delays, and the need for operational precision becomes clear. “Reassessing landed costs is absolutely essential,” says Taha Celik, VP of Supply Chain at Market Defense. “With Prime Day likely to run even longer than last year, brands are looking at longer sell-through windows and greater inventory exposure. It’s crucial to lock in deal and ad strategies early to protect margins, and just as important to stay agile—this landscape is moving fast.”

What if a brand is considering skipping Prime Day altogether? Opting out of the July Prime Day event is a risky move for any brand on Amazon looking to drive growth in 2025. Beauty brands in particular should take note—56% of Prime Day shoppers are women, aligning squarely with the industry’s core customer base. In 2024, 52% of those shoppers made impulse purchases, driven in part by the urgency and visibility of deal badging. Brands that choose not to participate miss out on critical “Prime Day” and “Limited Time Deal” badges, which Amazon has conditioned its customers to trust for both the best deals and top product picks. Without those visual cues, even hero SKUs can get buried in search results. And with 41% of all US adults shopping during Big Deal Days in October—despite the heightened anxiety and distraction of election season already in full swing—it’s clear that consumers are still showing up ready to buy when the right deals are in front of them.

Rethinking Price Increases in a Tariff-Driven Economy

Rising costs—from raw materials to logistics—are prompting many brands to consider price increases. However, raising prices on Amazon presents unique risks that must be carefully weighed, especially considering the platform sells over 350 million products, including more than 12 million directly from Amazon itself. In a marketplace this vast and competitive, every pricing decision carries significant implications.

For brands evaluating price increases in response to tariff changes, the strategic considerations go far beyond base cost. Brands should be asking themselves the following questions:

Conversely, for brands considering lowering prices to appeal to a broader mass-market audience, the risks are equally real. Competing with large-scale players like L'Oréal and Procter & Gamble—that have significantly more resources and advertising muscle—can be a costly and challenging endeavor, especially without the necessary infrastructure to support high-volume, low-margin sales. “In shaky economic times, the worst thing a beauty brand can do is play copycat,” says Vanessa Kuykendall, Chief Engagement Officer at Market Defense. “This is the moment to lean into your edge—your founder’s story, that killer formulation no one else has, the community that actually cares. Customers are being choosy with their dollars, so don’t panic and pivot. Stand tall in who you are and remind them why you’re worth it.”

The Off-Amazon Piece of the Puzzle

Complicating matters further, any pricing change—or promotional plan—must be mirrored across channels. If a brand runs a Memorial Day sale on its own site or partners with Ulta Beauty for a July promotion, but fails to align that offer with Amazon pricing, Amazon may react by suppressing the listing or deprioritizing the product in search results.

“Amazon’s pricing parity policy means that if your product is available for less on your DTC site or with a retail partner, Amazon may suppress your listing or pause your advertising,” said Dave Karlsven, SVP of Data Science and Advertising at Market Defense. “It’s a strict and often unforgiving system.” Inconsistencies in promotion can also confuse consumers, hurt conversion, and create tension with retail partners.

Coordinating promotions across Amazon and off-Amazon channels, then, is no longer optional—it’s foundational. “We always encourage our clients to build out promotional calendars that factor in all the key tentpole events,” says Karlsven. “It’s important to align messaging across every platform and get ahead of the curve by looping in distribution partners early.”

A High-Precision Year Ahead

For beauty brands on Amazon, 2025 will demand sharper forecasting, operational excellence, and strategic investment in high-impact moments. The brands best positioned for growth will be those that earmark sufficient ad budgets for tentpole events, align inventory with projected demand, and plan promotions well in advance—while ensuring cross-channel alignment on pricing to avoid penalties and preserve customer trust.

With Prime Day rumored to be longer than ever and likely more tariff changes on the horizon, success won’t come from winging it. The most resilient brands will approach pricing as part of a holistic, forward-looking strategy—not a last-minute scramble. Those who forecast wisely, operate with discipline, and stay aligned across channels will be the ones who rise above the noise.

Previous Reports:

Q4 2024 Amazon Top 25 Beauty & Personal Care

Q3 2024 Amazon Top 25 Beauty & Personal Care

Q2 2024 Amazon Top 25 Beauty & Personal Care

Q1 2024 Amazon Top 25 Beauty & Personal Care