Global consumers of all ages are no longer limited to buying local brands; increasingly, they see the world as one unified storefront, enabling brands to enter new markets faster. All eyes are on the Middle East and India as the big beauty markets to watch. India’s beauty and personal care market is projected to reach $17.4 billion by 2025 according to Euromonitor, while the MENA region is expected to grow to $60 billion by 2025.

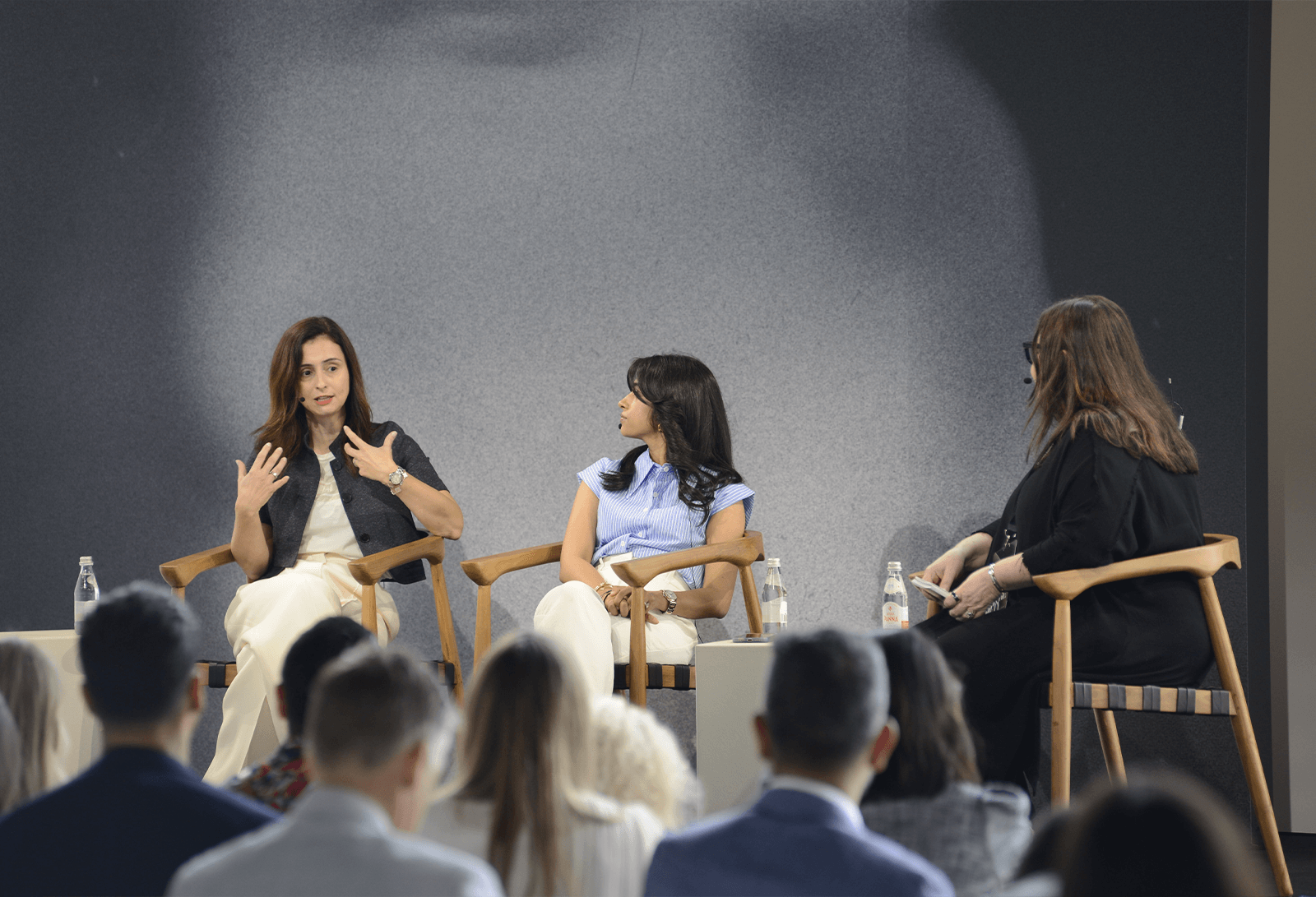

BeautyMatter welcomed two retail powerhouses to the FUTURE50 stage with Bhakti Modi, co-founder of Tira and Reliance Retail, and Jasmina Banda, Chief Strategy Officer of Chalhoub Group, to demystify the evolving nature of these beauty landscapes. In conversation with BeautyMatter CEO Kelly Kovack, Modi and Banda unpacked the important nuances of the Indian and Middle Eastern consumers and their purchasing motivations.

Modi highlights India as the most populous country with the youngest population—50% Gen Z and millennial. “They are moving away from basics and looking for brands that speak to their lifestyle aspirations and personal references: quality of ingredients, premiumization in skincare and makeup, sustainability, and transparency,” she says. With increasing urbanization, globalization, and increased online penetration across multiple verticals, they are also moving towards more independent brands in place of the top 10 brands that have previously dominated.

Banda notes the Middle East also has a very young consumer, with half of the population under the age of 35 and on average three hours of YouTube use per day in Saudi Arabia, making the region one of the highest consumers of social media. Snapchat is the second largest platform in the region due to its privacy benefits. She highlights the importance of nuance when it comes to the over 20 countries that comprise the region. In the UAE, only 10% are locals whereas Saudi Arabia has more than 60% to 70%. Kuwait is one of the most forward-looking consumers of the Middle East, while Katar has one of the highest GDPs in the world and has some of the highest spending on beauty but is very hard to manage and regulate. "Some of the markets like Dubai and Qatar are almost like city states; everyone lives 15 minutes away from a mall. Then you go to Saudi Arabia and there are Tier 1, Tier 2, Tier 3 cities, the complexity of delivering products to the mountains. It's very complex to navigate for brands coming from abroad," she adds.

Regarding what brands looking to enter the space should contemplate, Banda emphasizes the dominance of Sephora over the Middle East with the retailer covering half of the market, thereby offering an easy way of entry. Standalone outlets are more challenging due to high cost, while Egypt—another huge market—has strict regulatory restrictions. “One of the key things brands are looking at is how the consumer is extremely polarized in terms of what they buy from which brands," she says. Half of the market is fragrance with consumers having, on average, more than 20 prestige fragrances at home. "Most people layer seven fragrances before they go out. Skincare is less than 15% of market; that same customer will buy one liter of face wash at the drugstore. They have 40 to 60 lipsticks, on average, in their collection from $10 to hundreds of dollars per item," she adds.

Speaking on the Indian market, Modi observes, “The division of mass to premium is still 90 to 10. For any retailer to be big in size, you have to be able to hold brands from masstige to prestige."Skincare is still a category in the beginning stages, with the average woman using three to five products. While most retailers are only present in Tier 1 cities, e-commerce is allowing for a wider reach at a much lower cost. Eighty percent of beauty is still sold through brick-and-mortar. "Picking an omnichannel retailer will allow for scaling the brand in a big way. The belly of the market is still value. Localize the brand because retailers and distributors will help with regulatory issues in growing the beauty pie,” she proclaims.

When asked by the audience about supporting education in these new markets, Instagram and YouTube were pinpointed as important homes to the influencer landscape for India (where TikTok is banned). TikTok however still holds a massive weight in the Middle East, where Asian brands are having success in the skincare bracket, but instant gratification purchases like makeup and fragrance are the most popular.

Key Takeaways:

Want to continue reading this article and others just like it?

Subscribe to BeautyMatter and access the most current beauty intelligence and news updates.

SubscribeAlready a member, login here.