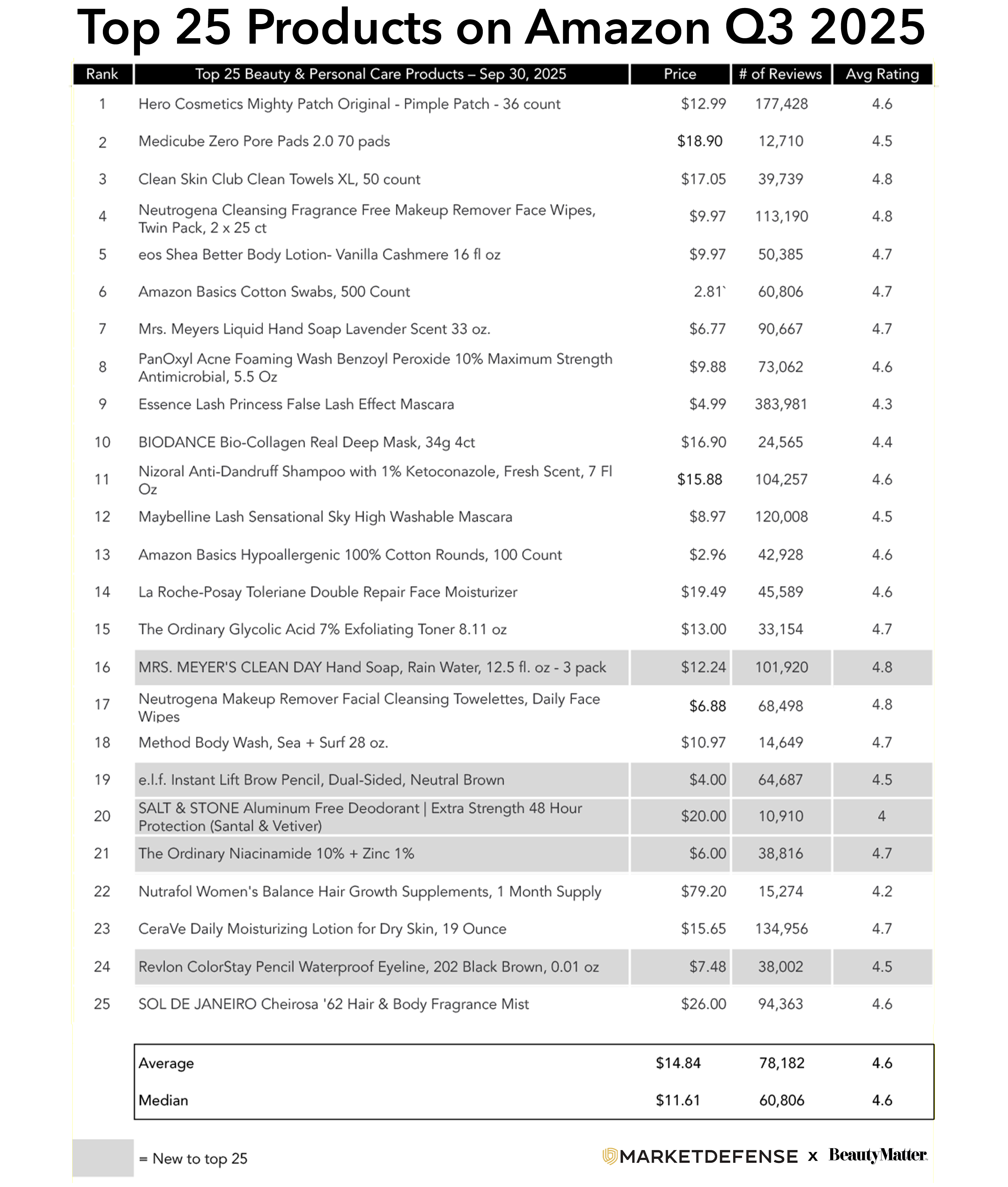

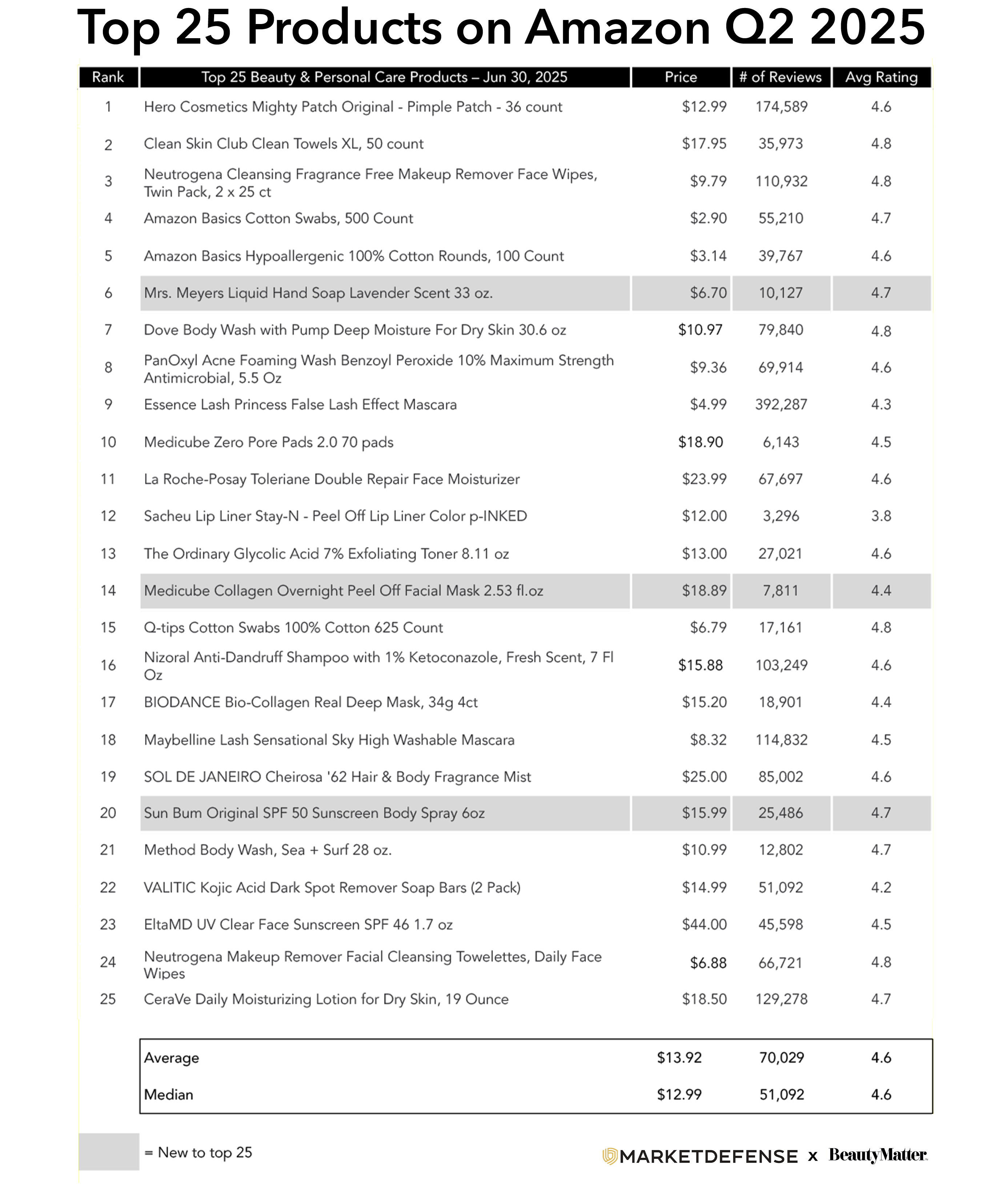

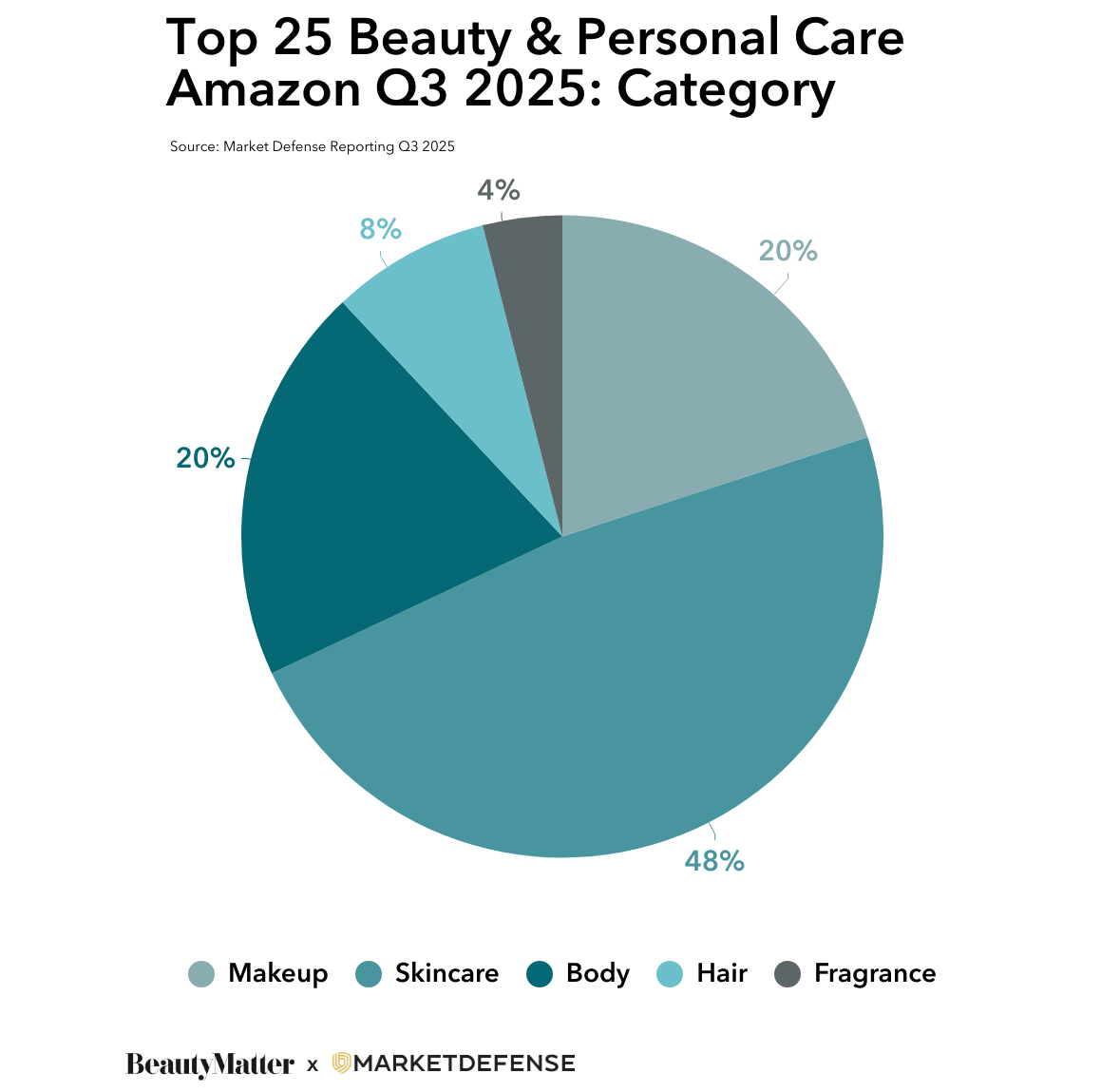

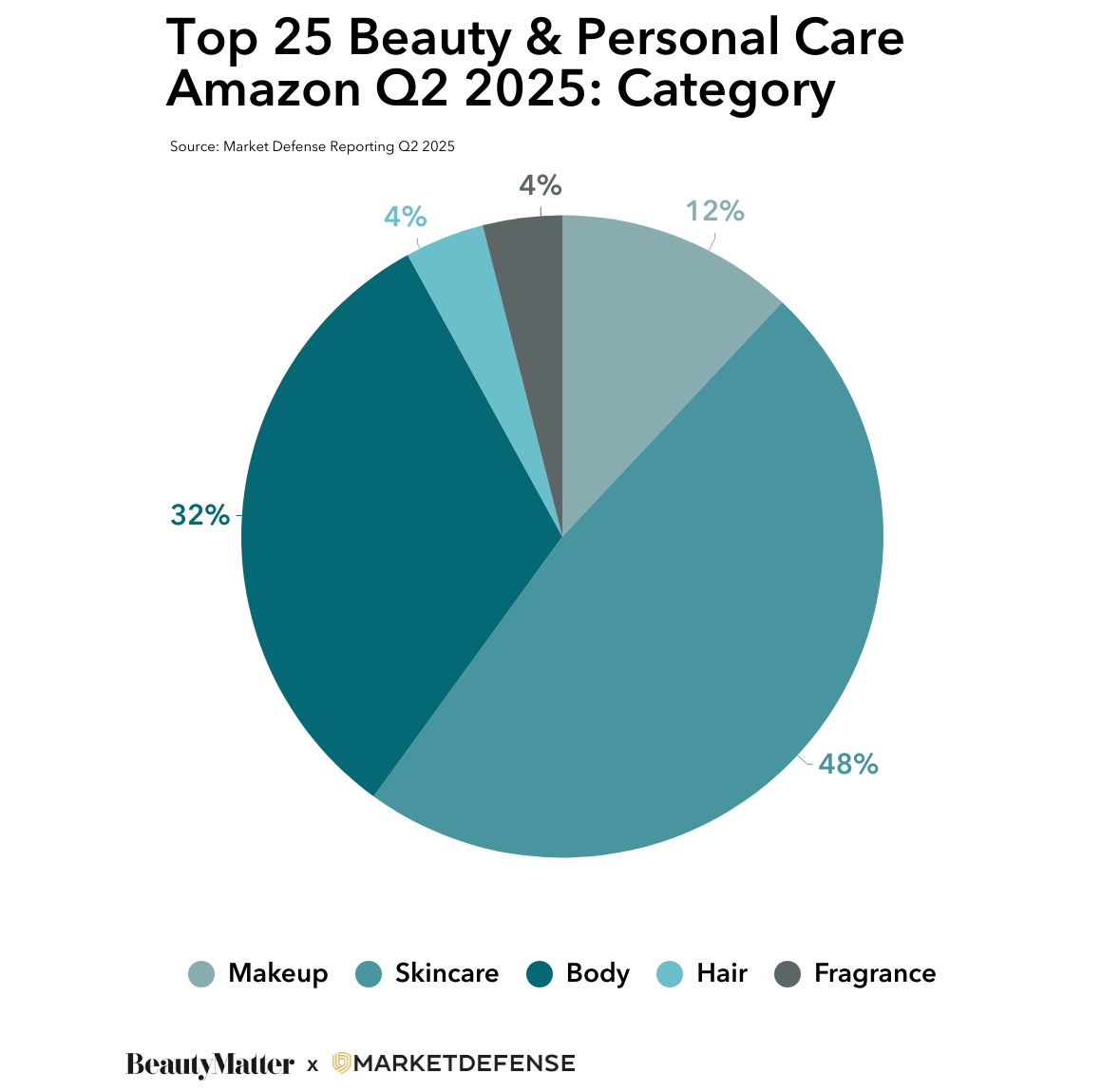

The Top 25 for Q3 2025 reflects a marketplace that’s rewarding consistency. Hero Cosmetics Mighty Patch Original held the #1 spot for the fourth straight quarter, while Clean Skin Club’s Clean Towels XL and Neutrogena’s Makeup Remover Wipes remained firmly in the top ranks.

The Skincare Top 10

The average price point of the Skincare Top 10 was $13.72, down 3.8% from last quarter.

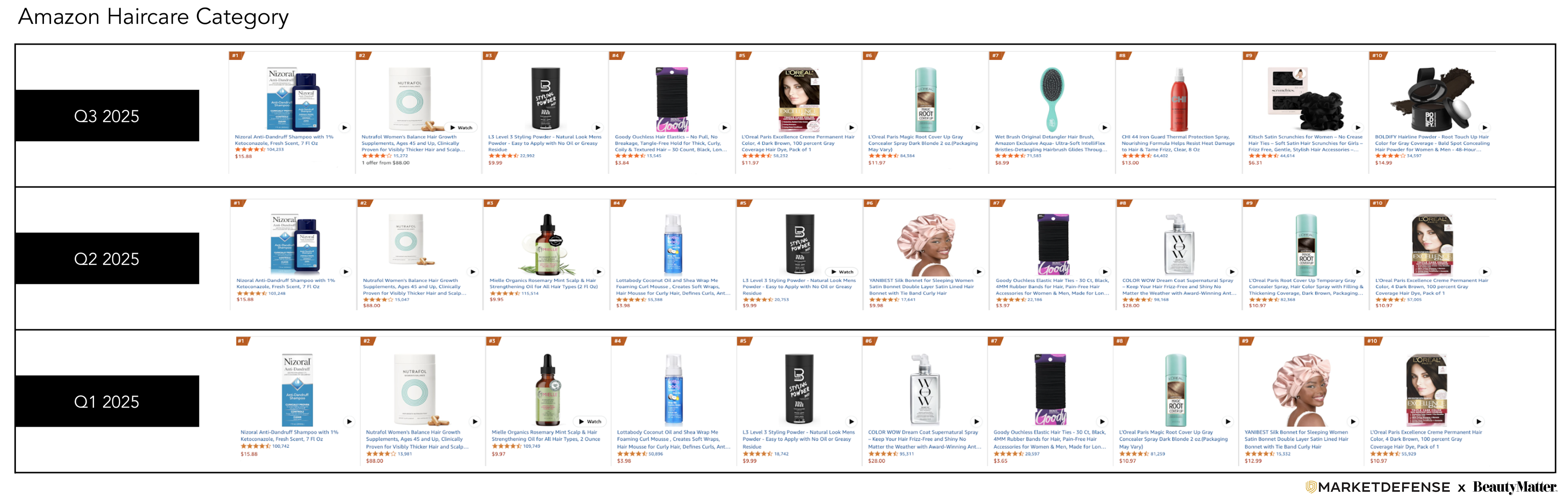

The Haircare Top 10

The average price point of the Haircare Top 10 was $18.49, down 3.5% from last quarter.

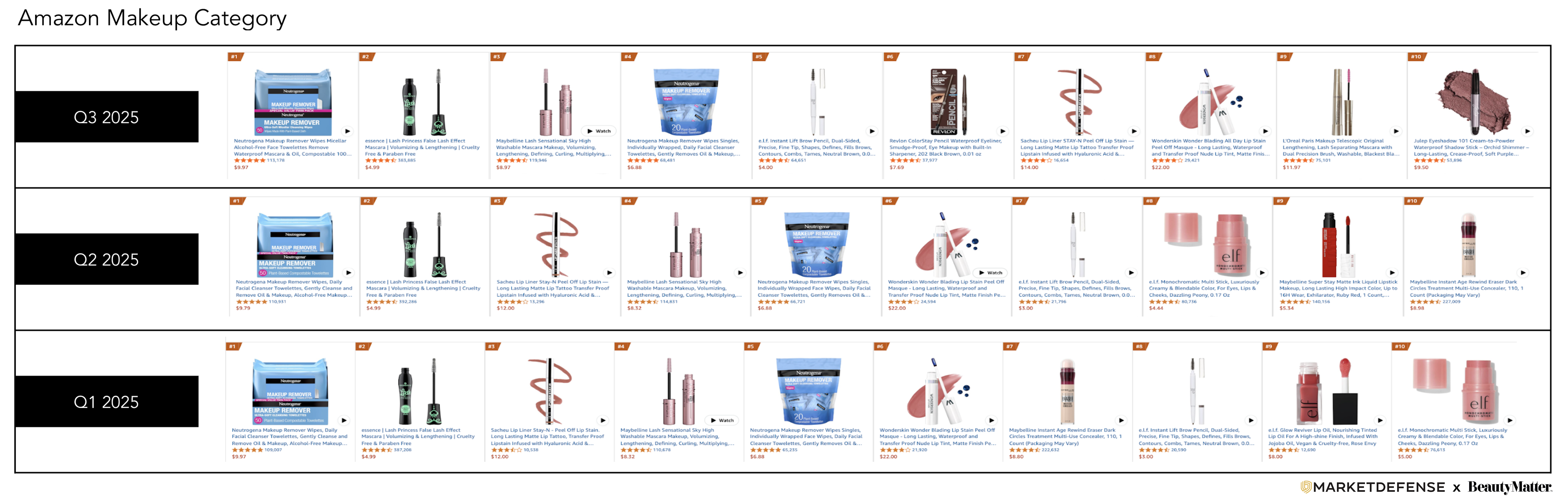

The Makeup Top 10

The average price point of the Makeup Top 10 was $10.00, up 16.6% from last quarter.

The real breakout story is Medicube. Absent from Q4 2024’s rankings, its Zero Pore Pads 2.0 entered at #16 in Q1, climbed to #10 in Q2, and finished Q3 at #2—its highest position yet—confirming that results-driven K-beauty continues to gain share. The brand’s off-Amazon momentum is fueling that rise: according to Charm.io, Medicube ranked as the #2 top-selling TikTok Shop brand in Q3, while the hashtag #koreanskincare generated 451M views during the quarter. That kind of cross-platform visibility is creating a powerful halo effect, where social virality translates directly into Amazon search intent and conversion.

The average price of a Top 25 product rose slightly to $14.04, up from $13.92 in Q2, supported by the return of Nutrafol Women’s Balance Hair Growth Supplements (#22, $79.20) and the entrance of new premium SKUs like Salt & Stone’s $20 deodorant. At the same time, lower-priced daily staples from Mrs. Meyer’s, Amazon Basics, and e.l.f. continued to dominate review counts and basket frequency, reinforcing that Amazon Beauty remains anchored in affordability and replenishment.

New to the Top 25 this quarter are:

The biggest headline belongs to Salt & Stone with the first deodorant ever to appear in Market Defense’s Top 25 rankings since tracking began in 2021. Its debut signals that underarm care has officially crossed from hygiene into lifestyle, where premium scent, clean formulation, and elevated design are redefining what consumers expect from the category. Market Defense takes a deeper look at why deodorant is becoming one of beauty’s most dynamic frontier categories, and what it takes to win in one of Amazon’s most competitive spaces.

Deodorant Redefined: From Hygiene to Lifestyle

“What was once a hygiene staple has become an extension of the clean beauty movement: a category where formulation, fragrance, and brand story all matter,” says Vanessa Kuykendall, Chief Engagement Officer at Market Defense.

Deodorant and Antiperspirants now represent a $65M+ monthly business on Amazon, up 26% year over year (YoY), matching overall Personal Care growth. With more than 900 brands competing and an average price of $19.97, the category is both crowded and lucrative.

The rise of Whole Body Deodorant is another signal of the category’s expansion. Searches for Lume Whole Body Deodorant grew 4x from 2023 to 2024 and continue to climb, proving that consumers are thinking more holistically about bodycare and odor management.

Prestige and clean-leaning brands have helped reposition the category entirely. Grown Alchemist, Salt & Stone, Phlur, Sol de Janeiro, and Nécessaire have blurred the line between deodorant and fragrance, applying fine-fragrance sensibilities to functional formats. Salt & Stone, in particular, leveraged its signature scents—Santal & Vetiver among them—to create a luxury olfactive experience that feels more like body perfume than “winter fresh.” Notably, all four leading “lux deodorant” brands maintain 4-star+ ratings, reinforcing consumer confidence that clean and effective can coexist.

Salt & Stone’s rise to #20 in the Top 25 was no accident. “They had a 150% increase in page 1 keywords acquired via Sponsored Ads YoY in Q3,” says Amy Rudgard, SVP of Client Delivery at Market Defense. “That was a big part of their story rising.” The brand’s media mix tells the rest: a heavy focus on non-branded competitive targeting and an aggressive use of Sponsored Brand Video Ads to win shopper attention and conversion.

The broader lesson, says Kuykendall, aligns with Amazon’s own findings: “At Accelerate, Amazon presented data showing that brands using full-funnel strategies see +17% awareness, +26% consideration, and +48% conversion gains. Salt & Stone is a clear example of that approach in action.”

“Across our portfolio, we see 30% of ad sales driven by brands targeting their competitors,” adds Dave Karlsven, SVP of Client Marketing & Data Science. “That balance between defense and offense, owning branded terms while capturing competitive share, is what allows growth to compound quarter over quarter.”

For brands looking to follow suit, Karlsven offers a data-backed playbook.

“In deodorant, 70%-80% of traffic and sales often come from just a handful of top search terms. Winning those keywords—‘natural deodorant,’ ‘aluminum-free deodorant,’ ‘men’s deodorant’—is critical. The leading brands focus their budgets on the top 20-30 search terms that actually move the needle.”

“You also need to own and leverage your branded search traffic so competitors can’t siphon loyal customers. Direct that high-converting traffic to the ASINs best positioned to win organically; it’s one of the fastest ways to gain rank and market share.”

“Finally, deodorant is a repeat-purchase category. The biggest growth unlock isn’t just new acquisition; it’s retention. Use Subscribe & Save, AMC data, and retargeting to drive reorders within 30-60 days. It’s all about turning first-time buyers into lifetime customers.”

The strongest players are treating deodorant as skincare with scent, and pairing clean, skin-beneficial formulas with refined fragrance storytelling, credible claims, and clinical validation that elevate the product beyond hygiene and into ritual. For brands hoping to make their mark in this evolving category, Market Defense’s advice is clear: “Put a lot of focus on storytelling, formulas that are good for the skin, [and have] natural and sustainable ingredients, strong claims, and visuals that make people smell it with their eyes,” says Rudgard.

Previous Reports:

Q2 2025 Amazon Top 25 Beauty & Personal Care

Q1 2025 Amazon Top 25 Beauty & Personal Care

Q4 2024 Amazon Top 25 Beauty & Personal Care